By John Helmer, Moscow

@bears_with

President Vladimir Putin has given instructions to accept the Trump Administration’s demand that in exchange for lifting sanctions against Russia, US capital must return to Russia on preferential terms as soon as possible.

For the new round of negotiations in Geneva later this week, Putin has replaced Admiral Igor Kostyukov, the military intelligence chief, as head of the Russian negotiating team with Vladimir Medinsky, a lower ranking Kremlin official. Medinsky’s instructions are that the military terms of settlement on the Ukraine battlefield, insisted on by Kostyukov at the Abu Dhabi talks, be subordinated to the terms negotiated by Kirill Dmitriev, Putin’s principal negotiator with the White House.

The change in the Kremlin line is reported in the Russian media as the “Anchorage formula” and the “Dmitriev plan”.

This has been publicly criticized by Foreign Minister Sergei Lavrov in coded attacks in media interviews and a speech last week to the State Duma, declaring “the reality is quite the opposite.” Lavrov – Moscow sources say – was reflecting the consensus of the General Staff, the Foreign and Defense Ministries.

Putin reacted through spokesman Dmitry Peskov in defence of the Anchorage formula. “The spirit of Anchorage” – Peskov told Tass – “reflects a set of mutual understandings between Russia and the United States that are capable of bringing about a breakthrough, including in the settlement between Moscow and Kiev…[and] are fundamental.”

Faction-fighting around the Kremlin over what this means has triggered dismay among those Russian businessmen who have acquired their new economic power with takeovers of foreign assets released by the exit of US and European corporations since 2022. These Russian sources report resentment at the backing which Putin has given to Russian Central Bank (CBR) Governor Elvira Nabiullina’s continuing high-interest rate policy for Russian borrowers in parallel with Dmitriev’s plan for low-interest rate US investors to re-enter Russia, recover their former market share, and generate the appearance of an investment stimulus in the run-up to the the State Duma elections on September 20.

Nabiullina and Dmitriev have combined to persuade Putin to allow them to make these Anchorage formula concessions to US negotiators Steven Witkoff, Jared Kushner, and Joshua Gruenbaum. Their last session in Miami on January 31 also included US Treasury Secretary Scott Bessent.

What makes these concessions a “fundamental breakthrough”, as Peskov calls them, has been revealed in a memorandum of conversation published on February 12 by Bloomberg. This reports a “high-level memo which was drafted this year…which was circulated among senior Russian officials”. No author, date, subject line, distribution list, or any other detail of the document has been reported by Bloomberg to authenticate it, or to indicate whether it was leaked by the Witkoff side or the Dmitriev side after the Miami talks.

The published summary has seven points, listed without quote marks. They indicate “US participation in Russian manufacturing” in the Russian aviation sector; “allow American firms to recover past losses” in the Russian oil and gas sector, “including offshore and hard-to-recover reserves”; “preferential conditions for US companies to return to the Russian consumer market”; “cooperation on nuclear energy, including for AI ventures”; “Russia’s return to the dollar settlement system, including possibly for Russian energy transactions”; “cooperation on raw materials such as lithium, copper, nickel and platinum”; and “working together to push fossil fuels as an alternative to climate-friendly ideology and low-emission solutions that favour China and Europe”.

There was no mention of Dmitriev in the Bloomberg report.

The next day Putin’s spokesman was asked to respond. He then identified Dmitriev by name. “A group on economic issues is working. On our side, it is headed by my colleague [Kirill] Dmitriev,” Peskov said. “Indeed, issues of trade and economic cooperation – both potential and proposed – are on the agenda, and they are being discussed. We hope these discussions will continue. At the moment, the de facto situation is such that, in practice, until, let’s say, a Ukrainian settlement is reached, it is hardly possible to talk about anything concrete, and for now this is limited to discussions.”

Peskov acknowledged to Tass that he was “comment[ing] on a Bloomberg report about a ‘Kirill Dmitriev plan’ that envisions the possibility of establishing joint ventures with the US and settlements in dollars.”

Peskov did not deny the plan’s points which had been reported. He also explicitly endorsed one of the points. “Russia has never abandoned the dollar; the US restricted its use for transactions, Kremlin Spokesman Dmitry Peskov said at a briefing. ‘After all, no one abandoned the use of dollars. It was the issuing country, the United States, that restricted a number of countries’ right to use the dollar. And these countries, naturally, are using alternative payment methods, alternative forms. If the dollar is attractive, then, of course, everyone will return to using it, including alongside other currencies.’”

Explaining Peskov’s endorsement of the Dmitriev plan, sources in Moscow believe Putin has been persuaded by Nabiullina of the CBR and other economic advisors that unless he agrees to the Dmitriev plan very soon, the Russian economy faces recession conditions before the September 20 national parliamentary elections. Nabiullina’s refusal to lower the CBR’s key rate more than 50 basis points to 15.5%, announced on February 13, came with several warnings that Russia’s GDP is slipping below the 1% growth rate officially reported, and thus into recession. “We have revised our 2026 investment forecast slightly downwards,” Nabiullina said, “the gradual slowdown in economic activity is accompanied by labour market easing…The situation for Russian exporters is complicated by sanctions. In view of the global market trends, we have reduced our forecast of oil prices for the next three years. Accordingly, we have also adjusted the forecast of the value of Russian exports.”

