By John Helmer, Moscow

Under pressure from the US Treasury’s Office of Foreign Assets Control (OFAC), an accused Swiss art fraudster, Yves Bouvier (lead image, right), has become the target of new money-laundering investigations of art dealings involving Russian businessmen.

Oleg Deripaska and Suleiman Kerimov (1st left) were hit by US sanctions announced by OFAC on April 6. In the announcement by the US Treasury, Deripaska was accused of money-laundering, bribery, extortion and racketeering. Kerimov was accused of money-laundering through the purchase of villas in the south of France, and failing to pay French tax on the deals.

Weeks earlier, Deripaska and Kerimov were reported by the US Treasury on a list of Russian oligarchs, published by OFAC on January 29. They are known to collect palatial residences, not artworks. Also listed with them by OFAC were two other Russians, Vyacheslav Kantor and Boris Mints. They have established well-known European art collections in Moscow, buying through dealers whom this week they decline to identify. Kantor says he started his collection on the advice of a neighbour in Geneva.

Not included on the OFAC list of January 29 is Vladimir Scherbakov (lead image, centre). He has accumulated his wealth from an Russian auto-assembly plant based in Kaliningrad. Also a resident of Geneva, Scherbakov has launched a lawsuit there against Bouvier as the dealer he accuses of defrauding him in the purchase of forty artworks. Asked this week to clarify the value of the alleged fraud and other details of the case, Scherbakov refuses to say.

The OFAC publication of January 29 did not accuse the Russians on the list of wrongdoing nor proscribe them. Today’s list of individuals sanctioned by OFAC, the Specially Designated Nationals and Blocked Persons List, shows Kantor, Mints, and Scherbakov are not sanctioned.

Works of art traded by Bouvier have been even more expensive than real estate; the details of the transactions even murkier when moved through the duty-free art warehouses known as freeports in Geneva, Singapore and Luxembourg. Bouvier is the controlling shareholder of the Singapore and Luxembourg freeports; for many years he has been one of the major art operators at the Geneva Freeport.

A Swiss by birth, with homes in Geneva and Zermatt, and a resident of Singapore since 2009, Bouvier has been attempting to recruit a Russian clientele since his first meeting with Dmitry Rybolovlev (pictured below) in Geneva in 2002; and at the annual fairs for the sale of fine art and antiques which Bouvier organized in Moscow between 2004 and 2008.

Dmitry Rybolovlev with two Picasso works sold to him by Yves Bouvier, but subsequently alleged to have been stolen by Bouvier’s associate, Olivier Thomas. Bouvier has denied wrongdoing, but in September 2015 he was fined €27 million by a court in Paris. Thomas, who has denied the allegations, was interrogated by the French police weeks later, then released without charge. The investigation was renewed the following year; Thomas then resigned from his post as chairman of the Bouvier-owned Luxembourg Freeport. Rybolovlev, who is not accused of wrongdoing, has surrendered the works to the French police until the police conclude their enquiry. Details of the case can be read here. Another Bouvier business associate, Jean-Marc Peretti, who runs an art gallery in Geneva, has also been reported as implicated in the affair.

Rybolovlev, the former control shareholder of the Russian potash producer Uralkali, was forced by the Kremlin to sell out of the company in 2010, and Kerimov appointed in his place; for details of that story, read this. Kerimov subsequently lost the company in a fight involving the Kremlin and Belarus president Alexander Lukashenko.

In the US Treasury’s list of Russian oligarchs, issued alphabetically on January 29, Deripaska was No. 19; Kerimov, No. 39; and Rybolovlev, No. 76, although he no longer has significant business in Russia. There are three potash oligarchs still active in Russia – Kantor (Acron) appears at No. 35 and Andrei Melnichenko (Eurochem) at No. 57. But Dmitry Mazepin (Uralchem) is missing from the list. Mazepin, born in Minsk but a Russian national, is now the controlling shareholder of Uralkali. Kantor and Melnichenko are recognized in the Moscow art market as collectors, like Rybolovlev, of record-priced artworks.

