By John Helmer, Moscow

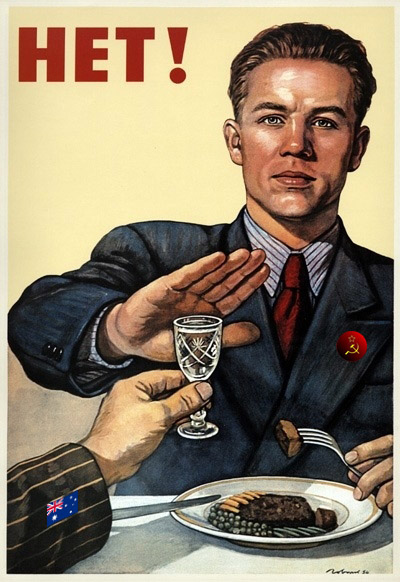

A three-judge appeals court panel in Chelyabinsk this morning preserved the injunction against Magnitogorsk Metallurgical Combine (MMK) completing its takeover of Australian iron-ore miner, Flinders Mines.

Today’s proceedings were a continuation of the May 30 hearing in Appeal Court no. 18 of the Chelyabinsk Arbitrazh Court, when Judge Galina Fedina, accompanied by judges Irina Sokolova and Svetlana Ershova, postponed consideration of parallel appeals submitted by MMK and Flinders Mines. Lawyers for the Australian company submitted additional materials on June 1, according to a notice on the court website.

They made no difference to the ruling. According to court spokesman Olga Tige, the Flinders Mines appeal has been decided and this morning dismissed. The MMK appeal has also been rejected.

The practical effect is that the deal-breaker remains in effect until July 2, the next scheduled date for a hearing by Judge Natalia Bulavintseva of the lower court. Bulavintseva imposed the injunction on March 30, following a brief hearing on an application by minority shareholder, Elena Egorova. The judge has refused to hear argument by both sides on the substance of the deal, the reasons for the deal reported in the minutes of the MMK board of directors, and evidence Egorova has offered to demonstrate the financial damage the A$556 million acquisition would inflict on MMK’s balance-sheet.

Egorova and her paperwork have failed to see the light of day for the two and half months of this unusual case. Her lawyer exists, however. She is Dina Danilchenko, and this is the background she has placed on her facebook page. Danilchenko was contacted at her Moscow law firm, Sofos Quatro, and invited to respond to questions about the case and to substantiate the existence of her instructing client. Her secretary responded: “if Dina considers it necessary, she will get in touch”. It wasn’t; she hasn’t.

Undecided, the court case now heads for the June 30 deadline when Flinders Mines and MMK must either agree to extend the quit-date for finalizing their deal, or to abandon the transaction altogether.

Australian promoters of the Flinders Mines share price have been placing in the press claims that Rio Tinto and Posco, the South Korean steelmaker, are potential buyers. Hedge fund managers gossip among themselves that there are also Chinese and Japanese bidders. Until June 30, however, there can be no formal negotiations for a new sale. On this speculation, the Flinders Mines share price has traded between 13 cents and 16 cents. The MMK takeover offer price was 30 cents.

“We will be doing everything we can to close the deal as we took this obligation under the agreement with Flinders,” Kirill Golubkov, MMK’s spokesman, has been telling the Australian media. His next announcement will be more informative.

Leave a Reply