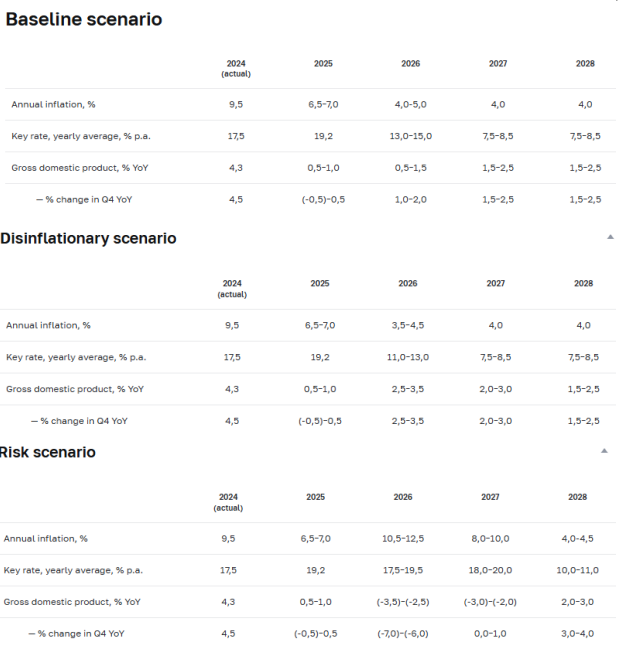

The CBR’s “baseline scenario” forecast is for GDP growth this year of between plus 1% and plus 2%. The “risk scenario” forecast is for GDP decline of between minus 6% and minus 7%. The deciding factor between the two outcomes in Nabiullina’s calculation is Trump strategy: “The risk scenario assumes escalation of international trade tensions, intensification of deglobalisation processes, import tariff increases worldwide above the levels predicted in the baseline scenario, and a sharp decline in the growth rates of the largest economies.”

In advance of the Bloomberg disclosure of the Dmitriev plan, there has been sharp reaction to Putin’s concessions to the US from Russia’s strategic allies – China, India, and Iran. The first signal of disagreement with Putin came from President Xi Jinping following their video conference on February 4. According to the readout from Putin’s national security adviser Yury Ushakov, “Vladimir Putin and Xi Jinping also exchanged views on their countries’ relations with the United States. Their approaches almost fully coincide.” This is diplo-speak for its opposite: it means Xi and Putin are unhappy with each other’s separate deal with Trump.

A well-informed source in Delhi said in anonymity: “So while [Indian] nationalists are calling out the Modi government out for betrayal of multipolarity by agreeing to Trump’s demand not to buy oil from Russia or from the pirate fleet, Putin has quietly surrendered to the Americans himself.”

A Dubai source engaged in trade payment arbitrage adds: “Even after the [Russian] Central Bank made the renminbi a reserve currency, the trade in renminbi has carried heavy costs for Russians, and many Chinese exporters simply refuse to do settlements in RMB. With India, the Central Bank never looked at Indian rupees as a reserve currency and has been very lukewarm. Russian Big Business more so. Their only interest with India has been in making large profits in trade and nothing else. No investment, no joint production. So Putin’s backing for Nabiullina and Dmitriev means fixation on the US dollar and submission to US hegemony. By the way, this is egg on the face of every podcaster talking of BRICS currency and Russia’s Eastern Pivot as gamechangers in multipolarity.”

A Moscow source adds that the Dmitriev plan reported by Bloomberg leaves out a major Putin concession allowing the privatization of the $300 billion in CBR reserves in a US-Russian “development fund” to be directed by family members of Trump and Witkoff, alongside Dmitriev. For more details, click to read.

“There is a crisis of decision-making around Putin now,” claims a Moscow source in a position to know. “If Putin breaks all his undertakings with the BRICS allies, especially China and India, and subordinates the military conditions for the Ukraine battlefield to ingratiating with Trump’s capital, then what is silent now will grow very loud and very soon.”

The history of the Dmitriev plan in Moscow began in this report of January 23, 2025. Proposed Russian concessions were identified then in aviation, oil and gas, the US dollar payment system, and the role of the United Arab Emirates for crypto concealment of bribes to the Trump and Witkoff families.

For the full archive on Dmitriev, click to read.

Left to right: Putin and Dmitriev; Dmitriev and Nabiullina (January 29, 2026).

The first report of Dmitriev’s agreement with Witkoff and Kushner on the privatization of the CBR’s frozen reserves into an “international development fund” was published on February 2, 2026. The proposal was discussed in Miami on January 31.

In outline, the scheme was also discussed with Putin and Dmitriev when Witkoff, Kushner, and Gruenbaum were at the Kremlin on January 23. “Importantly, the participants in the conversation between the President of Russia and the Americans reaffirmed the fact that bringing about a lasting settlement would be unlikely without addressing the territorial issue based on the formula as agreed in Anchorage,” Ushakov told the press immediately afterwards.