Vladimir Scherbakov (right), is not on this US oligarch target list. One of the richest Russian businessmen in Kaliningrad where he controls Avtotor, an auto import and assembly business, Scherbakov is suing Bouvier in Geneva for allegedly defrauding him in sale and purchase deals for forty artworks. There is no reporting of this case in the Geneva press; it is mentioned in the Paris business paper Les Echos in this report of April 24, 2017. According to Les Echos, Bouvier was reportedly acting behind an art commission agent employed by Scherbakov; Bouvier allegedly controlled several front companies in southeast Asia through which the art deals were done. Scherbakov and his son Sergei live in Geneva but they are not talking to the Swiss press. The affair is “delicate”, according to a Geneva investigator.

Kaliningrad where he controls Avtotor, an auto import and assembly business, Scherbakov is suing Bouvier in Geneva for allegedly defrauding him in sale and purchase deals for forty artworks. There is no reporting of this case in the Geneva press; it is mentioned in the Paris business paper Les Echos in this report of April 24, 2017. According to Les Echos, Bouvier was reportedly acting behind an art commission agent employed by Scherbakov; Bouvier allegedly controlled several front companies in southeast Asia through which the art deals were done. Scherbakov and his son Sergei live in Geneva but they are not talking to the Swiss press. The affair is “delicate”, according to a Geneva investigator.

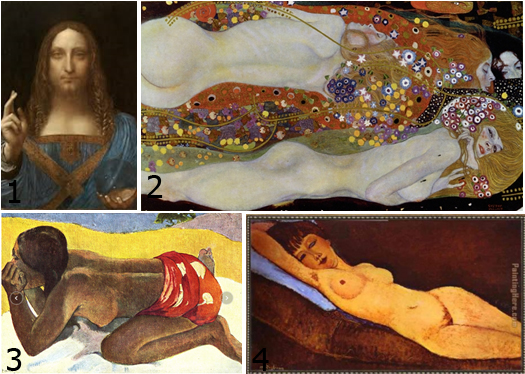

Scherbakov’s claims against Bouvier were filed in court in Geneva at the end of 2015. At the start of that year Bouvier came under investigation in Monaco, charged by Rybolovlev with defrauding him of about $1.1 billion in 37 sale and purchase transactions of paintings and sculptures between 2003 and 2014; Rybolovlev is domiciled in Monaco. The highest-priced works include Gustav Klimt’s “Water Serpents II”(pictured below, 1), for which Rybolovlev paid $183.8 million; Leonardo da Vinci’s, “Salvator Mundi” (2), $127.5 million; Paul Gaugin’s “Otahi” (3), €120 million; and Amedeo Modigliani’s “Nude lying on a blue cushion” (4), $118 million.

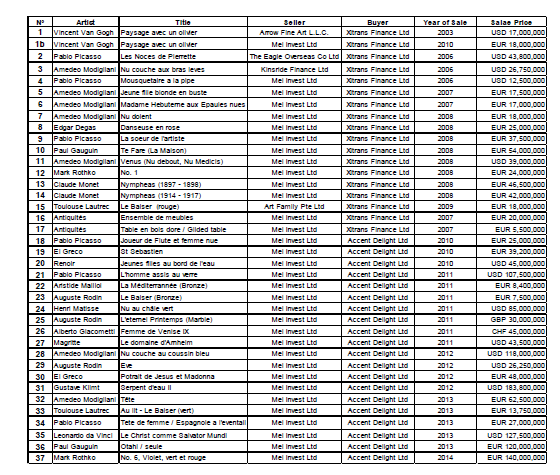

A list of 37 artworks sold by Bouvier companies to Rybolovlev companies, with their sale prices, was filed in a New York federal court proceeding late last year. In that case lawyers for Rybolovlev applied for orders to compel the Sotheby’s auction house to disclose the records of their dealings with Bouvier for review by the courts in Monaco, Geneva and London. Rybolovlev won that round; disclosure has begun.

