By John Helmer, Moscow

Dixy is the Russian supermarket chain which is proving that the secret to selling groceries across the country at an annual loss of billions of roubles is, er, TOP SECRET.

This makes Dixy unusual because it is the only one of Russia’s top supermarket chains losing money. It is also the only one whose shares are traded daily on the stock market with the legal duty to explain to shareholders why it is operating in the red.

Dixy is controlled by the cigarette oligarch Igor Kesaev, who is chairman of Dixy’s board of directors. He and his men have presided over loss-making at Dixy at the same time as the rival foreign and Russian-owned supermarkets are all reporting fresh profits for the half-year just ended, and profit growth for last year, too. Kesaev has also been purging his senior management, as if they, not he, are to blame.

Kesaev’s riches – Forbes puts him down this month as worth $2.4 billion – have produced a reputation for succeeding in business, not failing. His reputation is controversial because it is widely reported that he has benefitted from the administrative resources and personal backing of high-ranking officers of the former KGB, the present FSB, and the Russian Orthodox Church. Whether this is true, exaggerated, or untrue, the secretiveness of Dixy’s financial reports doesn’t help to clarify.

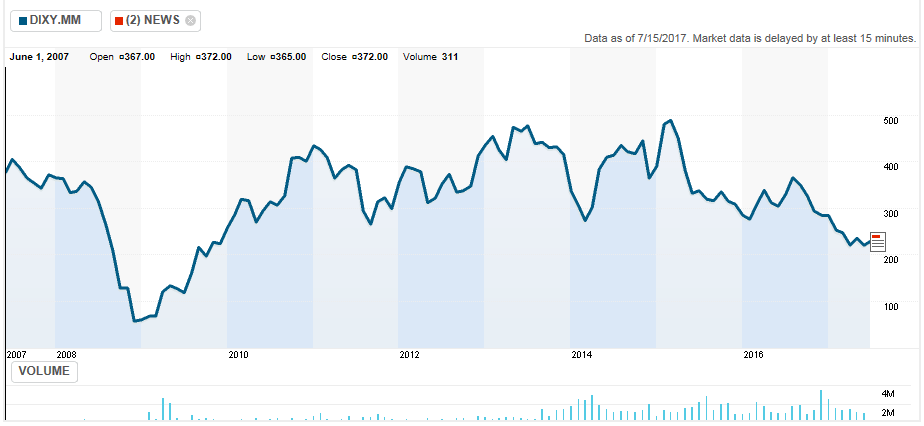

Bank and stock brokerage analysts, who follow Dixy’s rivals carefully and promote their shares, are fearful enough of Kesaev and his friends not to ask questions about his 10-year record in the company. TOP SECRET inside Dixy has turned, accordingly, into a plummeting share price – down by 55% since March 2015. Kesaev’s stake in Dixy has lost Rb147 billion ($2.5 billion). This is the minimum estimated loss of his stock value, because the full size of Kesaev’s shareholding in Dixy is also, er, TOP SECRET.

