by John Helmer, Moscow

@bears_with

Last week it happened that God and the United States Treasury managed to underwrite a record issue of Israel Government bonds to continue the war against the Arabs in Gaza, West Bank, Lebanon, Syria, Iraq – and Iran if necessary.

The war financing comprised $2 billion of five-year bonds, and $3 billion each of 10 and 30-year bonds.

The US Treasury guarantees bond holders that if Israel defaults on repayment of its obligations, the US will pay instead. Notwithstanding this, the Israelis were obliged to offer an extra 1.35%, 1.45%, and 1.75% more in interest over the going rate for US Treasury bonds for the same length of term.

The Reuters news agency headline on March 6 celebrated “Israel sells record $8 billion in bonds despite Oct 7 attacks, downgrade”. The propaganda agency based in New York quoted Israel’s Accountant-General as claiming the bond placement “results showed an “unprecedented expression of confidence in Israel’s economy by the world’s largest international investors”.*

In fact, according to well-informed bond trade sources in Europe, with the higher interest rates the market has just demanded from the Israelis, the spread between the Israel bonds and US Treasuries has never been wider, and the worse this spread will become for Israel. This is a vote of no-confidence from the market which the Israelis, the Americans, and their media are trying to keep secret.

The longer the war is protracted, the more obvious the costs of Israel Defence Forces’ (IDF) failure will become – and the deeper the negative bond sentiment will grow. By converting secrecy into money, the market is signalling that it has begun to turn against Israel – and profit at Israel’s expense.

Also unprecedented is the secrecy in which the “expression of confidence” has been managed by the US, French, and German banks acting as managers of the Israeli bond issue; and of the US Securities and Exchange Commission (SEC), which has had regulatory oversight of the process. The debt financing has been reported as a “private placement”; this has removed the requirement that the Israelis produce a public prospectus explaining how they think their war – plausibly genocide, according to the International Court of Justice in its ruling of January 26, 2024 – is going, and how long the IDF claim it will last.

This does not remove the legal requirement on the two US banks engaged in marketing the bonds to US investors, Bank of America and Goldman Sachs, to submit a formal application for SEC approval of what is called a letter of consent. However, asked to confirm the contents of the letter of consent application for the sale of the Israeli bonds, and its official approval, the SEC has refused to give any answer.

Goldman Sachs was asked the same questions. The bank also refuses to say.

Last October the chief executive of Goldman Sachs, David Solomon,* issued a personal letter to the bank’s employees claiming the Hamas operation was a “violation of fundamental human values”: Solomon then proposed a $2 million gift of bank funds “to organizations providing critical support and humanitarian relief in Israel”; plus additional bank money, three bank dollars for every one contributed by bank staff making donations under $25, and one for one if the staff contribution was over $25. Asked how much money has been raised for Solomon’s gift to the Israelis, the bank is refusing to reply.

In other words, Israel’s public genocide is a private secret among Americans who are paying for it, and among US government officials responsible for regulating the scheme according to US law.

According to well-informed bond traders, this deal-making is worth in fees to the dealmakers, led by Goldman Sachs, about $100 million.

For the strategy of protracted economic war against Israel, start on October 27 last. For the sequel, and a preview of international bond market calculations on the war on February 6, click to read.

Source: https://johnhelmer.net/

Russian strategy and tactics have been a wrestle between the Kremlin, the General Staff, and the Foreign Ministry; a multiple-line approach by the military; the convergence of ideologies between national liberation and terrorism; and the countdown to the presidential election on March 16-17. Read the last essay from January 25.

The following week, the downgrade by the Moody’s rating agency confirmed the inflection in market sentiment against Israel, with worse to come.

A month ago, Bloomberg’s Israeli reporter Galit Altstein was assigned the job of printing all the material he could find promoting the sale of the bonds. The headline of his report implied that Israel would be able to finance its war despite the Moody’s downgrade and the longer-term risks in the small print of the Moody’s report.