LIST OF ARTWORKS SOLD BY YVES BOUVIER TO DMITRY RYBOLOVLEV, 2003-2014

CLICK TO ENLARGE

Source: www.pacermonitor.com The US court record of last year, and the Singapore Court of Appeal ruling two years earlier, in August 2015 – read it here -- differ in the total number of artworks traded, and also in identification of the works themselves.

As large as these individual values are, they represent a relatively small fraction of the global art trade, just as Russian buying is a small fraction compared to the Americans, British, Chinese, and French. According to the annual Art Market report by UBS and Art Basel, the Swiss fine art fair, since 2006 the global art business turns over an average of 37.6 million transactions per year worth $59.2 billion. That’s an average of $1,575 per artwork. Rybolovlev’s buying from Bouvier over the longer period, 2003-2014, amounted to less than 0.3% of the market.

But Bouvier’s take was bigger — about 3% of dealer sales, according to the results presented in the Art Market reports. They indicate half of dealer transactions produced a gross profit margin of between 30% and 50%. One in 10 dealers was reported last year as acknowledging a profit margin higher than 50%. Sotheby’s reports in its financial results for 2017 that its turnover was $5.5 billion, and its gross profit margin ranged quarterly from a low of 45% to a high of 86%.

In February of this year a Swiss federal prosecutor in Geneva formally questioned Bouvier on the excess payments he had received. The prosecutor continues to investigate the allegations of fraud over the dealings with Rybolovlev which had been contracted under Swiss law during the period when Rybolovlev and Bouvier were both in Geneva, before Bouvier moved to Singapore in 2009. Rybolovlev moved to Monaco two years later.

Bouvier has told the Geneva prosecutor there was no contractual evidence that he had been engaged by Rybolovlev as a purchasing agent on a fixed commission. The documents are still being collected by the prosecutors. No judgement of the evidence or ruling of culpability has been made to date.

Bouvier recently told an art market publication he feels “sure to win all the pending cases”. He also said he has sold out of his art transport businesses, but he’s keeping “the Freeport he opened in Luxembourg with his partners, Olivier Thomas and Jean-Marc Peretti.” According to Bouvier, “he wants to now focus on new projects in Russia and Asia.”

Sources in the Moscow art market say it’s news to them that Bouvier is planning to return to the Russian art market; they don’t know what Russian projects Bouvier has in mind or who he has for Russian partners.

Sotheby’s has also been accused of aiding and abetting Bouvier in the Rybolovlev price-rigging scheme. Rybolovlev’s lawyers are seeking to open litigation against the auction house in London. Sotheby’s had “helped Mr Bouvier to mislead and induce our clients.” the lawyers told Bloomberg last December, “into purchasing artworks at grossly inflated prices relative to the prices at which Mr Bouvier had obtained the works from Sotheby’s or other sellers.” More than a third of the artworks Bouvier sold to Rybolovlev – including da Vinci’s “Salvator Mundi” were first traded to Bouvier by Sotheby’s. Bouvier and Sotheby’s, acting together, have gone to court in Geneva to forestall the attempt at litigating the alleged fraud in London.

Rybolovlev said through a spokesman that the London court case will focus on “the method of deception [Bouvier] used to add margins that were fraudulent and completely hidden from his client. The process will show how he did this and who [Sotheby’s] he worked with to do it.” Sotheby’s replied: “If Mr Rybolovlev persists with his attempts to bring a claim against Sotheby’s and its employee in the English court, Sotheby’s will vigorously challenge this, in light of the application which is currently before the Geneva court.”

Sotheby’s recent record of trading Russian art can be followed here. In 2012 Victor Vekselberg, another Russian oligarch currently sanctioned by the US Treasury, won a London court suit against Christie’s for selling him a forged work by the Russian artist Boris Kustodiev. Christie’s was the auction house which in New York last November 15 sold Rybolovlev’s da Vinci painting for $450.3 million (including the house’s 12.6% commission).

