By John Helmer, Moscow

Oleg Deripaska has never agreed to settle before judgement in international litigations against him, or against his management of United Company Rusal, unless Deripaska was certain his opponents held a winning hand. When Rusal announced last week that it has settled a London arbitration with Rusal shareholders, Victor Vekselberg and Len Blavatnik, what had happened was a big loss which Rusal’s public shareholders failed to anticipate – with the case still to run against Deripaska personally. That’s the mirror part.

The smoke part has been the failure of market reporting in Moscow and elsewhere to notice the significance of Vekselberg’s and Blavatnik’s victory, and the compensation Deripaska has undertaken, along with Glencore. It was Glencore’s contract for trading Rusal’s aluminium, which was the cause of action that Rusal has now settled.

The sudden, recent jump in the volume of Rusal shares traded on the Hong Kong stock market, pushing the share price up 19%, has drawn all the media attention, though it’s more smoke. Rusal’s peers Alcoa of the US and Aluminium Company of China (Chalco) are also up – by 20% and 13%, respectively.

The roll of those to whom Deripaska has conceded, and the payments they have cost him, include Mikhail Zhivilo, $65 million; Anatoly Bykov, $105 million; David and Michael Reuben, $100 million plus, Avaz Nazarov, $130 million; Mikhail Chernoy (Michael Cherney), $200 million plus. Because the terms of settlement were confidential and Deripaska admits to paying nothing, the actual sums are approximate.

In stock exchange notices on January 16 and 20, Rusal announced a settlement of its part in the two cases brought by Vekselberg and Blavatnik almost two years ago in the London Court of International Arbitration (LCIA). Rusal’s new announcement claims the terms of “amicable resolute[ion]” require Rusal’s “fulfillment of certain conditions precedent”, but it doesn’t say what these are. Rusal “makes no admission in respect of the claims brought against it, nor has it undertaken any financial obligations under terms of the Settlement.”

Sources close to Glencore say compensation has been paid, adding “Vekselberg got a moral and probably financial victory”. Neither Rusal nor Vekselberg will provide particulars.

Privately, Rusal insiders say they have been told Deripaska scored the victory; and that all that remains to be decided at the London court are “technicalities”. Rusal’s statement to the market claims “the Arbitrations… will continue among SUAL, Glencore and EN+ for the narrow purpose of interpretation of certain shareholder arrangements.” EN+ is Deripaska’s holding company; through it he holds 47.13% of Rusal’s shares and preserves his position as Rusal’s chief executive.

Vekselberg (right) has accused Deripaska of making an agreement with Glencore which gave it the lion’s share of Rusal’s aluminium trade without consulting the minority shareholders, including himself and Blavatnik as the SUAL partners. They had merged their Siberian Ural Aluminium (SUAL) company with Rusal in October 2006, receiving a minority shareholding in the reorganized Rusal in return. Five years later, when they objected to the terms of the Glencore deal as giving the trader too much of a role in Rusal sales strategy, and too much profit, Deripaska ignored them. Vekselberg was chairman of the Rusal board at the time. He resigned and went to court on April 4, 2012. A further claim, lodged in the LCIA on July 23, was consolidated into a single proceeding.

Vekselberg (right) has accused Deripaska of making an agreement with Glencore which gave it the lion’s share of Rusal’s aluminium trade without consulting the minority shareholders, including himself and Blavatnik as the SUAL partners. They had merged their Siberian Ural Aluminium (SUAL) company with Rusal in October 2006, receiving a minority shareholding in the reorganized Rusal in return. Five years later, when they objected to the terms of the Glencore deal as giving the trader too much of a role in Rusal sales strategy, and too much profit, Deripaska ignored them. Vekselberg was chairman of the Rusal board at the time. He resigned and went to court on April 4, 2012. A further claim, lodged in the LCIA on July 23, was consolidated into a single proceeding.

