By John Helmer, Moscow

As war and economic recession eat into their incomes, Russians are making fewer trips to restaurants and cafes. But because the tab is smaller, fast-drinks vendors are taking a larger share of the retail market than fast food. That ought to be good for Shokoladnitsa, Russia’s leading chain of hot-drinks and quick-service cafes. But cost-cutting by the chain has shortened menus and closed cafes, industry sources are now reporting. If Shokoladnitsa’s liabilities are overtaking its assets, the sources warn that Shokoladnitsa may follow the Russian shoe market’s leading retailer, TsentrObuv. In that financial black hole, the question is whether revenues and loan funds for another Russian retail market leader are being diverted to shareholder havens offshore.

The Shokoladnitsa chain, whose name in Russian means “chocolate pot”, was first popularized in the Soviet era by an eponymous café near the Octyabrskaya Moscow metro station. In the year 2000 the premises and the brand-name were acquired by Grigory Kolobov. The chain trades mostly in Moscow and St. Petersburg, with outlets in more than 20 other cities. The company website currently says it operates 240 Shokoladnitsa cafes in Moscow and the surrounding region; it doesn’t say how many countrywide. In 2014 it claimed to have 420, with a plan to expand the brand-name to 650.

Grigory Kolobov put his senior son Alexander (lead image) in charge of the business, and the two of them have seats on the board of a Cyprus company called Kalazaco Ltd. It holds the Russian assets, controls Shokoladnitsa’s cashflow, and makes dividend payments to family and shareholder companies in other offshore locations. No photograph can be found in Russian media archives of Grigory Kolobov. Shokoladnitsa’s finances are almost as invisible.

The records of Mossack Fonseca, the lawfirm for offshore operations detailed in the Panama Papers, indicate that starting in 2002 Grigory Kolobov was moving money from Russia into a UK company called Crofordshire Holdings.

His junior son Pavel (right) was also a director of this entity, and the company is still active. Pavel also operates a real estate investment company called PIMO based in Palma de Mallorca, Spain.

Between 2005 and 2009 Alexander Kolobov was moving money from Shokoladnitsa into a British Virgin Island (BVI) entity called Marsham Assets.

That company was struck off in April 2009. According to Alexander’s Facebook entry, he currently calls London his home town.

In 2006 Alexander Kolobov claimed in a Moscow newspaper that the annual turnover of Shokoladnitsa was about $30 million. In 2014, Mikhail Burmistrov, director of INFOLine-Analytics, a St. Petersburg market research company, said the turnover had jumped tenfold to $300 million.

A report by the Foreign Agricultural Service of the US Department of Agriculture (USDA), issued on December 17, 2014, claimed that in 2013 sales in the café chain segment of the market totalled Rb34 billion ($1.1 billion), and that Shokoladnitsa had “a value share” of 7%. That would make a dollar equivalent revenue figure of $74 million. According to the US government study, “regions are now becoming the main focus in expansion plans as Moscow and St. Petersburg are near the saturation levels of other major European cities in terms of chained cafés and independent cafés presence. Franchising is one of the main tools of coffee shops development, especially in the chained segment.”

Costs and profits have not been publicly reported. Nor have the chain’s debts to banks for the loans required to open new outlets. INFOline-Analytics has estimated the retail market in hot-drinks cafes might be worth as much as $2 billion, and that Shokoladnitsa’s share of that market might be more than 10%. INFOline-Analytics has presented no data to substantiate the claims.

The market research figures are contradictory on how well, or how weakly, Shokoladnitsa has been performing. By mid-2014, according to this market consulting report, Shokoladnitsa cafes were more numerous than McDonald’s outlets, and their number was growing at a yearly rate of 20%.

Burmistrov, by contrast, said the INFOline-Analytics surveys showed the popularity of coffee shops was already in decline. In 2013, he reported that 18.1% of Russians went to coffee shops — making them second only to fast-food restaurants in market demand. But that figure had dropped to 13% in early 2014.

According to the Euromonitor marketing organization, reporting “consumer desire to reduce expenditure led to a stagnating volume sales for tea, a highly saturated category in Russia, and also significantly impacted other hot drinks, which are not seen as products of first-necessity.”

In a report on the fast-food retailing market, released in May 2016, Euromonitor claims, that “in 2015, the Russian economy continued to demonstrate negative dynamics. Decreased oil prices, continuing geopolitical tensions, extended Western sanctions and the food embargo, import replacement, devaluation of the Russian rouble and high inflation, increased unemployment and reduced consumer purchasing power resulted in decreased consumer demand for consumer foodservice and optimisation of businesses among players. In this way, the weakest players stopped their operations in Russia and those that were left carefully reviewed their businesses and closed all unprofitable outlets.”

