By John Helmer, Moscow

@bears_with

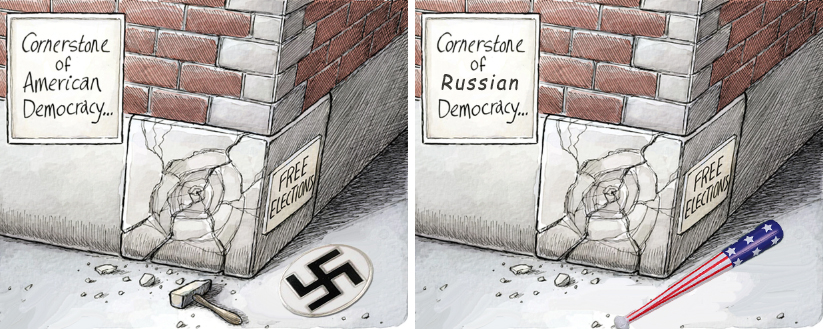

According to the rules-based order of the US and allied states now fighting their wars against Russia, Palestine, Syria, Iran, China, and North Korea, the enemy states are dictatorships by single men ruling by decree without elected legislatures, imposed by armed forces and propaganda apparatus using by terror methods. In a nutshell, the democracies versus the fascists.

In fact the opposite is the case. The US, France, and Germany are more efficiently fascist than the United Kingdom, but this is a matter of degrees. Since October 7, Israel has become more visibly fascist at the same time as it is proving less efficient, compared to its past in reputation and in fact.

When it comes to performance on the battlefield, where the fascist states must dominate in order to continue to subject their domestic populations, the power of their arms, money, propaganda is being defeated. This is happening in circumstances when the gender (he/she/they) of the dictatorship is as irrelevant as the mental competence. President Emmanuel Macron is a case of the first; President Joseph Biden a case of the second.

Every so often in the Russian press it is possible to catch a glimpse of how the domestic democracy really works. Of course, such glimpses and snippets don’t make political science, nor antidotes to the fascist ideology of the US side. They are also examples of how Russian money talks when it is at home.

Here is the touchstone question in the history of all the democracies of the west, and, incidentally, the trigger of many of their civil wars and wars of independence – who should pay tax to the state, who should decide, and how much?

During Boris Yeltsin’s regime there was a giveaway of assets, with an additional free-for-all concession scheme to foreigners investing in mining and oil and gas drilling. There were as many names for these schemes as there was ingenuity in the stealing.

To put a stop to that, recover revenues for the state treasury, and transfer the benefits from foreign corporations to local oligarchs, the individual and special-interest favouritism of the 1990s was replaced with two across-the-board or gross taxes – one on production out of the ground and a second on oil, gas and minerals exported over the border. The first of these has been called the Mineral Extraction Tax; MET for short in English, NDPI in Russian.

Since 2019 the Finance Ministry has been transferring its tax collection priority from export duty collection to MET. In the new trading blocs created by US and NATO economic warfare, this also protects the secrecy of Russian export and shipping transactions. Sanctions war is the final nail in the Yeltsin coffin of production sharing agreements (PSA) and other tax favours for western corporations.

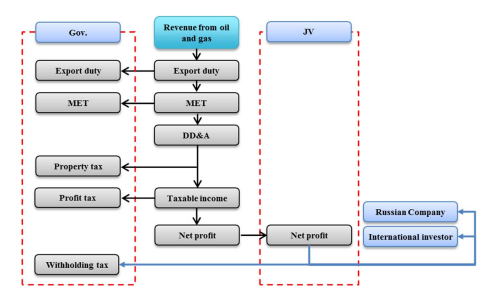

Naturally, the Chinese interest in understanding and negotiating terms of investment and trade with Russian miners and oil and gas suppliers has grown. This is an example of recent research by the think tank of the China National Petroleum Corporation (CNPC) to assist future calculations of investment margin and net profitability in projects CNPC is negotiating with its Russian counterparts, Gazprom, Rosneft, and Novatek.