In his resignation statement Vekselberg said: “due to the actions of its management, UC Rusal is presently facing a deep crisis, as a result of which UC Rusal has, in my opinion, deteriorated from an international aluminum leader into a company overburdened with debt and entangled in numerous lawsuits and social conflicts. As Chairman and director, I disagreed with a number of decisions in relation to the company’s strategic development, modernization of production and social and human resources policies, some of which were adopted by management without Board approval and in breach of shareholder agreements.”

Details of the 6-year, $47 billion deal running to 2015 were reported here. The SUAL case before the court called the deal “wrongful enrichment”.

Rusal issued a “clarification”, admitting the LCIA arbitrators were being asked to order a stop to “performing the [Glencore] contracts, rescission of the contracts, and damages against, inter alios, the Company.” Look carefully at the Latin term the Rusal lawyers used. Alios means “other persons” – in this case, Glencore, its chief executive Ivan Glasenberg (also a Rusal board director), and Deripaska. Wrongful enrichment as alleged meant they were the ones who had profited — at the expense of Rusal and its other shareholders.

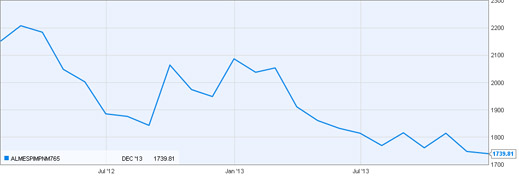

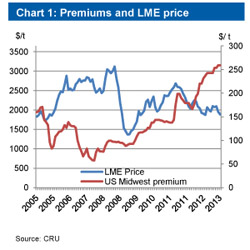

A source close to Glencore says that when the contract was drafted in late 2011, then pushed through the Rusal board over Vekselberg’s objections, the terms implied that Rusal’s take from sales of its metal would include a share of the London Metal Exchange (LME) delivery premium of $140 per tonne. Here’s what happened to the cash or spot price since then.

LME CASH (SPOT) PRICE CHART FOR ALUMINIUM SINCE JANUARY 1, 2012

At the start of the Glencore contract, the premium for getting the metal promptly out of the warehouse to customers amounted to less than 7% of the metal’s spot price. With much pushing and shoving by Glencore (inter alios), the premium decoupled from the price. It has now shot up threefold to a peak this week of $350 per tonne. At the same time, the cash price for the metal has collapsed to around $1,750. In the LME market, the premium is now running at 20% of the cash price. In the US, the premium is almost 25%.

At the start of the Glencore contract, the premium for getting the metal promptly out of the warehouse to customers amounted to less than 7% of the metal’s spot price. With much pushing and shoving by Glencore (inter alios), the premium decoupled from the price. It has now shot up threefold to a peak this week of $350 per tonne. At the same time, the cash price for the metal has collapsed to around $1,750. In the LME market, the premium is now running at 20% of the cash price. In the US, the premium is almost 25%.

For the effectiveness with which Rusal and Glencore have been hoarding aluminium in warehouses, restricting physical supply, and raising the delivery premium, read here. Swiss traders claim that in the deal with Rusal the growth of the gap between spot and premium has been all gravy for Glencore. Whether Glasenberg and Deripaska (right) may have a separate agreement on sharing that isn’t known. Evidence on where the delivery premium went for Rusal’s aluminium would have been adjudicated by LCIA if the case had gone to judgement.

For the effectiveness with which Rusal and Glencore have been hoarding aluminium in warehouses, restricting physical supply, and raising the delivery premium, read here. Swiss traders claim that in the deal with Rusal the growth of the gap between spot and premium has been all gravy for Glencore. Whether Glasenberg and Deripaska (right) may have a separate agreement on sharing that isn’t known. Evidence on where the delivery premium went for Rusal’s aluminium would have been adjudicated by LCIA if the case had gone to judgement.

This is one reason, trade sources believe, why Deripaska has agreed to settle Vekselberg’s charge, and why he and Glasenberg have decided to pay “large compensation”, according to a source close to Rusal.