Source: https://origin.www.bloomberg.com/ -- February 11, 2024.

According to Bloomberg, about $58 billion in new debt would be issued this year, up by a third from the prewar year. About 80% of that total is usually raised in the domestic Israeli market; but if Israeli investors lack the funds or are fleeing to safe havens for their money, a much larger percentage of the issue will have to be raised from international investors, most of them in the US. This, conceded Bloomberg’s Israeli informants, would require “private placements, which are typically bought by a few investors at most. Those have been arranged by banks such as Goldman Sachs and Deutsche Bank.”

“Domestic issuance in the first two months of this year,” Altstein reported for Bloomberg, “is projected to total the equivalent of more than $9 billion, a 350 percent rise from the same period last year…The cost of insuring against an Israeli default — as measured by credit default swaps — is now higher than that for lower-rated sovereigns such as Mexico and Indonesia, indicating some investors are nervous.”

Israeli financial media reporting indicates that the $8 billion in bond sales completed this month were entirely placed outside Israel.

In the money markets, nervousness fetches a rising price; in the case of Israel’s genocide bonds the only way to keep that price rise secret is through private placements. They are operations run by banks like Goldman Sachs which avoid the requirements of issuing a prospectus; obtaining a credit rating from a ratings agency which evaluates the prospectus claims; and making a market with semi-public meetings with investors and answering their questions. What Goldman Sachs does instead, according to those familiar with the bank’s operations, is to “dump the issue in state or institutional pension funds which can be counted on to hold the issue until maturity, and ask no questions.”

But even passive pension fund managers have their fiduciary limits: Israel’s war began to trigger withdrawals from both Israeli state and corporate bonds by Norwegian pension funds last November; by Danish pension funds after the genocide ruling by the ICJ in January.

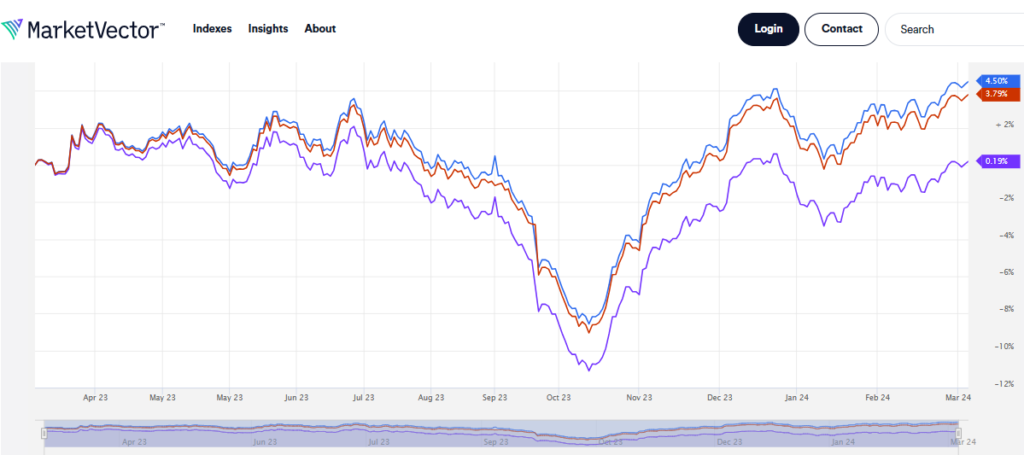

An index tracking ten Israeli corporate bonds for the banking, telecommunication, pharmaceutical, and real estate sectors, shows market demand for Israeli debt issues fell in the first month of the war, but then began recovering above the pre-war levels.

ISRAEL BOND INDEX SHOWS RECOVERY FROM WAR STRIKE

Source: https://www.marketvector.com/

By opting for private placement, the Israelis, Goldman Sachs and Bank of America agreed to avoid having to issue prospectus claims about the war against the Arabs which, if truthful, might reveal how false Israeli government claims about the war have been so far; and if false, would create a legal liability for the Israelis and the banks to being charged with a Section 17(a) fraud.