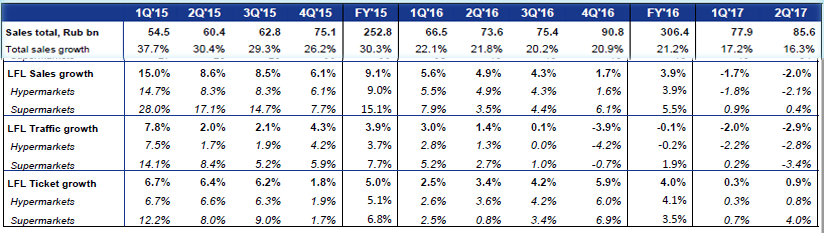

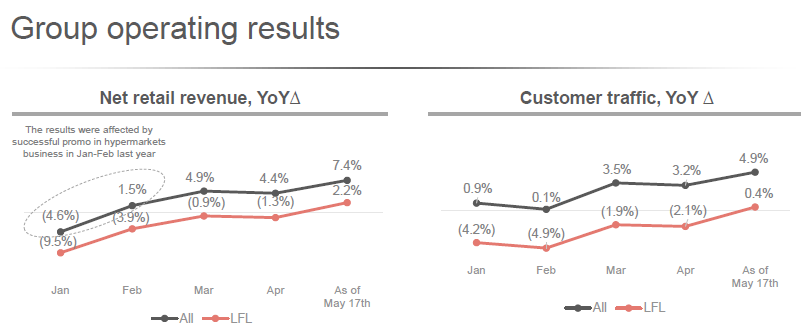

The Russian grocery trade naturally depends not on appetite, but on cash — on the availability of consumer income to spend. As wages have dwindled across the country, the grocery and supermarket chains have adapted swiftly, cutting product prices, changing shelf assortments, substituting sanctioned imports with alternative sources and domestic supplies. Month to month, this is how the money trends have been operating this year. The big pension bonus handed out by the federal government in January lifted grocery sales in the weeks which followed, though in real terms the growth rate has continued negative through May:

CLICK TO ENLARGE

Source: http://www.lentainvestor.com/en/files/file/download/id/1107

For earlier stories on how the retail food and supermarket business has fared since the start of 2014, click to read.

Dixy says it is controlled by Kesaev, but doesn’t say how many shares he owns or controls, directly and indirectly. The company’s auditor Ernst & Young confirms in its financial report for 2016, issued in March 2017, that “as of 31 December 2016 Dixy Holding Limited (Cyprus), owned 51.29% (2015: 54.42%) of the ordinary shares in PJSC DIXY GROUP. The Group is ultimately controlled by Mr. Igor Kesaev.”

Originally from Vladikavkaz, with an education at the Moscow State Institute of International Relations (MGIMO), Kesaev has built his Mercury Group of companies into a lucrative cigarette distribution business with a 70% share of the Russian market. There is ample evidence of how Kesaev managed to do this. Kesaev has also diversified into the arms business, not without controversy.

From, left to right: Dixy board chairman Igor Kesaev; Dixy chief executive and Kesaev trustie, Sergei Belyakov; Dixy founder and former control shareholder, Oleg Leonov

He also moved into groceries when at the end of 2007 he bought out Oleg Leonov, the founding shareholder of Dixy. Leonov, a St. Petersburger who dropped out of medical school to sell exam crib sheets to students, founded a parcel business in the city, and expanded into a small grocery chain called Uniland. Joining Leonov were others from St. Petersburg who knew each other from the army or university, and who specialized in logistics, transportation, and the muscle required in St. Petersburg in the 1990s for the protection of shops.

Leonov converted Uniland into Dixy, keeping 65.5% of the shares for himself and his Uniland comrades; the remainder was held by Citigroup and Cube Private Equity. These institutions then sold out at an initial public offering (IPO) on the Moscow Stock Exchange in the spring of 2007. They and Leonov were hoping for a London exchange valuation of more than $2.5 billion for the company, so they told the press. They ended up with a Moscow exchange capitalization of $864 million.

After the IPO Leonov kept about 51% of Dixy’s shares, but continued looking for buyers among the other Russian supermarket operators. None was interested in a takeover. Leonov and Kesaev then found each other, and in December they agreed Kesaev would buy Leonov’s shares. The deal price was not revealed.

Leonov timed his exit nicely. Between 2007, when retail market conditions were positive, and the end of 2008, when the economic recession had commenced, Dixy’s share price collapsed from Rb400 to Rb50, although Kesaev wasn’t selling shares, and it is not clear who was.

Dixy’s share price then recovered, also on very little share trading, to a peak of almost Rb500 in mid-2013. Kesaev hinted at a secondary listing for Dixy shares in London or new York during 2013, but this didn’t happen. There was active share trading in Moscow, as can be seen from the volume bars at the bottom of the chart, but that drove the share price downwards again as the crisis of 2014 began.