Rybolovlev has charged that Bouvier originally paid Sotheby’s $80 million for the da Vinci, but charged him $47.5 million more, a mark-up of almost 60%. According to Rybolovlev, he was paying Bouvier a commission of 2% for arranging his purchases, and the difference was Bouvier’s fraud. Bouvier says the 2% was not deal commission. Bloomberg reports one of Bouvier’s lawyers as claiming the 2% covered “administrative costs, including insurance, transport and condition reports and, in some cases, escrow accounts between down payment and final payment.”

According to calculations reported in the press, based on court papers filed in Monaco and in a US Court of Appeal’s ruling of August 2017, on the 37 art works Bouvier arranged for Rybolovlev to buy, Bouvier netted $1.1 billion more from Rybolovlev than he had paid out for the initial purchases. When Rybolovlev resold the works – many at substantial losses except for the da Vinci – the net financial result was a loss to Rybolovlev of $13.8 million.

Sources in Geneva and Luxembourg say the only major Russian art buyer to work with Bouvier was Rybolovlev. Sources in Moscow disagree. They believe Bouvier arranged artwork trades for several Russian oligarchs, but their names remain secret. Bouvier himself announced in Moscow during the 2005 art fair that Russian tax rules for importing fine artworks should be reformed, but in the meantime he offered offshore dealing facilities to wealthy Russian buyers.

At the first of the Moscow fairs in 2004 — Bouvier told a Russian publication later — “we worked with the Ministry of Culture and Moscow City Hall. We did fancy events, which sought to attract not only the Russian elite, but also the western one. During one of those evenings I was carefully running my eyes over the hall and understood that for the first time I was seeing such a large number of billionaires.” Many of the wealthy participants that evening later became his clients, Bouvier has claimed.

Left: one of the display salons at the Moscow World Fine Art Fair (MWFAF) at the Manege in September 2005. Right: Bouvier speaking at the fair opening on September 26, 2005. The next day the press reported a reception at the Kremlin. It was also reported that on the first day of the show a painting by Peter Paul Rubens titled “Crucifixion with the saints” was sold for $11 million, along with two works by Marc Chagall for $630,000. The Rubens work cannot be traced in the Rubens catalogue, nor details of the seller and buyer. Russian oligarchs reported as attending the 2005 fair included David Yakobashvili, Mikhail Fridman, and Victor Vekselberg.

In May 2017 a list of Russian oligarchs was reported in Moscow as “The price of taste: Rating of the most expensive pictures in collections of Russian businessmen”. Rybolovlev was included with his Klimt. Also included were works bought by Roman Abramovich, Konstantin Grigorishin, Petr Aven, Victor Vekselberg, Alexander Smuzikov, Alexei Ananiev, Boris Mints, and the two potash oligarchs, Vyacheslav Kantor and Andrei Melnichenko. If Bouvier played a role in their trades, noone is admitting it now. Ananiev and his brother Dmitry fled Russia last December after the Central Bank closed their Promsvyazbank, and they were accused of embezzlement and fraud; for details, read this.

Melnichenko’s record in art dealing, along with his wife’s taste in sculpture, were exposed in this 2013 New York court case against their art dealer, David Benrimon; the Melnichenkos settled with the dealer on confidential terms; for the details, read this.

The double-priced sculpture and the Melnichenko couple from the story illustration; source -- http://johnhelmer.online/in-the-oligarchs-backyard-mr-mrs-andrei-melnichenko-sue-for-100-centimetres/ The Melnichenko art collection also reportedly includes “two enormous works from Claude Monet's ‘Water Lilies’ series". The sales of two of the Monet series of paintings to an anonymous buyer fetched £40.9 million at Christie’s in 2008 and £32 million at Sotheby’s in 2014. Speculation about Melnichenko as the buyer has been reported but not confirmed.

In Luxembourg, a source close to the freeport says he has no knowledge of artworks in store which are owned by Russians. Disclosure of the beneficial owners of artworks held in the freeports is now the rule in both Luxembourg and Geneva. Bouvier’s arrest in Monaco in February 2015, and the start of parallel investigations elsewhere, have precipitated public and parliamentary demands for tighter inventory control and more transparency at the freeports.

