By John Helmer, Moscow

Petropavlovsk Plc has almost run out of tricks.

Advertisements placed at the start of this month in the London papers that the goldminer may be on the receiving end of a Russian-funded bailout lifted the London Stock Exchange share price for less than 24 hours. The market capitalization has since continued on its trajectory towards worthlessness. Kirill Androsov of Altera Capital, the door-opener for a fresh Sberbank financing, is refusing to say which way the door is swinging. According to a leading London mine financier, “Petropavlovsk’s assets just don’t have any value. Low grade and tough metallurgy. Gentle euthanasia is the best option.”

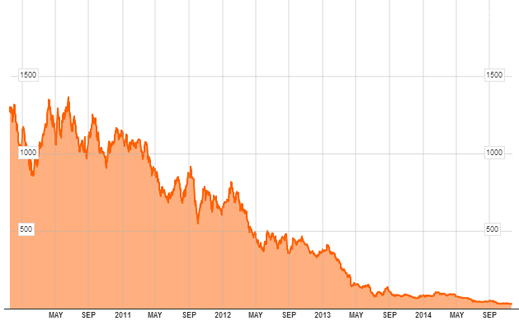

Petropavlovsk draws its name from its founding and controlling shareholders, Peter Hambro (lead image, centre) and Pavel Maslovsky (right), and their families. Four years ago, when gold was booming, their company was worth £2.6 billion on the London Stock Exchange. Today it is at £38.5 million.

FIVE-YEAR TRAJECTORY OF PETROPAVLOVSK SHARE PRICE

Source: Bloomberg, http://www.bloomberg.com

The story of how Hambro and Maslovsky converted a fareastern Russian gold deposit called Pokrovsky from a Magadan region shareholder business into one of their own has been told here and here. It has also been untold in the prospectuses the duo have issued in London and Hong Kong to attract international market money and shareholders.

Bankruptcy is closer to the telling in this notice, which Petropavlovsk and its auditors issued on August 28: “ in the absence of refinancing the Group will breach covenants in its banking facilities at 31 December 2014. In addition the US$310.5 million outstanding Convertible Bonds are due for repayment in February 2015 and the Group does not currently have sufficient committed facilities or available funds to refinance this debt…The Directors have concluded that the combination of these circumstances represents a material uncertainty that casts significant doubt upon the Group’s ability to continue as a going concern.”

In the history of Petropavlovsk (formerly Peter Hambro Mining), Hambro and Maslovsky were accused by Oleg Mitvol (right), then the mine licence regulator at the federal Ministry of Natural Resources, of violating licence terms and mining the stock market – boosting the share price rather than investing in goldmining. Under pressure from Mitvol and the mining media, Hambro threatened libel action; Maslovsky lobbied Mitvol’s superiors.

In the history of Petropavlovsk (formerly Peter Hambro Mining), Hambro and Maslovsky were accused by Oleg Mitvol (right), then the mine licence regulator at the federal Ministry of Natural Resources, of violating licence terms and mining the stock market – boosting the share price rather than investing in goldmining. Under pressure from Mitvol and the mining media, Hambro threatened libel action; Maslovsky lobbied Mitvol’s superiors.

Mitvol ended up losing his post. Maslovsky became a senator in the Federation Council representing Amur until he withdrew to rejoin the management of the goldminer last month.

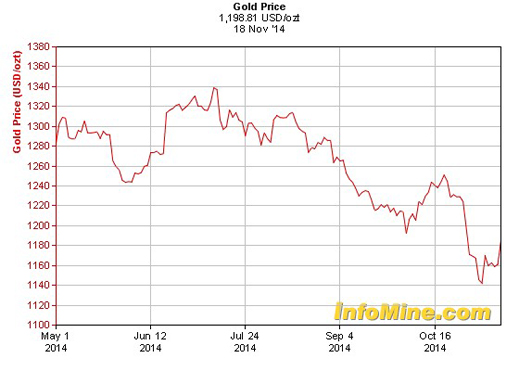

Mining analysts say the problem for Petropavlovsk is in the ground, not in the management. Its ore deposits are reported to have the lowest gold-bearing grades in the Russian goldmining sector. Rivals Polyus Gold, Polymetal and Kinross report double or higher grades at their mines. At the same time, Petropavlovsk cash costs of extracting its metal and taking it to market are among the highest in the Russia gold sector. So long as the market price of gold remained high, Petropavlovsk could cope with the financial squeeze. But if gold drops faster than it is possible for the mining company to reduce its costs, the squeeze becomes a stranglehold.

Source: http://www.infomine.com

If that prospect for the future isn’t bad enough, the immediate problem for Petropavlovsk is how to refinance its liabilities. The company papers claim it can count on increasing its output of gold this year, and cut the cost of producing it. By selling more ounces even at the dwindling gold price, and by exploring and booking more mineable gold in reserves and resources, the company reported in August “the exploration success, together with the new discoveries such as those at Malomir’s Berezoviy area (5m at 22g/t), gives confidence for the future.”