DIXY GROUP SHARE PRICE TRAJECTORY, 2007-2017

Kesaev runs the company from the 9-man board, with former Mercury employee Sergei Belyakov as chief executive; MGIMO is his alma mater, too. The lawyer on the board and in charge of Dixy, Artem Afanasiev, is also from Kesaev’s tobacco operations; so is Leo McLoughlin, an Irishman who used to run the Philip Morris company supplying cigarettes for Kesaev to distribute, and a participant in the Philip Morris decision of December 2013 to buy 20% of Kesaev’s tobacco company for $750 million, alongside Japan Tobacco International which bought another 20% for the same price. Then Russian cigarette sales started downward, although Kesaev still managed to turn a profit.

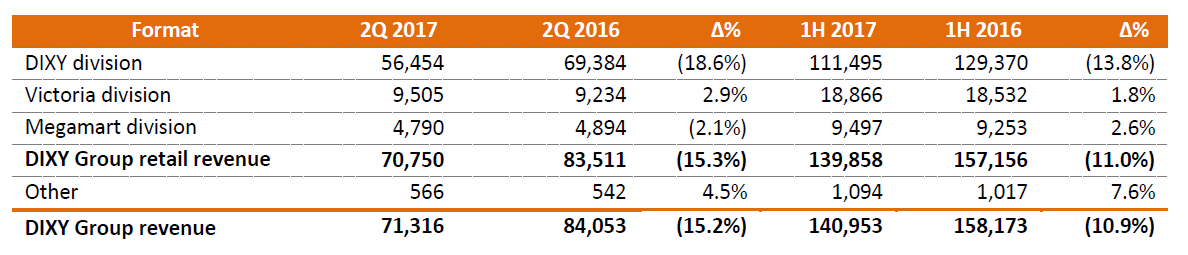

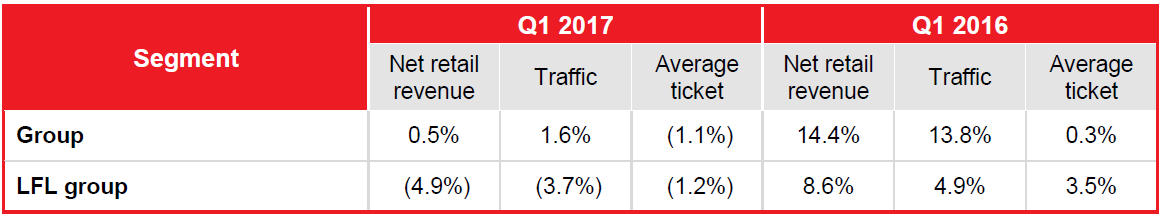

Not so fortunate at the groceries company. On July 14 Dixy reported negative sales growth through June 30:

Source: http://www.dixygroup.com/~/media/Files/D/Dixy/operational-results/en/2017/DIXY%20GROUP_2Q%202017_ENG%20Final.pdf

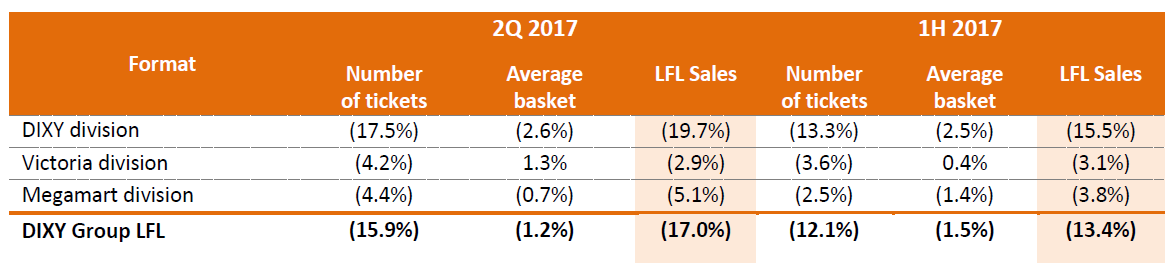

Comparing numbers of paying customers (tickets), the average customer purchase (basket), and like-for-like (LFL) sales at the same shops over time, Dixy’s performance is even worse:

Source: http://www.dixygroup.com/~/media/Files/D/Dixy/operational-results/en/2017/DIXY%20GROUP_2Q%202017_ENG%20Final.pdf

CEO Belyakov blames the rest of Russia for Dixy’s results. “Russian food retail sales are still to recover. The DIXY Group revenue performance in the second quarter followed the market trend and the LFL numbers were predetermined by the high base effect from the 2Q 2016. We are shifting to smarter promo offers targeting best-selling and most popular SKUs [stock keeping units – product range]. We are scrutinizing our assortment in key categories, so our customers could have a wider choice of high quality products at a good price. At the same time we are continuing to improve the own brands’ representation in our shelves: since the beginning of 2017 we have introduced nearly 200 new products while the share of private label goods reached 19% of DIXY network’s sales.”

