By Olga Samofalova, translated from the Russian* @bears_with

Russia has a strong competitor in the south of Europe in the form of Azerbaijani pipeline gas. It will flow through the Trans-Adriatic Pipeline (TAP) directly to Greece, Bulgaria and Italy in November. Azerbaijani gas has already caused Gazprom a lot of trouble in the Turkish market. What damage will it do to Russian gas in the southern European market?

Construction of the Trans-Adriatic Gas Pipeline (TAP) has been completed. This pipeline is already filled with Azerbaijani gas. There are still technical formalities, but in November the first pipeline gas from Azerbaijan will flow to Greece, Bulgaria and Italy. The pipe runs from the Greek-Turkish border to the receiving terminal in southern Italy. Just the three European countries have contracted 10 billion cubic meters of gas from Azerbaijan.

Click on source for enlarged image: https://upload.wikimedia.org/

The Azeri offshore field called Shah Deniz, in the Caspian Sea, was first offered for development to the Australian company BHP in 1990, after it had defeated BP and Staoil (Norway) in the bidding for the concession; Robert Arnopolsky and John Helmer were the principal advisors in that transaction. BHP then relinquished its position to BP and Statoil. Statoil sold out in 2013-2014. Currently, the field is operated by BP with a share of 28.8%. Other partners include TPAO (19%), SOCAR (16.7%), Petronas (15.5%), LUKoil (10%) and NIOC (10%). The principal TAP shareholders are BP, SOCAR, and Snam.

TAP is a continuation of the TANAP gas pipeline, which runs from the Azerbaijani field [Shah Deniz] through Georgia and passes through Turkish territory. Turkey already receives its 6 billion cubic meters of Azerbaijani gas via TANAP.

Tougher competition in the Turkish gas market has already reduced Gazprom’s share there. So, in the first quarter of this year, Russian gas supplies to Turkey fell by 17%. And in July, the volume of Russian gas purchased by Turkey decreased by almost a third in annual terms. Azerbaijan became the main supplier in July. However, the volume of Azerbaijani gas has also decreased, but not as seriously. For Turkey, LNG (from Qatar) has come to the fore, which has become cheaper than network gas from Russia under long-term contracts, where the cost is tied to the price of oil with a nine-month lag. Turkey has started buying cheaper liquefied natural gas, reducing the purchase of pipeline gas. But in this situation, the volume of Russian gas has suffered more.

The appearance of Azerbaijani gas in Bulgaria, Greece and Italy also does not bode well for Gazprom. Gazprom supplies about 3 billion cubic meters of gas per year to Bulgaria and Greece under contracts (data for 2018). These two European countries have contracted 1 billion cubic meters a year from Azerbaijan. If the Bulgarians and Greeks choose all the available volumes of Azerbaijani gas, Gazprom may lose a third of the volumes in each of these markets. “In percentage terms, Azerbaijan will become a strong competitor in the market of Greece and Bulgaria. However, in real terms, the loss of 1 billion cubic meters in the Bulgarian market and 1 billion cubic meters in the Greek market does not look so critical. Although, of course, I would not like to lose anything at all,” says Igor Yushkov, an expert at The Financial University under the Government of the Russian Federation, an expert at the national energy security Fund.

With Italy, the situation is different. It is initially a major buyer of Russian gas. “The Italian market is valuable for Gazprom. Italy traditionally shares with Turkey the second and third places in terms of volume of Russian gas purchases (Germany is traditionally in the first place). The Italians were among the first, along with Austria and Germany, to buy our gas in Europe half a century ago. In percentage terms, the losses may be small, but in real terms they are more significant. There is a more unpleasant story here than in the Bulgarian and Greek markets,” the expert notes.

For example, Italy previously purchased 22.7 billion cubic meters of Russian gas, but now it will be able to take 8 billion cubic meters from Azerbaijan. In the worst case scenario, Gazprom will have to reduce supplies to the Italian market to 14-15 billion cubic meters. “It remains to be seen whether Italian buyers will choose all the contracted Azerbaijani gas. How much will depend on its price as a competitor with Russian gas,” Yushkov notes.