Asked this week to clarify to what banks the mining company owes the money, and how much, spokesman Alya Samokhvalova said that as of December 31, Petropavlovsk owed Alfa Bank $115 million, VTB $225 million, and Sberbank $479 million. The Alfa debt was paid off by mid-year, she says, leaving bank debt totalling $680 million. Debt to bondholders amounts to $308 million.

Company reports also identify its principal bankers as including Asian-Pacific Bank. Based at Blagoveschensk, in the Amur region, it is a related party in which Hambro owns 17% and the Maslovsky family, 17%. Samokhvalova said today that the mining company doesn’t owe the bank anything.

According to press leaks appearing in the Financial Times and Telegraph of London on the same day, November 4, Petropavlovsk may be rescued by the buyout of its bond debt by two investment funds, Altera Capital of Moscow and Sapinda Holding of Berlin. As reported, Sapinda is (or was) proposing to buy between $150 million and $250 million of the bonds. Altera would either share in that purchase, or make an additional one of its own. The acquirors would then convert their bonds into shares, taking control of the goldminer and starting loan repayments to Sberbank and VTB on terms the state banks appear to have agreed with the buyout funds in advance.

The advertised deal indicated the bondholders would have to accept a 30% discount on par value of their paper, while the bond conversion would give Altera and Sapinda up to 80% of the company’s shares. Either Hambro and Maslovsky would stump up cash of their own, or else they would face dilution and exclusion from management.

Exactly how this would be done — if indeed there is an agreement between the banks, bondbuyers, Hambro and Maslovsky, and other shareholders — isn’t. The company issued a statement, late on November 4, implying that it had nothing to do with the newspaper reports. The company “is continuing to talk to its senior lenders, bondholders, other stakeholders and third parties in order to complete a holistic refinancing of the Group’s outstanding 4% Convertible Bonds due February 2015… As part of this ongoing process, the Company has also been in receipt of approaches by various potential third-party investors in recent months. The Company continues to examine all its options and is working towards a solution in as expedient a manner as possible. No transaction has yet been approved or agreed.”

Hambro told the newspapers he preferred “self-help” – less money for bondholders, less dilution for himself. He helped the Telegraph report that the Altera-Sapinda offer was almost hostile. “[The] offer would leave investors, creditors, and Hambro out of pocket, presenting the founder [Hambro] with a big dilemma: accept the best offer under duress but leave all your backers out of pocket or try to negotiate better terms and risk the new investors walking away?”

Sapinda is the creation of Lars Windhorst, (below left) a German entrepreneur living in London, whose investments before Sapinda put him and out of bankruptcy. The executive in charge of the group’s mining investments is Tim Whyte, whose appointment was announced in January. He has reportedly engaged Artem Volynets (right). American trained, Volynets last worked for two of Oleg Deripaska’s heavily indebted groups, Rusal and EN+.

Whyte was asked to clarify what function Volynets occupies in relation to Sapinda’s investment decision-making, and what investments Sapinda may have already made in Russia. He refused to answer. Asked to clarify the current status of the negotiations with Petropavlovsk and Hambro. Whyte claimed: “our firm policy is not to comment on any market based rumors.”

That leaves Altera Capital. As reported here, Androsov (right), a managing partner of Altera, is a former Russian government official and protégé of German Gref, when he was in charge of the federal Ministry of Economic Development and Trade. When Gref moved on to run Sberbank, Androsov moved into lines of business which have attracted heavy financing from Sberbank. The record of Ruspetro, a problematic oil driller in northwestern Russia, was revealed here. Ruspetro’s downward trajectory on the London Stock Exchange has been almost as steep as Petropavlovsk’s, and it is now equally worthless.

Moscow and London sources believe it is unlikely that major banks like Sberbank or VTB would want to refinance a goldmining business with Petropavlovsk’s prospects; and even less likely that a small investment fund like Altera would expose itself to the risks. The Moscow sources suspect that as he was in the Ruspetro case, Androsov is the intermediary between Sberbank and Petropavlovsk. Sapinda, these sources also suspect, depends on Androsov to arrange a transaction in which Sberbank can clear its loan book of a potentially bad debt in exchange for an indirect equity investment whose future, though foggy, appears to be shared with other risk-takers.

Vyacheslav Pivovarov, chief executive of Altera, was also with Androsov in the Russian government.

He has told Kommersant that Petropavlovsk is on the rocks, and that Altera is part of a consortium offering Hambro’s board a debt-for-equity proposal. “In the present macroeconomic situation,” Pivovarov is quoted as telling the newspaper, “the company is not viable with $ 900 million of debt and restructuring bonds will not solve the problem.”. The Altera proposal, he also said, would benefit stakeholders “on the upside after the company’s debt will fall.”

Androsov and Pivovarov were asked what is the investment case for investing in Petropavlovsk at its current level of debt, at the current level of the gold price, and given the technical particulars of grade, mining difficulty, and high cash cost. They were also asked to clarify their relationship with Volynets and Sapinda in the proposed takeover of Petropavlovsk. There has been no reply.

Leave a Reply