Konstantin Belov (right), head of research at Uralsib Bank, reported in the bank’s daily Russia Informer on July 17 that there had been a purge of Dixy’s management. “The fundamental appeal of the company remains low. Considering that replacement of the leadership of the company occurred at the beginning of this year, we don’t expect emergence of visible operational improvements earlier than the second half of the year.” The purge has been invisible on Dixy’s website and in its press releases; why it happened is just as obscure.

the bank’s daily Russia Informer on July 17 that there had been a purge of Dixy’s management. “The fundamental appeal of the company remains low. Considering that replacement of the leadership of the company occurred at the beginning of this year, we don’t expect emergence of visible operational improvements earlier than the second half of the year.” The purge has been invisible on Dixy’s website and in its press releases; why it happened is just as obscure.

In December 2015 Kesaev moved Belyakov from smokes to staples. Together, they decided to hire a Portuguese retail veteran, Pedro Manuel Pereira da Silva (pictured below, left), as Dixy’s chief executive. He picked two fellow Portuguese, Julio Marques Duarte (centre) and Juan Giralt Silva (right), to be Dixy’s chief operating officer and head of commercial sales, respectively.

Ten months later, on January 24, 2017, they were all gone. No explanation has appeared. By the end of 2016 other executives of Dixy from the St. Petersburg days were also gone. This year the senior management includes only two Dixy veterans, Alexander Komissarov (below, left) and Oleg Zhunikov (right).

Source: http://www.dixygroup.com/who-we-are/our-leadership.aspx?sc_lang=en

A market source in Moscow, who asked not to be quoted by name, said the blame was imported, not home grown. “The Portuguese managers haven’t achieved the aims which had been set up by the owners. They didn’t know all the specific features of Russian retail market. For example, they tried to optimize the inventory and assortment by reducing the amount of SKU [stock keeping units] from 5,000-6,000 previously to 2000-3000 SKU now. But that caused a loss of interest of consumers, who turned instead to Lenta, Magnit and X5 in order to have a bigger choice of goods. Buyers want to find products with good quality and low price, but Dixy can’t provide that right now.”

A Moscow investment bank analyst, also seeking anonymity, said “if to speak about the reasons for [Dixy’s] decrease of profit, we can say they are influenced by internal problems of the company, because X5 and Magnit are showing good results in the current economic situation in Russia.” He couldn’t say exactly what the internal problems have been.

Belov of Uralsib Bank adds: “DIXY failed to adapt properly to the weakening macro-environment in recent years, as customers’ behaviour became much more selective and sensitive to pricing. In part, the company’s relatively small scale and hence weaker bargaining power to get good purchasing terms could be a reason for that. But apparently there were some purely managerial issues as well.”

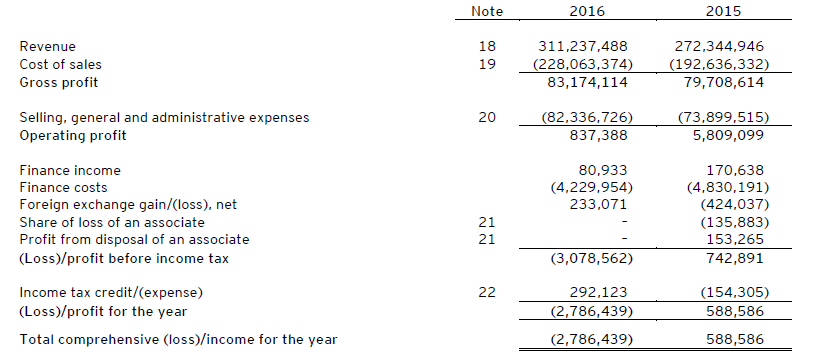

The departed managers are mute, but the Dixy balance-sheets reveal more than the analysts are saying. Here is the company’s summary for 2016, when, despite robust revenue growth over the previous year of 14.3%, an all-time record loss was recorded:

DIXY’S CONSOLIDATED STATEMENT OF INCOME FOR 2016

(in ‘000 Rbs)

Source: Dixy -- page 10.