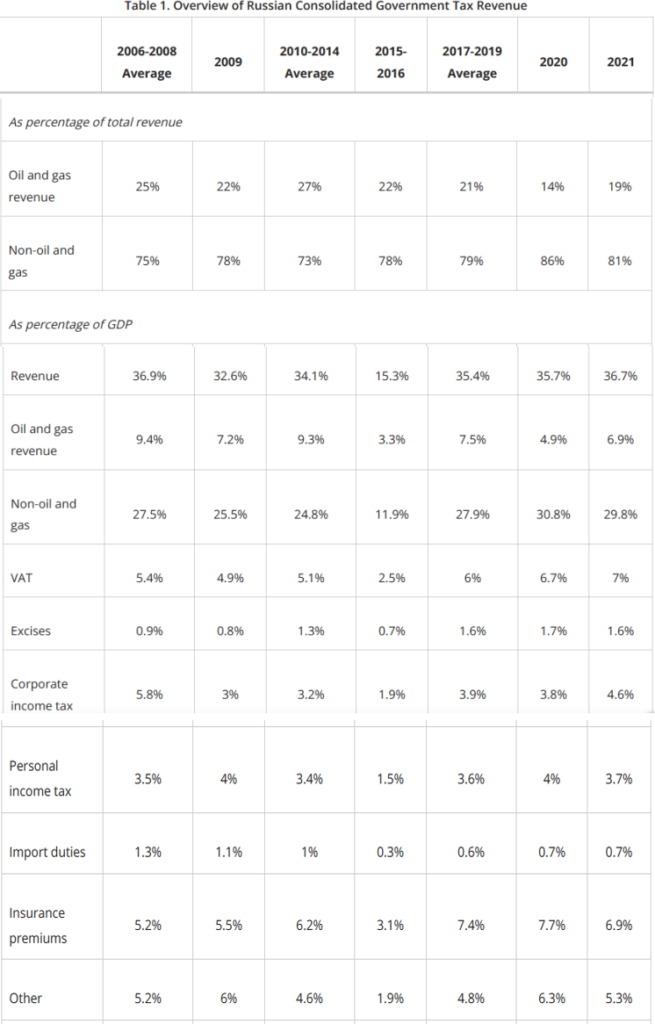

The CNPC researchers express the purpose of their study more discreetly, and also more politically — “to investigate instability of tax regime which is one of the main concerns for decision making in asset acquisition…to reduce aboveground risk of unstable fiscal regime and boost international investment in Russia. Also, [to make] key suggestions…for international investors who are interested in oil and gas assets in Russia.” Here is their diagram of how MET operates in the larger Russian treasury scheme of revenue collection:

RUSSIAN TAX REGIME FOR OIL AND GAS PRODUCTION

DD&A = Depreciation, Depletion and Amortisation, the accounting scheme allowed by the state as a tax offset or deduction in the calculation of property and profit tax. Source: https://hal.science/

A Polish think-tank interpretation of the transfer of tax collection from export duty to MET, the so-called tax manoeuvre, can be read here. In this self-serving history of taxation during and after the Yeltsin regime, this International Monetary Fund (IMF) staff paper noticed that “the underlying problem was a lack of political will to take tough actions against politically well-connected taxpayers”.

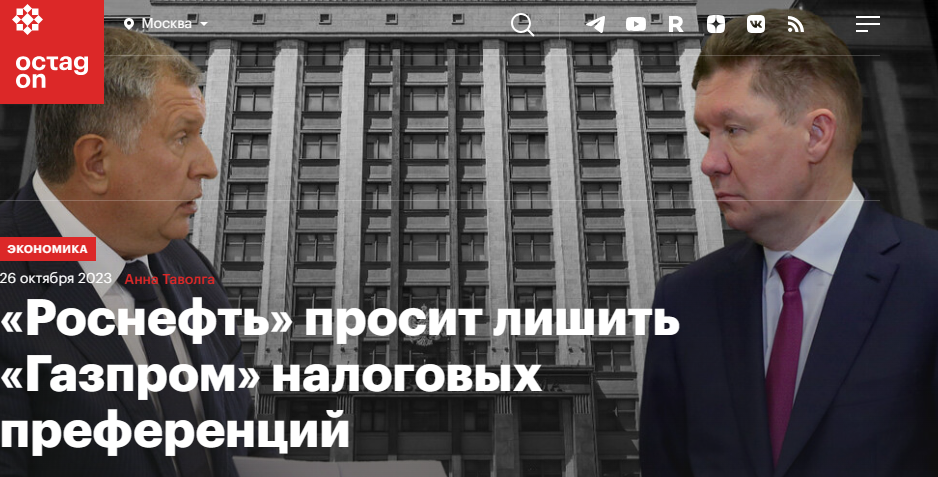

In this news report by Octagon, published last week in Moscow, the current political contest is analysed between Gazprom and Rosneft, the leading state-controlled energy corporations. The principals named in the contest are Alexei Miller, chief executive of Gazprom, Igor Sechin, his counterpart at Rosneft, and Vyacheslav Volodin, Speaker of the State Duma.

