By John Helmer in Moscow

Novorossiysk Commercial Seaport Company (NCSP is the London ticker), the only internationally listed Russian port, crashed Friday [August 7] by almost 6% in Moscow stock market trading, despite a stable report and ratings confirmation from Standard & Poors. S&P’s August 6 report said that continuing growth of Russia’s seaborne trade on the export side, especially of oil and grain, supports a stable outlook for the Black Sea port, with rising cargo volumes, improving revenues, higher cashflows, and a modest decline in debt. Taken cumulatively, S&P said it is reconfirming the port company’s BB+ issuer rating.

However, S&P warned that NCSP “lack[s] sophisticated corporate governance”, adding that the “concentrated ownership structure poses additional risks to creditors. Existing corporate governance provides some protection, but doesn’t fully balance inherent conflicts of interest.” S&P fails to say what the port company’s ownership structure is.

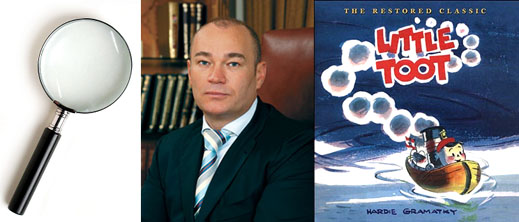

The company’s financial report for 2008, released this past April, also does not clarify the shareholding split between Alexander Ponomarenko (picture) and Alexander Skorobogatko, who are identified in auditor’s notes, along with their families, as “the ultimate controlling parties”. The company’s annual report indicates that they hold 50.01% through Kadina, an offshore registered company. This also suggests that since the initial public share offering in London in 2007, NCSP’s free float amounts to about 18.3%. Another 20% stake is owned by the Russian state, but this appears to be under control of the state-owned Russian Railways Company (RZD). This leaves about 12% of the shares unaccounted for, but described in the annual report as unidentified minority shareholders.

The 7-man board, chaired by Ponomarenko, includes 2 federal government officials and 2 representatives of RZD, indicating that the state holds larger de facto majority on the board than Ponomarenko and Skorobogatko. In 2008, there were uncorroborated reports in the Russian press that Ponomarenko and Skorobogatko had sold part of their stake in NCSP to Arkady Rotenberg, who controls the Northern Sea Route Bank (SMP in Russian).

The biggest bank creditors to NCSP are Unicredit and Bank Austria Credditanstalt, followed by the Russian state savings bank, Sberbank. At the end of last year, they held loans totaling $166 million, while an issue of loan participation notes amounted to $297 million. According to the latest analysis by S&P, as of June 30, NCSP has total cash of about $270 million – more than enough to cover loans maturing this year of $35.4 million. “Adequate cash is also available to pay for maturities in 2010 and 2011,” S&P says.

A report this month by Troika Dialog, a Moscow investment bank and brokerage, warns that there is likely to be a slowdown of cargo volumes at Novorossiysk in the second half of this year. S&P adds: “A negative trend in NCSP’s traffic, indicating higher-than-expected volume risk and competitive pressure in the industry, could also negatively affect the ratings.” Falling cargoes, according to the company’s report for the first six months, were urea fertilizer (UAN), scrap metal, cement, and incoming containers.

In a footnote to its disclosure policy, the port company has also announced that it is expanding its tugboat business. A company release of July 30 says it is buyingfour tugs for €25 million. The first of the newbuilds is to be delivered before the year’s end; the other three over the next year. Ponomarenko is reported on the company website as hinting thatthe vessels became available from a yard at a bargain price. The tugboats will be owned by anew company — Longbranch Shipping Enterprises Ltd. registered in Cyprus – which has been set up as a subsidiary of PJSC Fleet, a subsidiary which is 85% owned by the port company group. Fleet already operates a fleet of 52 vessels, including 27 tugboats, firefighting and emergency cleanup vessels. Altogether, it is possible to read from the company accounts that Fleet had assets worth $43 million at December 31. The accounts also show there was a vessel writedown of $21 million by year’s end. Notwithstanding, the onshore fleet company is reported to have generated revenue in 2008 of $51 million, and profit of $12 million.

The new tugboat company, Longbranch Shipping, is to be 80% owned by Fleet, and 20% by what the website release calls “partners of the Group who have extensive experience in tug and towing business in ports of Eastern Europe.” Company spokesman Mikhail Schur was asked to explain the secrecy surrounding the yard building the tugs and the seller. “We will abstain from giving any other comments,” he replied.

Leave a Reply