By contrast, in the previous economic downturn years of 2008 and 2009 Dixy’s losses were Rb324 million and Rb112.4 million.

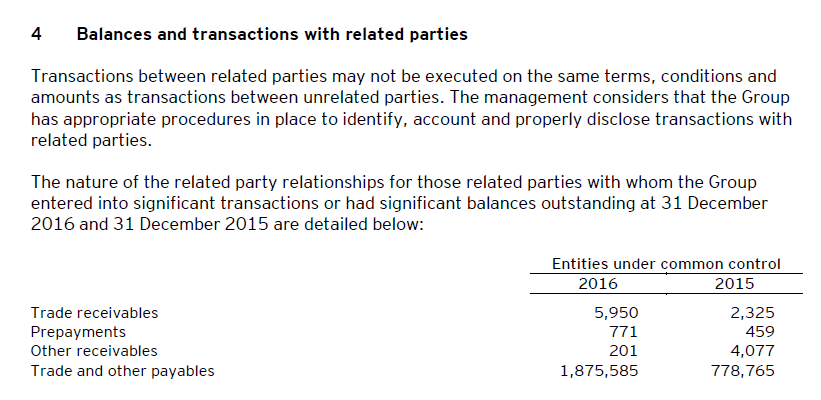

What explains the jump on the cost and expense lines? Dixy’s accounts reveal a peculiar phenomenon – in the crisis years sale revenues continue growing, but cost of sales and management expenses rocket, causing losses to balloon on the bottom-line. It appears from the financial records that managers have been paying hefty bonuses to themselves. Kesaev has also been engaged in related-party trading, adding costs for Dixy but transferring benefits to his other companies. Last year Kesaev, who hasn’t been taking a dividend from Dixy in 2015 and 2016, obliged the company to buy some of his shares.

Source: Dixy — page 31.

Some of Dixy’s cost increases – for example, in advertising, insurance, recycling – are regarded in the market as susceptible to corrupt practices.

There has been no charge of wrongdoing inside the company, but equally, no evidence of what its “internal troubles” have been to produce losses when Dixy’s Russian peers have all been doing much better. Their performance is reflected in their share price trajectories.

DIXY COMPARED TO ITS PEERS — ONE-YEAR SHARE PRICE TRAJECTORY

Key: blue=X5, yellow=Magnit, green=O'Key, pink=Lenta, and at bottom, brown=Dixy.

Dixy’s current market capitalization is $468 million. Its current share price is trading at the bottom of its 52-week range. See: https://www.bloomberg.com/quote/DIXY:RM