“In Italy, competition in the gas market is extremely tough, as there are pipeline gas supplies from Russia and Algeria, plus there is an opportunity to get LNG. Now the pipeline supplies of Azerbaijani gas will also be added here. Italy now has a full range of all possible suppliers of the blue fuel, except that Norway is not significant. Therefore, Rome can get discounts from literally all suppliers,” the source is certain.

In the worst case scenario, the appearance of Azerbaijani gas in Europe will result in Gazprom losing 10 billion cubic meters of gas. With deliveries in the region of 200 billion cubic meters per year, this is not critical for Gazprom, but it is still unpleasant. Another point is that it is not necessary that the Europeans will choose all 10 billion cubic meters of gas from Azerbaijan, Yushkov notes. In the contracts with Azerbaijan, there is no “take or pay” condition; that is, a strict requirement for exactly 10 billion cubic meters. This means that the Europeans will be able to choose the gas that is cheaper, the source explains.

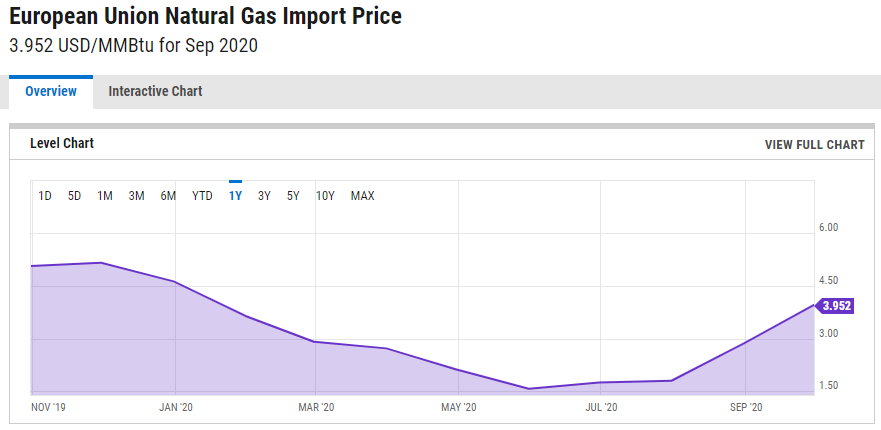

This year, the European gas market has presented a lot of surprises. Quarantine coupled with the crisis, a warm winter, and record gas reserves in underground storage after the winter contributed to the fact that gas consumption in Europe has sunk quite a lot. And most importantly, prices on the spot market in Europe have fallen to minimum values. There is a unique situation when LNG has become extremely cheap, and even cheaper than pipeline supplies.

Source: https://ycharts.com/

However, the price situation is already beginning to return to normal. Gas has already started to cost more than $180 per thousand cubic meters on the spot market in Europe. For comparison, this summer prices fell to $40-$50 (the historical minimum of $31 was reached on May 21). The onset of the heating season will trigger further price increases. In November, the price of gas on the spot market in Europe may return to last year’s values.

On the other hand, Gazprom’s gas prices in contracts with the oil-linked price formula will be low in the fourth quarter, by contrast. According to Yushkov, most likely in the region of $100. It is logical that the buyer will choose Russian gas.

“Gazprom has about 30% to 40% of its contracts tied to oil. In April, May, and June, oil prices were very low, less than $40 per barrel. This is now reflected in the cost of Russian gas. Gazprom will now increase the volume of deliveries to Europe,” Yushkov said. Prices are higher on spot, and the cost of Azerbaijani gas for Europeans is most likely tied to spot.

However, in the future, if the price situation changes, Gazprom may have to give Italy a discount in order not to be left out. This is a matter for future agreements.

