By John Helmer, Moscow

Victor Rashnikov, owner of the Magnitogorsk Metallurgical Combine (MMK), appears to have done it to Prime Minister Vladimir Putin one more time.

The latest financial report, issued last week by the company, reveals a whopping 93% plunge in net income – second quarter compared to first quarter — despite a 9% gain in sales revenues. And if that wasn’t bad enough, the company forecast for the third and fourth quarters suggests that Rashnikov is aiming to limit production and cut costs in Russia, and transfer his profit-taking to Turkey.

The last time the steel oligarch tried to convince the Prime Minister in July, Rashnikov prompted Putin to say on a trip to Magnitka and a session with local steelworkers: “I am sure that as the global and Russian economies improve, this market will only expand, there is absolutely no doubt about it. No doubt about it.”

Woe betide the steelmaker if he can’t make good on assurances to Putin that he will assure full-capacity domestic production, and growth of output to feed growing demand in Russia’s auto, construction and machine-building industries. Worse betide if he’s the only Russian steelmaker who falls short when his rivals manage to meet their undertakings.

Among the Russian steelmakers, none is more oriented to the Russian market than MMK. The latest report indicates that 75% of its sales go to the domestic market. Among its export markets, Ian leads with 8% of all steel sales; followed by 5% to Turkey, and 3% to Italy.

Inside the Russian market, MMK’s major clients remain pipe-makers, machine builders and the auto industry. Together, they account for 54% of the domestic shipments. The company says its sales are focused in the Urals and Volga regions. According to a company release, “shipments to these regions accounted for 72% of domestic shipments and 48% of total shipments in Q2 2011. Demand for MMK steel in these key regions grew by 17% y-o-y in H1 2011.”

That’s a confidence-build sign, but the financial results released last Friday are less so. MMK reported that despite a second-quarter gain in sales revenues to $2.4 billion, up 9% on the first quarter, rising costs for iron-ore, coking coal and scrap, depressed operating profit, and pushed earnings (Ebitda) and net profit down sharply on the first quarter. Cost of sales grew 11% quarter on quarter to $2 billion; earnings fell 6% to $380 million; and net profit plunged 93% to just $10 million. A $25 million foreign exchange loss was one of the factors pushing profit down.

A company statement emphasized the improvement in the financial picture by comparing the first half of this year with the same period of 2010. On the half-year basis, sales reached $4.6 billion, a gain of 25% over the first half of 2010. Notwithstanding, Ebitda for H1 fell 3% year on year to $783 million, while bottom-line profit remained unchanged at $147 million.

The MMK statement claims that “sales growth was driven by increased revenue from HVA [high value-added] products, which grew at a faster pace and amounted to USD 974 mln in H1 2011 (33% higher y-o-y), revenue from HVA sales in Q2 2011 increased 12% q-o-q and equalled USD 515 mln.” Among the quarterly performance drivers, MMK cites the result that “MMK’s average steel price continued to increase in Q2 2011, up 6% q-o-q to USD 807. Growth in costs was mainly driven by higher prices for raw materials. Iron ore contract prices rose about 30% q-o-q. Coking coal prices grew 15%, scrap prices grew 5% q-o-q.”

MMK owns part of its coking coal supply through 83%-owned subsidiary Belon; but depends on independent suppliers for the remainder of its coal, and until it readies the new Prioskol mine, almost all of its iron-ore requirement. . Rashnikov used to own the scrap supplier to the mill, but sold it. However, he still owns MEK, which supplies the electricity the steelmill depends on. In the section on related-party transactions, MMK’s financial report indicates that MEK sold the steel company $85 million worth of electricity in the first half of this year, up 4% on the same period of last year.

Looking to the end of this month, MMK says it is hoping for a better financial result for the third quarter. “Iron ore contract price has decreased by 2% in Q3 2011, while coking coal and scrap prices remained stable. Cost inflation due to raw materials costs is not expected for the remainder of 2011.”

A quick study by Alexei Morozov, steel analyst of UBS Moscow, notes that Rashnikov’s company has done significantly worse than his Russian steelmaking rivals, Vladimir Lisin (Novolipetsk) and Alexei Mordashov (Severstal). “MMK’s poor 2Q11 results (which showed a q-o-q decline, while Russian peers have all already posted/expected to release quite strong q-o-q results) were mainly due to its low level of vertical integration: high iron ore costs significantly increased COGS in 2Q11. Iron ore/coking coal/scrap contract prices rose 30%/15%/5% q-o-q, respectively. In addition, 2Q11 volumes were not strong. We think most of the recent cost growth has already been reflected in the 2Q11 results, so better pricing on the domestic market (whose share in MMK’s volumes is over 65%) and solid construction sector demand in Russia may lead to some improvement in sales volumes in 3Q11. Nonetheless, costs will likely remain high and any improvement in earnings is apt to be marginal.”