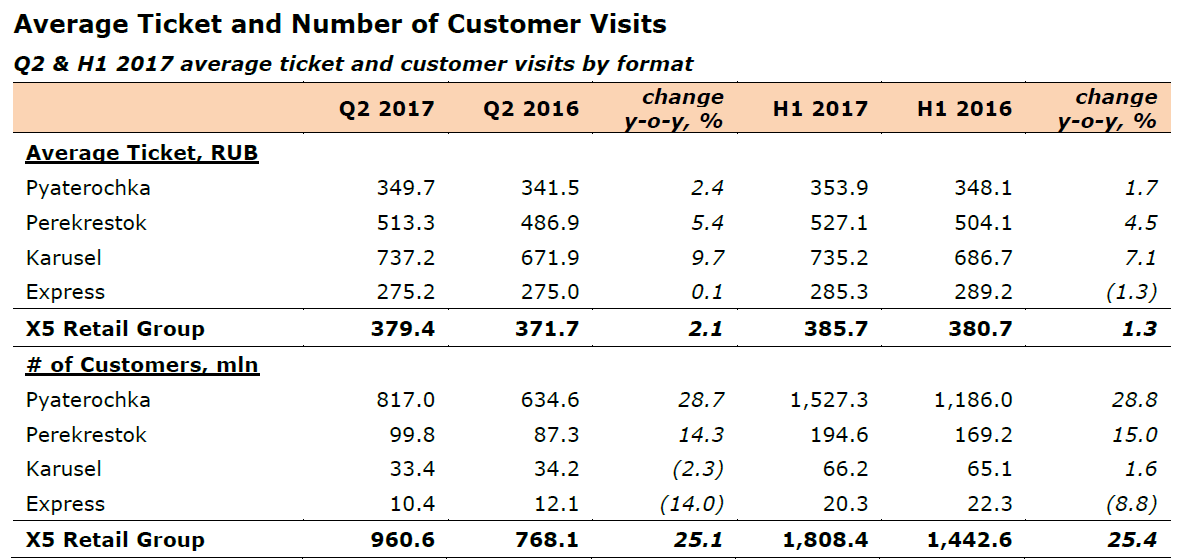

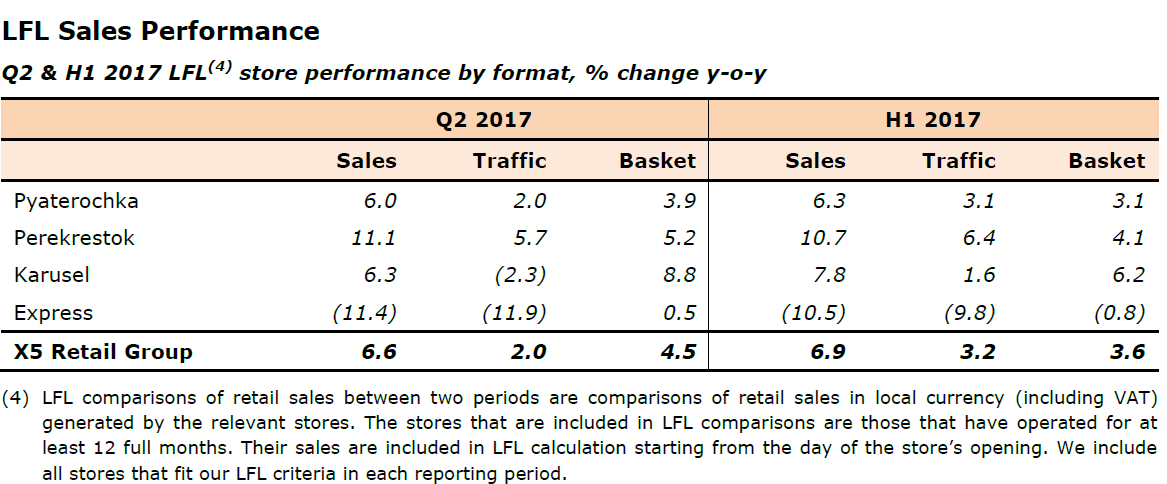

The exceptional growth story comes from X5, which is controlled by Mikhail Fridman; for more on Fridman’s businesses, read this. This month X5 reported that overall sales growth in the first half of 2017 was 27%, compared to last year; and 31% rate of growth at X5’s low-priced outlet, Pyaterochka. What is evident from this table is that a big increase in shoppers visiting the low-price chain is driving sales upward, even though their spending, the average ticket, is about the same as last year:

Removing the effect of opening more stores, and comparing performance like for like at X5:

Belov of Uralsib comments: “Comparable sales of X5 Retail Group have increased by 6.6% in 2nd quarter 2017 (against plus 7.3% in 1st quarter 2017). At the same time the consumer stream has grown by 2%, and the average bill by 4.5%. ” The latest report from X5 “confirms that for rate of growth the company remains the undisputed leader of the Russian sector of food retail.”

Lenta, the rival supermarket chain with a volatile shareholding history, isn’t so successful. Total sales growth for the March and June quarters of 2017, compared to a year ago, is strong between 16% and 17%. However, this reflects the effect of adding more sales outlets. Lenta’s like-for-like sales trend is negative, and so is the number of customers (traffic).