Glencore’s report and financial statements for 2012 do not identify the SUAL claims in London as a contingent liability, let alone a “large” one. Instead, the auditor’s notes make this general claim about litigation: “Glencore believes the likelihood of any material liability arising from these claims to be remote and that the liability, if any, resulting from any litigation will not have a material adverse effect on its consolidated income, financial position or cashflows.” (Emphasis added.)

Paul Smith, investor relations spokesman for Glencore, and Charles Watenphul, the press spokesman, were asked to clarify what part Glencore has played in the SUAL settlement; what compensation it is paying; and what modification of the Rusal contract Glencore has accepted for the remaining two years. They won’t say.

Glencore’s last annual report (for 2012) also reveals that it has written $1.2 billion off the value of its stake in Rusal. “As a result of the continuing challenging macro economic environment impacting the global aluminium market, UC Rusal’s share price has remained below Glencore’s acquisition fair value for what has now been determined to be of a prolonged nature and therefore, as at 31 December 2012, $ 1.2 billion of previously recognised negative fair value adjustments have been reclassified from OCI [other comprehensive income] to the statement of income.” The 8.75% shareholding was also posted by Glencore as “available for sale” at $840 million (page 134). At today’s market price, sale of the Glencore stake would fetch $462 million.

Now that Glasenberg and Deripaska have decided to compensate Vekselberg and Blavatnik, what assessment of the Glencore deal has been made by Mikhail Prokhorov? His Onexim holding is reported on the Rusal website as controlling 17.02% of the issued share capital. Onexim’s managing director, Dmitry Razumov (right) is a public critic of Deripaska’s role in leading the company into a debt hole. He and Prokhorov were asked this week whether the settlement between the SUAL shareholders and Rusal, and the compensation paid in relation to the Glencore contract, are of benefit to them?

Now that Glasenberg and Deripaska have decided to compensate Vekselberg and Blavatnik, what assessment of the Glencore deal has been made by Mikhail Prokhorov? His Onexim holding is reported on the Rusal website as controlling 17.02% of the issued share capital. Onexim’s managing director, Dmitry Razumov (right) is a public critic of Deripaska’s role in leading the company into a debt hole. He and Prokhorov were asked this week whether the settlement between the SUAL shareholders and Rusal, and the compensation paid in relation to the Glencore contract, are of benefit to them?

Their spokesman responded that for the time being they aren’t saying anything. This may change in due course, he adds.

Combining Onexim’s 17.02% stake in Rusal with the 15.8% held by SUAL Partners adds up to more than the simple voting power of 32% if their right to veto Deripaska’s decision-making is confirmed by the LCIA.

This is the significance of the trial continuing in London over the central power-sharing term of the shareholder agreement between Vekselberg and Deripaska of October 2006; this is what Rusal’s December 31 notice calls “the narrow purpose of interpretation of certain shareholder arrangements.” According to the original shareholder agreement, the power-sharing proviso gave, and still gives SUAL Partners a veto right over important transactions, including related-party transactions between the company and its shareholders or their subsidiaries.

This is the significance of the trial continuing in London over the central power-sharing term of the shareholder agreement between Vekselberg and Deripaska of October 2006; this is what Rusal’s December 31 notice calls “the narrow purpose of interpretation of certain shareholder arrangements.” According to the original shareholder agreement, the power-sharing proviso gave, and still gives SUAL Partners a veto right over important transactions, including related-party transactions between the company and its shareholders or their subsidiaries.

The LCIA must still rule on whether Deripaska, in league with Glasenberg, has violated this veto right. In the legal contingencies section of Rusal’s financial report for 2012, where Rusal described to the market the LCIA litigation, the company auditor claimed: “Management do not expect that the arbitration will have a material adverse effect on the Group’s financial position or its operation as a whole.”

That was on March 1, 2013. Last week’s disclosure of what is happening inside, as well as outside the London court has transformed the management expectation. Today the prospect for Rusal is different.

Leave a Reply