The expert does not attach much importance to plans to double the supply of Azerbaijani gas to Europe via the TAP gas pipeline from 10 to 20 billion cubic meters. “The big question is whether Azerbaijan will have enough gas to meet its current contractual obligations. There can be no talk of any doubling now. In this regard, it is very significant that in 2017-2018, Azerbaijan returned to purchasing Russian gas, as there was not enough of its own gas. The country has serious problems with production. The Shah Deniz-2 field proved to be very difficult and expensive to develop. If investors had known from the beginning what this project would cost them, they would not have invested. As a result, the cost of gas produced there is very high. It seems that there is a lot of gas, but it is not so feasible to extract it. Therefore, the expansion of TANAP and TAP is hardly worth talking about,” says Yushkov.

According to him, investors can easily find a project that will produce the same volumes of gas, but will require much less cost. Therefore, there are big doubts that someone will decide to invest money in increasing production at the Azerbaijani field. Talk about the appearance of other gas in these pipelines – from Iran or from Turkmenistan – is still just talk.

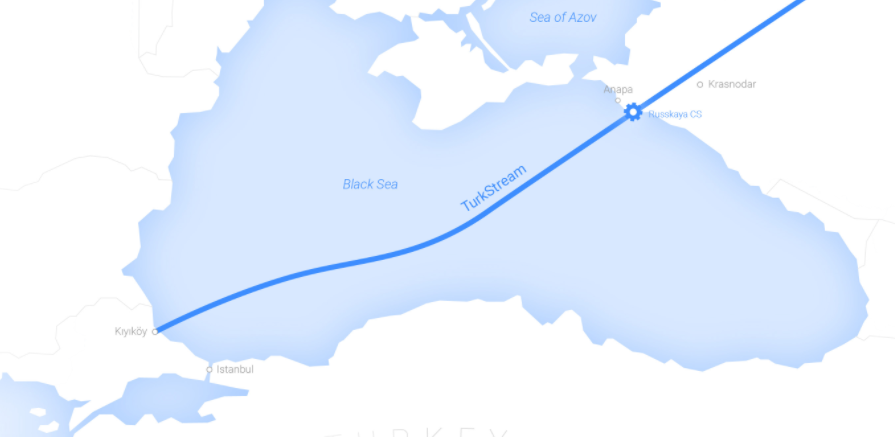

The appearance of a gas pipeline with Azerbaijani gas in southern Europe does not detract from the significance of the second line of Turk Stream.

Source: https://www.gazprom.com/

The first stage, as you know, is already working to supply Russian gas directly for domestic consumption in Turkey. The second stage of the pipeline takes Russian gas to Bulgaria, Serbia and Austria (the main point for delivery and acceptance of Russian gas for European buyers as specified in the contracts).

“Gazprom needs the second stage of Turk Stream strategically in order to be able to transfer gas away from the Ukrainian pipeline to a more profitable route,” Yushkov says.

All that remains is to complete the bridge from Bulgaria to Serbia. However, the Bulgarians have not yet done this, and as a result, Russian gas has ended up in a dead-end. It was supposed to be completed last year, but now it will happen at best by the end of 2020. Last year, the Russian President accused the Bulgarian leadership of deliberately delaying the implementation of the project on Bulgarian territory. “This is a very ugly story on the part of Bulgaria, especially after it abandoned South Stream. Then the Bulgarians lost everything – the money for the transit of as much as 53 billion cubic meters of Russian gas, and a discount on Russian gas,” says Yushkov.

However, Moscow met Sofia halfway, offering to return to cooperation within the framework of the Turkish Stream, in order for the route of the pipeline to go, not to Greece, but to Bulgaria. As a result, Russia stepped on the same rake with the Bulgarians. “Gazprom is purposefully moving towards its goal: to create a system where you can choose routes for gas delivery to Europe. In fact, what remains is to complete a small section of the Nord Stream–2 pipeline, plus this bridge between Bulgaria and Serbia, and then all the gas pipelines of Russia bypassing Ukraine will be ready. I don’t think Russia will ever build anything else in the western direction. There are several years left until the end of the contract with Ukraine, and Russia will definitely not extend it,” the source concludes.

[*] The original article was written by Olga Samofalova and published by Vzglyad in Moscow on October 13.

Source: https://vz.ru/

Leave a Reply