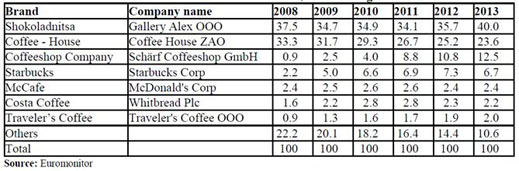

GROWTH OF RUSSIAN COFFEE SHOPS BY NUMBER OF OUTLETS, 2008-2013

Another Euromonitor report on Russian cafes and bars, dated May 2016, claims “Russians continued to lose their purchasing power, which combined with increased prices resulted in decreased demand for cafés/bars in 2015…In 2015, Gallery Alex OOO [the Russian registered company operating the Shokoladnitsa business] generated a 15% value share in cafés/bars and only a 6% share in the number of outlets in 2015… high prices, growing competition from other categories and decreasing consumer purchasing power hampered the development of the company in 2015.”

Figures provided for this report by Euromonitor indicate that between 2014 and 2015, the total value of the café and bar market contracted from Rb94.1 billion ($2.4 billion) in 2014 to Rb93.8 billion ($1.5 billion). Shokoladnitsa’s share of that sales figure, according to the Euromonitor measurement, was 14.5%. Sales revenue for cafes and bars is predicted by Euromonitor to rise this year by just 1% to Rb94.8 billion.

If Euromonitor is accurate in estimating total market sales and Shokoladnitsa’s value share when it was operating more than 400 outlets, then revenues of Shokoladnitsa appear to have peaked in 2014 at $348 million. If the chain is closing outlets so that value share has slipped to 7%, revenues this year may be no more than Rb14 billion ($212 million). Euromonitor has no idea of the financial condition of the companies leading the market, so it cannot say if a stagnating or retreating revenue line will mean loss-making for Gallery Alex, Shokoladnitsa’s Russian operating company.

The USDA study also warned that the entire market is in trouble. “In addition to serious political tensions and economic hardship, chained coffee and independent cafes have also been forced to deal with a nationwide public smoking ban enacted in summer 2013. Smoking prevalence remains unusually high in Russia – 41.7 percent of the population in 2013 – and this could have a negative impact on coffee culture outside of the home.”

Loss-making and descent towards insolvency are the red-line trends in the only stock exchange-listed Russian restaurant company, Rosinter. Its outlet brand-names include Il Patio, Planet Sushi, American Bar & Grill, and Mama Russia. With Whitbread of the UK, it also operates Costa Coffee shops in Russia.

The Rosinter financial report for 2015, issued in April, reveals that the company’s revenues fell 13% from 2014 to Rb7.7 billion; expressed in US dollar equivalent, that’s a drop of 20%.

Rosinter’s debt servicing bill grew 43% in this period to Rb278 million. Losses jumped 36% in 2015 over 2014, and totalled Rb593.7 million ($9.7 million). According to the local audit firm ADE, Rosinter’s “current liabilities as of December 31, 2015, of RUB 3,112,771 (RUB 2,139,558 as of December 31, 2014) exceeded its current assets by RUB 2,276,026 (RUB 1,047,094 as of December 31, 2014). The net current liability position primarily results from trade and other payables and short-term loans amounting to RUB 1,540,151 and RUB 1,346,083, respectively… Based on the currently available facts and circumstances the management and directors have a reasonable expectation that the Group has adequate resources to continue in operational existence for the foreseeable future.”

This is not optimism which the Moscow and London stock markets share. The chart illustrates the steady decline of the Rosinter share price; at the current point its market capitalization is just under $14 million. The recovery this year of the crude oil price has lifted the Moscow (MICEX) stock index, and halted the decline of X5, the supermarket chain whose discount-price tactics have been gaining revenues and market share from its rivals; for more details, read this. Rosinter has continued to tumble.

5-YEAR TRAJECTORY OF ROSINTER SHARE PRICE COMPARED TO X5 SUPERMARKET AND MOSCOW STOCK EXCHANGE (MICEX) SHARE INDEX

KEY: Rosinter=yellow; X5=pink; MICEX index=blue

Source: http://www.bloomberg.com/quote/ROST:RM

According to Olga Tretyakova at the Ipsos Comcon market research firm in Moscow, Shokoladnitsa’s revenue line is being supported by a relatively low customer check, averaging Rb390 ($6.40), 25% less than the average tab at pizzerias and half the average of other fast-food restaurants. This has been good for Shokoladnitsa’s market share. While surveys by Ipsos Comcon have found a small contraction in the overall number of eat-out trips by Russian consumers, there has been a marked shift away from restaurants towards hot-drinks cafes. They took a 17% share of the retail market in 2014; 20% in 2015.

Inside Shokoladnitsa there have been signs of financial trouble since the economic crisis of 2009. By mid-2012, according to this report,a management purge was under way and wages for kitchen and service personnel were being cut. The product formats were changed, cutting out food items first to reduce preparation and supply costs, but later adding them back to attract more customers and lift sales volumes. At Coffee House, Shokoladnitsa’s closest competitor, heavy borrowing in hard currency to save the chain after the downturn of 2008-2009 proved to be unsustainable. Increasing the number of outlets and reducing the average customer check with more drinks, less food, failed to lift the profit-loss line. By the start of 2014 Coffee House, with 226 outlets and annual revenue reported to be about $160 million, was looking to sell out.