In the US Securities Act, which the Securities and Exchange Commission (SEC) enforces, Section 17(a) “makes it unlawful to ‘employ any device, scheme, or artifice to defraud’, ‘obtain money or property’ by using material misstatements or omissions, or to ‘engage in any transaction, practice, or course of business which operates or would operate as a fraud or deceit upon the purchaser.’ This provision is closely tracked by Section 10b of the Securities Exchange Act and Rule 10b-5, which is used more widely by investors suing for fraud.”

The ICJ ruling against Israel in January has not stopped or even paused the IDF operations in Gaza, the West Bank, or on the northern front with Lebanon. However, the court has established a benchmark for “material misstatements and omissions” in what the Israel bond marketeers can say without running into Section 17(a) fraud litigation. This makes Israel’s war financing riskier and a bond prospectus impossible; it also makes the interest rate cost to the Israelis more expensive. For Goldman Sachs and the other banks engaged, that has meant more profit with higher fees.

Asked what the market was thinking about the private placement of the Israeli paper, a veteran European trader refused to reply. Other traders in Switzerland answered in generalities until Israel’s bonds were mentioned; then there was stonewalling. “It’s certain there’s an omerta,” a trade source commented. “The Israeli finance ministry has claimed the bond offer drew 400 investors from 36 countries making bids totalling $38 billion. But there is no mention of how the bonds were actually allocated. I suspect there were many token offers and only a few selected buyers got most of the issues.”

The Israeli financial source Globes claims “demand for the issue was led by first-rate strategic investors such as pension funds, insurance companies, hedge funds, and institutions that have been holding Israeli securities for many years.”

Source: https://www.reuters.com/

According to this report, Israel’s economy contracted an annual 19.4% in the fourth quarter from the prior three months, which was double the rate of GDP loss which had been the consensus of economists Reuters had been polling.

A bond trade source at an international institution points out that “when issuing a bond, the lead manager charges a fee. The net proceeds are going to be obviously less. The question is how much is Goldman Sachs charging in fees? This is usually stated in a prospectus but we don’t have that in the Israeli case. If the issue is difficult to place, the lead manager will contract with other banks to share the burden. They will then use a portion of the fees to make a market for the issued instruments and stabilize the pricing. Again this should be disclosed.”

In the results given by Israeli officials to Reuters on March 6, it was reported that Israel sold $2 billion of five-year bonds, and $3 billion each of 10 and 30-year bonds. “This is unusual,” the trade source comments. “If you need to restructure your economy you would expect most of the costs will be upfront, with payback from the higher efficiencies or higher profits reimbursing the borrowed funds later. This should not take ten or thirty years, so another calculation is in play.”

He believes the Israel government’s calculation is that the war on the military front is going to get worse, and the economic war for longer than can be acknowledged publicly. “So they are trying to lock in as much money for the long term as they can now, leaving less to pay back in the short term. They say they are aiming to raise $58 billion over this year, but we are already three months in — they have $50 billion still to go. At this rate of timing and at this pricing, they won’t make it.”

“As for the fees charged by a lead manager for an $8 billion debt issue, these can vary depending on several factors including the complexity of the issuance, prevailing market conditions, and negotiation between the government and the lead manager. Typically, lead managers charge a percentage fee based on the size of the offering, often from 0.5% to 2% of the total amount raised. Therefore, for an $8 billion issue, lead manager fees could range from $40 million to $160 million. However, these figures are indicative and could vary based on the specific terms of the deal.”

“I speculate that the fees will be around $100 million. The princes at Goldman Sachs are being rewarded handsomely. We will have to wait and see if they will regret it. The buyers should also be asking the fee question. If there is no answer, then these Israel bonds are not being bought or placed based on financial reasoning. It’s political, ideological, religious.”*

The SEC last published an Israel bond prospectus in June 2018. The amount of the placement is not recorded.