Bouvier was given a Monaco court bail of €10 million in 2015; the proceeding is now more than three years old. Lawyers following the case believe the Geneva prosecution is more advanced. The US Court of Appeal ruling of last August reveals that Rybolovlev has waived a claim for damages or financial compensation from Bouvier in Monaco. He will be seeking damages from Bouvier and Sotheby’s in London. The records of the criminal cases are not publicly available.

The parallel investigations of Bouvier have uncovered a network of more than 170 company names in more than a dozen countries, through which he is accused of moving the profits he made from his art dealings with Rybolovlev. Freeport sources say he and his business partners have invested about €10 million of their own cash in building the freeport in Singapore, which opened in 2010, backed by several Singapore government officials and ministries; and about the same amount for the freeport in Luxembourg, which began operating in 2014. The bulk of the construction and start-up funding has come from local banks.

Bouvier’s associates in these businesses have been identified as two Swiss of Corsican origin, Alexandre Camoletti and Jean-Marc Peretti. Camoletti was identified as one of the lawyers of Bouvier’s freeport company in 2015. At the time Camoletti reported he was associated with a Swiss law firm called RRLegal. The website of the firm no longer exists, and the Geneva telephone number for Camoletti at the firm is not in service. The Panama Papers reveal a dossier of companies with which the firm (aka R & R Avocats) has been associated. Swiss company records show that Camoletti has been a shareholding partner of Bouvier’s in three of his companies, Smartcopter, STS and EuroAsia Investment. Camoletti is currently registered as a trader of commodities from Africa, based in Geneva.

Kerimov has also employed Swiss and French-based Corsicans who are now charged with fraud and tax evasion in real estate sales schemes in the Côte d’Azur The Geneva-based fixer charged in the Kerimov case is Alexander Studhalter. There appears to be no overlap between the Kerimov group and the Bouvier group. Kerimov is not reported to have been interested in artworks.

Another of Bouvier’s business partners is Olivier Thomas (right) who was president of the Luxembourg Freeport until he was accused in Paris of stealing Picasso works; he has been replaced by Robert Goebbels, a former Luxembourg government minister. Yves Meyer, a Swiss national, is reportedly the principal manager of the network of Bouvier companies and supervisor of the cashflow. Meyer came to Bouvier from a wealth management career at the private Swiss bank, Banque Pasche. Accused of money-laundering, the bank was sold in 2016. Meyer’s role in Bouvier’s network of art-trading companies was confirmed in this Singapore court judgement.

of the Luxembourg Freeport until he was accused in Paris of stealing Picasso works; he has been replaced by Robert Goebbels, a former Luxembourg government minister. Yves Meyer, a Swiss national, is reportedly the principal manager of the network of Bouvier companies and supervisor of the cashflow. Meyer came to Bouvier from a wealth management career at the private Swiss bank, Banque Pasche. Accused of money-laundering, the bank was sold in 2016. Meyer’s role in Bouvier’s network of art-trading companies was confirmed in this Singapore court judgement.

Russian art dealers in London say they have done no business with Bouvier, and very rarely ship or collect works in or out of the freeports.

Sotheby’s is resisting Rybolovlev’s bid to put the auction house on trial for fraud, alongside Bouvier, in London. Sotheby’s claims it had no idea that when it traded with Bouvier he was re-selling the same works immediately to Rybolovlev at a 50% mark-up or more. Bouvier claims he was free to make large profits by trading the artworks to Rybolovlev at whatever price the Russian would accept. “I will be clear,” Bouvier has told a New York publication. “If I buy for two and I can sell for eleven, I will sell for eleven.”

A Moscow art market source, who requests anonymity, says: “Bouvier is rather smart fellow. He usually analyzes the preference of his potential clients and the possible profit from the deal. We don’t know if he had been working with other Russian oligarchs, but probably, I think, he had negotiations with some of them. Not Aven – he is a good specialist himself in the [Russian] avant-garde; Vekselberg is known for his Fabergé Easter eggs collection and isn’t focusing on paintings. Bouvier, as the owner of Freeport, knows how to keep the dealmaking secret.”

