By John Helmer, Moscow

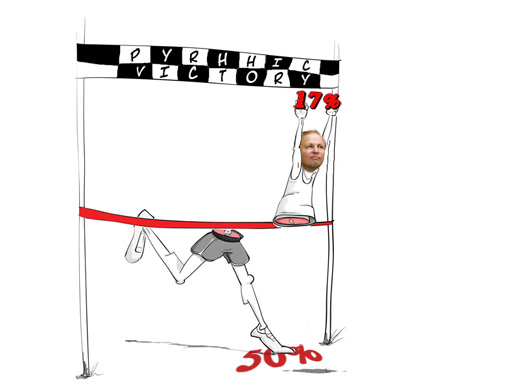

The London Paralympics aren’t over for BP’s chief executive, Bob Dudley. Even if he wins gold, he’s finishing with fewer limbs than he started with.

According to the Financial Times version of the negotiation to date between Rosnft, BP, TNK-BP, and between Igor Sechin, Bob Dudley, and Mikhail Fridman, a deal in which Rosneft buys out the 50% Russian shareholding in TNK-BP, and then buys out the equally sized BP stake for a total of about $56 billion, “ would mark a victory for Bob Dudley, BP’s chief executive, extricating the UK oil major from a partnership with a group of Soviet-born billionaires that has been plagued by often tempestuous shareholder conflicts. The deal would give BP $15bn-$20bn in cash plus a stake of 10-20 per cent in Rosneft, one person close to the situation said.”

That unnamed person has been helping lift BP’s share price by 6% since Monday; that’s about £500 million ($805 million) in market capitalization. There’s no motive for either Sechin or Fridman to enrich BP at this point, and thereby increase the costs of their proposed transactions and the size of their borrowing requirement. Despite the repeated admonitions from the UK regulator, the Financial Services Authority (FSA), against leaks to the press of inside information intended to lift share price, it looks like Dudley and his associates are the ones claiming victory.

Terry Macalister at the Guardian — long one of Dudley’s conduits and promoters – is less gung-ho this time round. He reports that Dudley is making a hop, step and a jump — “a partial retreat from the biggest oil and gas province in the world but could trigger a big payout to BP shareholders through a special dividend. It would also tie the British oil group into an embrace with the Kremlin.”

Until the terms are formally announced by the BP board later today, when it will be clear if BP is selling out of its 50% position in TNK-BP, in return for money and a minority stake in Rosneft, it’s not possible to calculate by how much of a slice Sechin has topped Dudley and BP’s board and shareholders.

If Fridman and his Alfa Access Renova (AAR) partners have agreed to sell their 50% stake in TNK-BP for about $28 billion in cash, then BP cannot get more for its equal-sized stake. How much of this Rosneft will pay in cash and how much in Rosneft shares also isn’t clear yet. That will depend in part on Sechin’s creditworthiness. The more he can raise to pay off BP, the smaller the minority bloc of shares BP will be left with. There’s also the readiness of Fridman and AAR to accept their cash on the instalment plan, allowing Rosneft more time to borrow for the payout.

If BP is to be paid $15 billion in cash, as has been reported in the Russian press and accepted for analysis by the Moscow investment banks, then the balance of $13 billion owed to BP would buy just 17% of Rosneft. The leak to Macalister at the Guardian claims BP will end up with less — 15% of Rosneft. (BP already owns a 1.6% shareholding of Rosneft.) Who is there in the Moscow market, or in the international markets, who believes that a 15% to 17% stake in an oligarch or state-controlled Russian enterprise is a good deal, let alone a victory? Total, for example, has a 9% stake in Novatek, with an option to pay to lift this to 19%, but who doubts its subordination to the control shareholders, Gennady Timchenko and Leonid Mikhelson?

If BP is thinking of keeping its 50% of TNK-BP, and accepting Sechin’s mandate in place of Fridman’s, the BP board is bound to ask Dudley to guarantee that he isn’t taking BP out of the frying-pan and dropping it into the fire. Financially, there may be even smaller dividends to book on BP’s dwindling balance-sheet than there used to be. For as Renaissance Capital warned back in July, “if a national oil company replaces one of the partners in the JV, which we think is quite likely, this may negatively affect the investment case of TNK-BP as its future capital allocations would shift from dividends towards capex.” When it comes to securing Russian guarantees, Dudley has a track record of misjudgement and mistake.

In June, when the most likely source of cash for Sechin to buy out both AAR and BP was Surgutneftegas, it was suggested that at the end of the transaction chain, BP would end up with far less in Russia than it has been booking for oil reserves, capital value, and cash earnings. That’s still the case. In promoting his feats to be otherwise, Dudley is making old General Pyrrhus look mentally, as well as physically, challenged.

Leave a Reply