For the back story archive on Miller, click to open; for Sechin, click; and Volodin here.

The one decision-making, power-wielding name missing from this Russian report is the name which is never missing from the foreign media – Vladimir Putin.

The Russian text has been translated verbatim without cuts or editing. Illustrations and captions have been added for clarification.

Left, Igor Sechion; right, Alexei Miller. Source: https://octagon.media/

A Harvard University propaganda outlet has attempted to discredit Octagon’s reporting as state controlled with the objective of “discrediting stories from independent newsrooms, criticizing protestors, or vilifying the Ukrainian government.”

October 26, 2023 ROSNEFT CALLS FOR DEPRIVING GAZPROM OF TAX PREFERENCE

By Anna Tavolga

The downside of the unplanned increase in the wholesale gas tariffs scheduled for the next two years will be an increase in the tax on the extraction of natural resources. The corresponding bill was adopted by the State Duma in the first reading on October 17. According to the legislators, the measure will allow replenishing the budget by withdrawing additional revenues from gas producers which they will receive from indexing.

However, the increase in the mineral extraction tax for Gazprom will be lower than for the other gas producing companies. The head of Rosneft, Igor Sechin, has called for correcting the mistake. Will the regulators and legislators acknowledge this?

A new round of confrontation between Gazprom and Rosneft in the gas field was outlined this week. Three days after the adoption of the bill providing for an increase in the MET for gas from 2024, State Duma Speaker Vyacheslav Volodin received a letter from Igor Sechin. In his appeal, referred to by Kommersant, the chief executive Officer of Rosneft points to the ‘disparity’ that will arise in the event of the adoption of the law.

Judging by the figures given in the bill, the discrepancy is quite significant. The MET rate is planned to be increased by a special coefficient (Kkg) introduced this year. From January 2023 to June 30, 2024, this is to be 134, from July 1, 2024 to June 30, 2025 – 285, from July 1, 2025 – 305.*

The document provides that the Kkg indicator for the owners of the Unified Gas Supply System will be set in the first half of 2024 at 303, for independent companies, 555, in the second half of 2024. The coefficient for Gazprom will then grow to 454, for independent companies to 706. From January 1, 2025, for Gazprom it will be 428, for independent companies, 779; in the second half of 2025, the state monopolist will receive a coefficient of 448, independent companies, 799. Finally, from January 1, 2026, the Kkg will be 464 and 863, respectively.

As a compromise to eliminate the disparity, Igor Sechin proposes to increase the MET coefficient for everyone to the level provided for Gazprom.

The head of Rosneft sees the main injustice in the fact that his company supplies gas only to the domestic market, mainly to power plants. Indexation, as previously reported by Octagon, will not affect the electric power companies at first, which means that Rosneft will not be able to become its beneficiary [by raising its gas price]. At the same time, the MET will be increased for all gas produced.

In addition to equalising all gas producers in terms of adjusting the mineral extraction tax, Sechin puts forward the idea of imposing an additional tax on companies which receive increased revenues from their gas supplies to premium export markets. In this not so veiled form, the proposal would compensate with additional tax revenue for the state treasury.

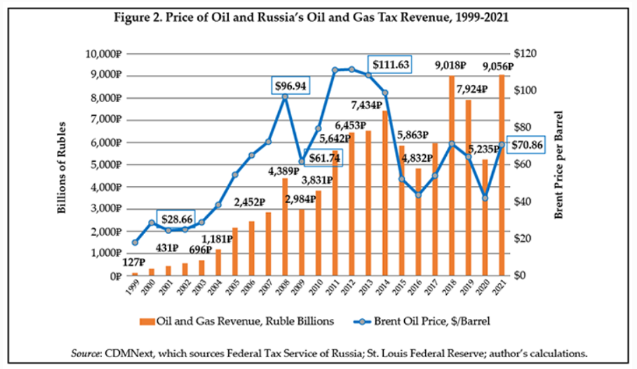

The main goal of adjusting tax legislation in its various aspects is to increase budget revenues – this has been repeatedly declared by officials. In the first nine months of this year, the federal budget received 34.5 percent (5.6 trillion rubles) less oil and gas revenues compared with the same period of last year. From the proposed increase in the mineral extraction tax, the Ministry of Finance is expecting additional revenues to the treasury in the amount of over a quarter of a trillion rubles for 2024-2026.