The US Government was identified as the guarantor of the debt paper. “The amount of guarantees that may be issued to Israel under the loan guarantee program may be reduced by an amount equal to the amount extended or estimated to have been extended by Israel for activities that the President of the United States determines are inconsistent with the objectives and understandings reached between the United States and Israel regarding the implementation of the loan guarantee program. Under the program, the United States issues guarantees with respect to all payments of principal and interest on certain bonds issued by Israel. The proceeds of the guaranteed loans may be used to refinance existing debt. Under the $9 billion loan guarantee program, between September 2003 and November 2004 Israel issued guaranteed notes totaling $4.1 billion face value. Israel has not issued any notes under the loan guarantee program since November 2004, and up to $3.8 billion of U.S. loan guarantees (subject to the reductions described above) remains available.”

There has never been a determination by the President that the guarantees should be suspended because of “activities…inconsistent with the objectives and understandings reached between the United States and Israel”. For the Biden Administration, genocide is not an “inconsistent activity”.

The map accompanying the 2018 prospectus shows the occupied West Bank and Golan Heights as subject “to agreements between the State of Israel (the “State” or “Israel”) and the Palestinian Liberation Organization”. The Golan Heights are legally Syrian territory, and there is no agreement. Gaza is marked separately without explanation – and without an agreement with the Hamas administration of Gaza. According to the document, before the date of the prospectus, Israeli military operations against Hamas in Gaza “did not materially affect the Israeli economy.” To claim this now is not only propaganda, it would be a material misstatement — in SEC terminology, a Section 17(a) fraud.

Click to enlarge view on source: https://www.sec.gov/ -- page D-1.

During the marketing of the $8 billion in bonds, there were highly confidential briefings for selected investors. According to Globes, “prior to the offering, Israel’s Accountant General Yali Rothenberg and his team led rounds of extensive meetings in Europe and the US.”

US bond trading sources believe it likely that Goldman Sachs and Bank of America, the two US banks identified as placing the bonds in the US market, sought to protect themselves from what Rothenberg and his Israeli officials said at these meetings, and from later reaction by bond buyers if the war goes longer and much worse for Israel than they were led to believe. A letter of consent seeking approval from the SEC is protective cover from Section 17(a) fraud liability in the absence of SEC review and approval of a prospectus.

Scott Schneider is head of public affairs and press spokesman at the SEC. He speaks for Gary Gensler, chairman of the SEC since 2021.* The SEC was asked by email whether “the widely publicized Israeli government bonds to be issued this year on a private placement basis are subject to SEC supervision to the extent of requiring a formal application for consent to the issues.” He was also asked to say what letters of consent have been approved by the SEC in relation to earlier Israeli issues.

Left to right, Yali Rothenburg, Israel’s Accountant General; Gary Gensler, SEC Chairman; Scott Schneider, SEC press spokesman.

There was no reply to the email, and no reply when the questions were repeated by telephone to the SEC press office in Washington.

When clarification of the letter of consent issue was then requested from Goldman Sachs, the press spokesman in New York, Jen Blackhall, promised a response, but none there came. The stonewalling by Goldman Sachs has also extended to the patsy question asked – how much in charity funds have been donated to Israel on CEO Solomon’s request to his staff last October.