In Moscow Kantor and Mints were asked this week to say if they have bought or sold artworks through Bouvier or his companies; and if they have stored their artworks at Bouvier-controlled freeports. They refuse to answer.

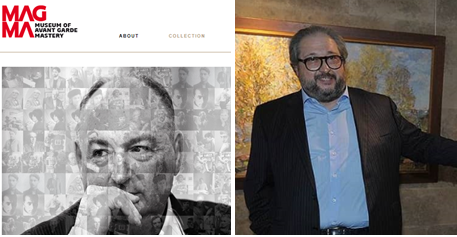

Kantor has been buying works for his Museum of Avant-Garde Mastery (MAGMA) since 2001. He held his first public exhibition in Geneva in 2009. Chagall, Modigliani, and Rothko are three of the painters Kantor has collected, whose works also appear in the reports of Bouvier’s dealings with Rybolovlev.

Left: Vyacheslav Kantor in a collage of artists included in his MAGMA collection, from the MAGMA website. Right: Boris Mints, who opened his Museum of Russian Impressionism in Moscow in 2016. The museum collection can be viewed here. Although they are named on OFAC’s January 29 list of oligarchs, in the current edition of the OFAC Specially Designated Nationals and Blocked Persons List (SDN) Kantor and Mints are not included. On President Vladimir Putin’s list for his annual Christmas dinner for the oligarchs, Mints has never been included; Kantor, once. For more on Kantor’s relationship with Putin, read this. Mints fled Russia for London early in May, in the wake of official investigations of his alleged financial malfeasance.

In Geneva, in parallel with the Rybolovlev and Scherbakov fraud cases, the Swiss authorities are investigating whether Bouvier and his associates have been operating their offshore company network to move the proceeds of their art dealings into tax-free havens, in order to deprive the Swiss of tax Bouvier would be obliged to pay if he were legally domiciled in Switzerland. Reportedly, Bouvier has homes in Geneva and Zermatt, but also homes in Paris and Singapore. Other businesses in Switzerland Bouvier has invested in include a luxury apartment development; a soft-drinks production company; and two aerospace technology companies. These have either been sold or are in bankruptcy. Art galleries in Singapore and in Europe, with which Bouvier has been associated, have also folded.

Sources in Luxembourg say the freeport is struggling to break-even with high costs and a heavy bank mortgage. One attempt to sell to the Canadian Thomson Reuters group by the freeport’s chief executive, David Arendt, was blocked by Bouvier, so Arendt resigned at the end of 2016. He has been replaced by a former French customs official, Philippe Dauvergne. Proposals to expand by building new freeports in Beijing and Shanghai have run afoul of Chinese state opposition.

Left to right: Yves Bouvier and David Arendt in 2013; Robert Goebbels and Philippe Dauvergne in 2017.

A European Union (EU) parliamentary investigation of the two freeports in Europe, Geneva and Luxembourg, reported late last year that “lack of control” at the freeports is “enabling money laundering and untaxed trade in valuables.” The two Eurodeputies who led the investigation between July 2016 and December 2017 are Werner Langen (Germany) and Ana Gomes (Portugal). They issued their report to the European Parliament on November 16. The report concluded: “storage facilities of this type could be used to launder money as they circumvent international transparency rules.”

Asked to estimate the total value of the art works in inventory in the two freeports, Langen said “the investigation of so-called freeports was not the main focus of the inquiry committee. However, six of my colleagues and I were invited by Mr Goebbels to visit the Freeport Luxembourg in February. We weren’t informed about the exact numbers of the value of the stock. The freeport is controlled by the Luxembourg customs, the operator himself has no information about the value of the stored goods.”

Asked whether Russian-owned artworks in the freeports might come under US or EU sanctions, Langen was non-committal. “The question of whether Russian art stored in freeports is also affected by the US and EU sanctions does not arise at the EU level, as this falls within the competence of the national tax authorities.”

Langen said that following his committee’s report to the EU parliament, a series of recommendations were sent to the EU Commission to adopt new regulations “to reduce the risks of abuse of freeports. So far the Commission has not done so.”

Leave a Reply