CLICK TO ENLARGE

“All the same,” says Belov, this “is a good level for the present condition of the market, and it is significantly better than Dixy’s results. Lenta remains one of the fast-growing retailers in Russia.”

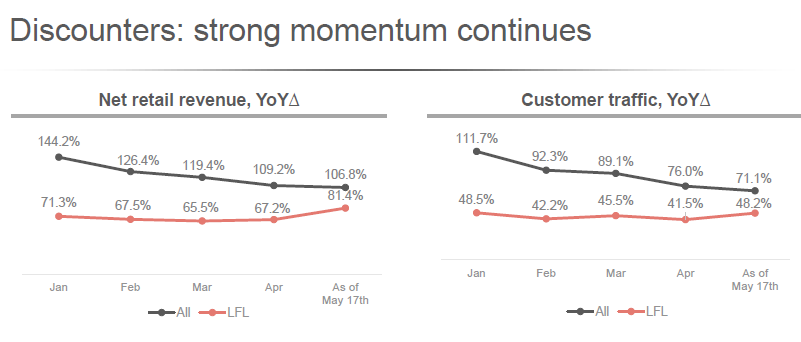

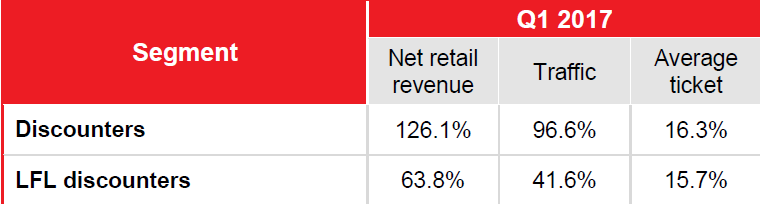

O’Key, whose shares are also listed in London, has been concentrating on expanding the number of its cut-price shops. Its most recent report of results for this year go to mid-May. These indicate modest growth of revenues and customers, especially on the like-for-like comparison. There has been an acceleration of the results at the lowest-priced discount stores, though their customer appeal in the market isn’t as great this year as it was during 2016. Still, the growth of discount selling is being propelled by the opening of new stores. On a like-for-like comparison O’Key says that in the first quarter the direction for its sales, customers, and individual spending turned down.

Source: Okeyinvestors.ru

In the aggregate, however, O’Key says that in the first quarter its retail sales jumped nearly 64%, and customer traffic by 42%. Month by month in the January to March period, the rate of growth appeared to be slowing. Still, O’Key’s remain the best growth rates in the Russian grocery market.

CLICK ON IMAGES TO ENLARGE

Source: Okeyinvestors.ru

According to Armin Burger, head of O’Key’s discount store business, “our customer base continues to grow rapidly despite the competitive pressure. High customer satisfaction with our product offering leads to a higher than expected number of items in the basket, which translates into robust LFL numbers. The segment continues to post positive dynamics in Q2. In addition, with higher sales density, our profitability started improving significantly as well.” The group also replaced its chief executive and commercial director in recent weeks. These are now Croatians, Miodrag Borojević and Ivan Dropuljic. This month the head of IT for the group was also replaced.

Belov of UralSib is also pessimistic that Magnit, the retail grocery and supermarket leader with the largest market capitalization, would improve. That’s a story for another time.

Dixy’s investment relations director Denis Davydov (right) and press spokesman Vladimir Rusanov were asked to address the negative stock market sentiment, explain Dixy’s financial reports, and clarify why it is performing so differently from the other grocery chains in the Russian market. When they did not answer their office telephones, four questions were emailed.

and press spokesman Vladimir Rusanov were asked to address the negative stock market sentiment, explain Dixy’s financial reports, and clarify why it is performing so differently from the other grocery chains in the Russian market. When they did not answer their office telephones, four questions were emailed.

The company executives refuse to answer. Davydov was also asked to clarify what Kesaev’s indirect shareholding in Dixy may be, and identify all stakeholders, apart from Kesaev, with more than 5% of the shares who comprise the reportedly large free float. He declined to say. Dixy’s minority public shareholders are also TOP SECRET.

Leave a Reply