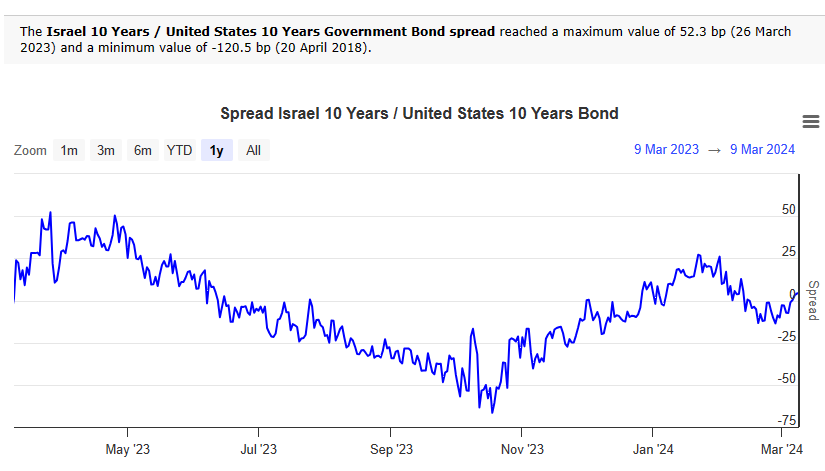

Bond traders in London, Europe, and the US consulted for this story believe that the most reliable indicator that the money markets have begun to turn against Israel can be found in the spread between the interest rates (or yield-to-maturity**) of Israel’s bond issues compared with US Treasuries. For more details, click to read.

COMPARISON OF THE SPREAD BETWEEN 10-YEAR ISRAEL & US BONDS, MARCH 11, 2023-MARCH 11, 2024

Source: https://www.worldgovernmentbonds.com/

The positive-negative spread between Israel’s 10-year government bond yield and the United States’ 10-year Treasury yield indicates when Israel’s yield is lower or higher than that of the US Treasury at that particular point in time.

The source, Worldgovernmentbonds.com, explains: “In the case of government bonds, the yield spread also means credit spread. These countries usually differ regarding credit quality. A positive spread means that the percentage yearly return of one bond over another is higher. For example, if one bond is yielding 5% and another is yielding 3%, the spread is 2%, or 200 basis points (bp).”

What remains unclear is whether the private-placement Israel bonds are included in the charting; if they are excluded, this is an attempt to keep the political and military meaning of the spread from becoming obvious outside the bond market.

The international bond trade source explains: “Until the war, Israel was able to finance itself at a lower cost than the US government, if you look at the 10-year bond spread in basis points [percentage points] between them. Then at the start of the war the situation reverses itself. Israeli bonds lose their advantage. The Israeli government is now having to pay a premium in interest rate over US Treasuries in order to secure buyers. Last week’s reports show that Israel is committing to pay 135 basis points over comparable 5-year US Treasuries, 145 basis points over 10-year Treasuries and 175 basis points over US 30-year bonds. For comparison, US 5-year bonds currently yield 4.15%, 10-year Treasuries are at 4.16%, and 30-year notes yield 4.30%.”

“Note that the chart is lagging behind the new $8 billion placement, and has not yet registered the widening of the spread against Israel. This is because the chart is based on all bonds which have a residual maturity of ten years, so it is showing an average. This average indicated that Israel’s 10- year residual maturity bonds were trading at a positive spread of 4.9 basis points (100 basis points = one percent) to the US equivalents. Worldgovernmentbonds.com does not provide a listing of the issues included in its calculations, but future charting can be expected to reveal the latest private placements will accelerate the widening of the spread. With $50 billion more in private placements still to go, the cost to the Israelis will become higher than ever before – and the spread will be pushed wider. That is if the private placements are included in the charting.”

“The outcome of the latest Israel government bond issue is nothing for them to cheer about. The previously favourable spread compared to their US Government guarantor has evaporated and now reversed itself. The same goes for the loss of money market confidence in Israel.”

[*] When an international court of law determines that a religious organization like the state of Israel is plausibly genocidal, it is relevant to note the religious affiliations of organizations which may be assisting in the genocide with money or propaganda. For example, the Reuters executive responsible for ethics and standards is Alix Freedman, who is Jewish. The SEC Chairman since 2021 is Gary Gensler, who is Jewish. The Goldman Sachs chief executive David Solomon is Jewish.

[**] The yield to maturity (YTM) of a government bond is a measure indicating the total return investors can expect to receive if they hold the bond until it matures, taking into account its current market price, the coupon payments, and the time remaining until maturity. For more details, click to read.

Leave a Reply