Source: https://www.taxnotes.com/f

Read more: https://www.forbes.com/

Source: https://www.taxnotes.com/

At the same time, the agency provides forecast estimates of the revenue that gas producers will receive from the indexation increase in tariffs. In particular, Deputy Finance Minister Alexei Sazanov has noted that Gazprom’s revenue from the increase in gas tariffs in 2024-2026 will amount to about 120-130 billion rubles per year.

It is claimed that by adjusting the MET according to the new legislative amendment, more than 90 percent of these funds will be withdrawn.

The State Duma Committee on the Budget explained the difference in the adjustment for Gazprom and other manufacturers by the fact that it is necessary to equalise the economic conditions of conducting business activities of various enterprises. If we proceed from the volume of sales, Gazprom’s contribution to the replenishment of the budget will indeed be higher than that of other companies, but how fair in actual fact the preferential taxation scheme is a moot point – power politics is what is visible here, not logic.

‘The introduction of different rules for manufacturers of the same product is a violation of the antimonopoly legislation. It is not clear what kind of alignment of conditions we are talking about. Are Gazprom’s costs higher? The corporation enjoys a monopoly right to pipeline exports, owns the pipe monopolistically so the independent producers must pay for access to it, while production conditions in the Far North and new fields are harder for the independents; that is, they incur heavier costs. But for all that, Gazprom is protected by the halo of a state system–forming company,’ Leonid Krutakov comments to Octagon; Krutakov is Associate Professor of the Financial University under the Government of the Russian Federation.

Left, Alexei Sazanov; right, Leonid Krutakov.

According to the expert, in fact, the amount of mineral extraction tax for independent producers will be about twice as much as for the gas monopoly. It follows from this that if 90 percent of the profits to come from the gas price increase are withdrawn from Gazprom, then the rest will have to give more than 100 percent to the state.

‘That is to say, Gazprom will be able to raise its prices by only 10 percent, and independent producers will suffer additional losses – they will not just compensate for the increase in tariffs, but they will also have to pay the Ministry of Finance,’ Krutakov continues.

As a result, this measure, if implemented in its current form, will lead to an increase in prices, from which the consumer will suffer first of all, the analyst believes.

Taking into account the Russian climate, where heat and energy costs per unit of product significantly exceed European ones, a drop in domestic production is inevitable. The implementation of promising projects which Rosneft and Novatek are engaged in is also under threat.

Krutakov believes that the adoption of the controversial bill in the first reading was the result of lobbying efforts by Gazprom’s management, but now the intervention of the head of Rosneft creates a certain intrigue.

‘Will Igor Sechin’s requests be heard? Let me remind you that he is the executive secretary of the presidential commission on the development strategy of the fuel and energy sector. Accordingly, from the outcome of this story we will see whose political resource is the stronger,’Krutakov is convinced.

A session at the Kremlin of the Commission on the Strategy for the Development of the Fuel and Energy Industry, October 27, 2015, at which President Putin acknowledged the commission chairman, Igor Sechin. Source: http://en.kremlin.ru/

The last session of the commission reported by the Kremlin was on August 27, 2018; source: http://en.kremlin.ru/

The last record of Sechin discussing MET with Putin was at a one-on-one meeting they had on April 1, 2019. Putin asked if “the budget manoeuvre, an increase in the mineral extraction tax (MET) and, consequently, the so-called reverse excise tax? Is this an effective mechanism?” Sechin avoided a direct answer. “We are working with the Government on this. The Finance Ministry is looking for sources to implement this reverse tax mechanism, the so-called adjustment coefficient (ratio). But we are keeping the prices down”.

The first signals from the authorities have already arrived. On October 25, Alexei Sazanov responded to Rosneft’s appeal. He said that the Government has also received proposals from the oil company and the issue is being worked out. ‘The material balance is being looked at in order to make a final decision. Now all this is being studied,’ the official said.

The date of consideration of the bill in the second reading, judging by the information on the document page on the State Duma website, has not yet been determined.

[*] Kkg=corrected coefficient of gas. This is the resulting sum of a complex calculation of production and price variables, including amount of reserves, reserve depletion, region of production, complexity of extraction technology, viscosity and other characteristics of the oil, etc. For an outline of how the coefficient formula is calculated, read this.

Leave a Reply