In March 2008, before the market downturn which started in the last quarter of the year and persisted through 2009, Alexander Kolobov told a business publication that Shokoladnitsa was “trying somehow to stand out from the crowd [rival hot-drinks cafes], to find uniqueness and individuality. I think we now are original in many ways, but in some ways we are still similar to the others.” To finance the cost of market differentiation and expansion of sales, according to Kolobov, “we combine equity and debt. In particular, loans from banks. Now, of course, it’s the wrong time to anticipate a quick return. But with an estimated return on investment for new stores not exceeding four years, we are quite satisfied.”

Kolobov added that at the time the opening of a new café cost between $150,000 and $200,000 in investment. From 2008 until 2014 Shokoladnitsa added more than one hundred outlets of its own, and almost that number of franchisee-financed cafes. The investment required from the Kolobovs, borrowed by them from banks, is estimated to have been between $20 million and $40 million.

Russian market sources suggest that although revenues have grown since then, profitability may have peaked in 2008. Rosinter, for example, reported its last positive profit results in 2006 and 2007.

The Kolobovs are likely to have been having comparable financial difficulty. They then made the strategic decision to save themselves by buying out Coffee House. The transaction was announced in October 2014. Market experts expressed scepticism at the time that the move would save Shokoladnitsa financially because “Shokoladnitsa and Coffee House have stopped being the place where people go.”

No details of the Shokoladnitsa takeover of Coffee House have been published, so it isn’t clear how much debt was transferred in the deal, and how much cash the Kolobovs paid out. To finance the takeover and cover his own rising debt, Kolobov senior announced he was selling 40% of his shares of the Shokoladnitsa-Coffee House combination to Acmero Capital, a Hong Kong-registered entity owned by Povarenkin (below, left).

Povarenkin, a mining company operator in Georgia, Armenia, and eastern Siberia, started with two seats on the board of Kalazaco in 2014; he now occupies one of them. According to Acmero, its 40% represents a “commitment of USD 120 million for Foodservice/QSR segment [Shokoladnitsa].”

Acmero won’t say if this has already been paid, or it’s a promise to pay. The figure suggests the Kolobovs and Povarenkin agreed the consolidated business was worth about $300 million, and that after the Coffee House debts were subtracted from its value in the deal, the Kolobovs had to pay out roughly half the amount Povarenkin agreed to pay in for his shares. That may have left the Kolobovs with about $60 million in cash. Since market reports indicate the assets of the combined café group are shrinking, it appears the Kolobovs are not reinvesting cash in the business.

Shokoladnitsa’s finance director, Ilya Chernomzav (above, right) is also on the board of Kalazaco. His shares are linked to a Czech-registered company he owns called United Property Holding s.r.o.; and to an earlier Prague-registered entity called VK Property s.r.o.

Another Russian stakeholder on the board is Nikolai Ermoshkin (below left). In 2014 he was working for Sergei Generalov (right) at Generalov’s London holding, Industrial Investors. Generalov and Povarenkin have been longstanding partners in mining, maritime transportation, and other businesses.

Industrial Investors was asked to clarify if it has a stake in Shokoladnitsa through Kalazaco, and to confirm whether Ermoshkin represents its interests on the Kalazaco board. A Moscow spokesman for Industrial Investors said Ermoshkin has not worked there for “a long time”, and that the holding has “no connections to Shokoladnitsa”. According to this record, Ermoshkin is employed by Povarenkin for the present as chief investment officer of Acmero. He lists himself as living on Hangman’s Lane, Welwyn, north of London.

Povarenkin’s and Generalov’s history together at the GeoProMining company is one of controversial acquisition pricing; rapid leveraging of assets; and the reluctance of public shareholders to buy into a forecast of falling revenues. Why would Povarenkin be investing in a company whose fortunes were tailing off, and with market forecasters predicting worse to come? Povarenkin describes his personal interests as those of a “noted gastronome with a great interest in foods from around the world.” Market sources acknowledge that retailing food and drink in Russia can be a cash cow; they ask if Shokoladnitsa can be milked offshore, where the Kolobovs, Kalazaco and Acmero count their takings, before the profit-loss line is reported on the Russian balance-sheet?

At INFOline-Analytics Burmistrov (right) was asked if he knew what the revenues, profits or losses, and bank debts have been for Shokoladnitsa since 2013. He was also  asked if he has heard whether the group is having difficulty accounting for the expenditure of loan funds or meeting loan repayments. He replied: “We can’t help you. It’s too long and complicated work to be done without your paying for it”.

asked if he has heard whether the group is having difficulty accounting for the expenditure of loan funds or meeting loan repayments. He replied: “We can’t help you. It’s too long and complicated work to be done without your paying for it”.

At Shokoladnitsa Alexander Kolobov and Chernomzav were asked to clarify the terms of the deal with Acmero to buy out Coffee House. They were also asked to say what loss or profit Shokoladnitsa made in 2014 and 2015; and how its assets compared with its liabilities at the start of 2014 and the start of this year. A spokesman replied the questions should be put in email form, and “it will be answered in ten to fifteen days.”

Leave a Reply