In a forecast for the third and fourth quarters, MMK suggests that most of its production growth is likely to come in Turkey from the Atakas complex in Istanbul and Iskenderun. “Overall Russian steel consumption is expected to grow by 10% in 2011, mostly driven by auto and machinery builders and construction sector,” the company assessment released Friday claims.

“We expect MMK Group steel output to increase 10-15% in Russia and Turkey in 2011. MMK’s production growth will primarily come from the ramp-up of operations in Turkey and increased capacity utilization in Russia. We intend to continue increasing HVA steel product output, thanks to the launch of production of high-quality cold-rolled automotive steel at Mill 2000, phase 1 of which was commissioned on 15 July, 2011. The continuous hot-dip galvanizing unit at the MMK Istanbul site was commissioned on July 15, 2011, this marks completion of construction of the MMK metallurgy complex in Turkey. At the moment the metallurgy complex is being ramped up to full capacity, which is planned to be completed by the end of 2011.”

Rashnikov now owns 100% of the Atakas steelmaking complex in Turkey, having agreed in March with his former 50% local partner to buy him out for $485 million. Of that amount, $243 million has already been paid; the balance will be paid by November 1.

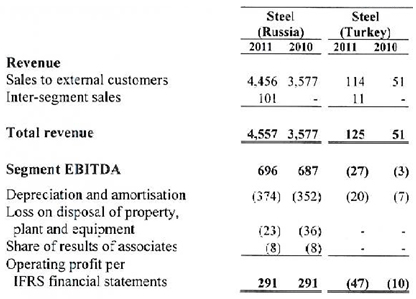

The latest MMK report values the Turkish assets at $2.1 billion, compared to $16.6 billion asset value for MMK’s steelmaking assets in Russia. Against that, Atakas is showing liabilities of $1.4 billion, while the Russian division has liabilities of $6 billion. The financial operations report shows that in the first six months of this year, Atakas ran up a $47 million operating loss, while the Russian mill reported a $291 million operating profit.

MMK was asked to clarify the production and financial profiles of the Russian and Turkish divisions. The data reported last week indicate that by year’s end, Atakas will be able to turn out 2.3 million tonnes of steel per annum. At the same time, MMK says that its output in the first half of this year, minus the Atakas contribution, was 5.1 million tonnes. That was just 3% ahead of a year ago. Domestic shipments of this steel were up; export volumes were down.

The company is claiming that full-year output for this year will be up 10% to 15% over last year. If so, the range will be between 11.3 million tonnes and 11.8 million tonnes. That is still well below MMK’s pre-crash peak of 12.2 million tonnes in 2007. That too lags the Soviet-era peak when MMK’s crude steel volume hit 16 million tonnes in 1989.

Getting MMK to say how much of its Russian capacity is utilized at present is tricky. A company source declined this week to provide a figure for the tonnage of finished steel produced if MMK’s Russian division is operating at full, installed capacity. The company claims that full-capacity output at Atakas will amount to 2.3 million tonnes per annum, and that this operating level should be reached by the fourth quarter of this year.

Production at Atakas will total 700,000 tonnes for 2010, MMK’s latest report claims. This suggests that two-thirds of this year’s growth in steel production at MMK will happen, not in Russia, but in Turkey.

Does Rashnikov intend to run Atakas flat-out, while holding back the Russian production lines? How the two units are linked together operationally and financially MMK refuses to say. MMK was asked what volume of steel it ships to Atakas for processing, and what are the projected earnings (Ebitda) for the Turkish division, once it is in its full production cycle. Despite the company’s stonewalling, one thing looks sure — the negative earnings number for Atakas in the first half of 2011 is likely to be succeeded by positive figures by year’s end, with an earnings margin that may well be superior to the 15.7% result reported last week for MMK as a whole. That in turn was shrinking, compared to the earnings margin of the fourth quarter of last year, 20.9%, and the first quarter of 2011, 18.2%.

MMK also reports that its indebtedness is rising, largely because of the acquisition and investment costs of Atakas. As of June 30, gross debt was $4.1 billion, up 17% since January 1.

Leave a Reply