Ushakov went on to clarify the Anchorage codeword: “While exchanging views on the [Gaza] Board of Peace, we emphasised our readiness to transfer US$1 billion to its budget from Russia’s assets frozen under the previous US administration. The remaining part of the Russian assets frozen in the US can be used for rebuilding the territories damaged during the hostilities after a peace agreement is signed between Russia and Ukraine. Discussions of this issue will continue in the bilateral economic group…further development of bilateral Russian-US relations was discussed at the conceptual level, considering the huge potential of our countries for cooperation in various spheres. American representatives are already considering certain plans that could be implemented after the settlement of the Ukraine crisis.”

Moscow sources claim that in the outcome of Kostyukov’s negotiations in Abu Dhabi, Putin has been persuaded that the military outcome the General Staff is pursuing for capitulation of the regime in Kiev will be a Pyrrhic victory if it cannot relieve the Russian economy of the impact of the US-led sanctions war, including the escalating US and NATO war against the Russian maritime fleet. Putin had believed – the sources add – that in the Anchorage formula, Trump had agreed to Russian military success on the Ukrainian battlefield, and in parallel he would lift sanctions by halting their enforcement.

That was on August 15, 2025. Instead, nine weeks later on October 22, Trump ordered new measures to stop China and India buying oil from Rosneft and Lukoil.

Source: https://home.treasury.gov/news/press-releases/sb0290

US and NATO preparations for a naval blockade of Russian tanker deliveries followed, starting with Operation Southern Spear in the Caribbean on November 13. The first US seizure of a Russian-flagged tanker was on January 7, 2026.

The most recent US operations have included seizures of the Russian-owned Aquila II in the eastern Indian Ocean on February 9, followed by the Veronika III, also in the Indian Ocean, on February 15. For a review of the applicable maritime law, read this.

The Pentagon has made clear it is extending its blockade of Venezuela to Iran and to Russia. “No other nation has the reach, endurance, or will to do this. International waters are not sanctuary. By land, air, or sea, we will find you and deliver justice. The Department of War will deny illicit actors and their proxies freedom of movement in the maritime domain.”

Moscow sources now claim Trump has been encouraged by Dmitriev’s negotiations with Witkoff to escalate the sanctions war at sea and to toughen the terms for Putin to accept the US corporate return to Russia. Lavrov has publicly responded: “this means that the Americans have set themselves the task of achieving economic domination. Furthermore, while they ostensibly made a proposal regarding Ukraine and we were ready to accept it (now they are not), we do not see any bright future in the economic sphere either. The Americans want to take control of all the routes for providing the world’s leading countries and all continents with energy resources. On the European continent, they are eyeing the Nord Streams, which were blown up three years ago, the Ukrainian gas transportation system and the TurkStream. This illustrates that the US objective – to dominate the world economy – is being realised using a fairly large number of coercive measures.”

Anticipating direct military contact between Russian and US forces at sea, Putin has refused Russian Navy, General Staff, and Security Council recommendations for Russian military response to US and European attacks on the Russian trade routes and tanker fleet.

The evidence of the role the Central Bank is playing in Putin’s acceptance of the Dmitriev plan can be found in Nabiullina’s public explanation last week for her refusal to lower the CBR’s key rate by more than fifty basis points to 15.5%.

Source: https://www.cbr.ru/eng/press/event/?id=28304 – with English translation in voiceover.

“The economic situation has been developing generally in line with our baseline scenario,” Nabiullina said, adding there are risks of a worsening of the forecasts from inflation above the baseline; “moderating”(contraction) in the economic growth rate, in “consumer activity”, in “investment dynamics” and in “demand for housing mortgage loans”. Other negative risks include “labour market easing” and “trade disputes and global market fragmentation.”

Nabiullina’s mention of the baseline scenario refers to the CBR’s strategy paper issued on November 27, 2025. These are the three scenarios:

Source: https://www.cbr.ru/eng/about_br/publ/ondkp/on_2026_2028/ “The main risks to the development of the Russian economy are related to both internal and external conditions. In view of this, the Bank of Russia considers two unfavourable alternative scenarios. The proinflationary scenario assumes a combination of internal and external factors, which will be the reasons why demand will be higher and supply will be lower than predicted in the baseline scenario. Due to tightening sanctions, the growth rate of production capacities will be lower than in the baseline scenario. Tighter sanctions will also lead to Russian crude prices stabilising at lower levels. To prop up the economy, the Russian Government will expand subsidised lending programmes and strengthen protectionist measures aimed at encouraging import substitution. However, supply will still be lagging behind rising demand, which will amplify inflationary pressures. Prices will also be affected by heightened inflation expectations as they will be declining more slowly and be more responsive to all proinflationary factors. The risk scenario assumes escalation of international trade tensions, intensification of deglobalisation processes, import tariff increases worldwide above the levels predicted in the baseline scenario, and a sharp decline in the growth rates of the largest economies. Combined, these factors will entail a global financial crisis, the scale of which might be comparable with the 2007–2008 crisis. The sanction pressure on the Russian economy is likely to strengthen in this scenario as well. According to the Bank of Russia’s estimates, the materialisation of risks in these two scenarios will speed up inflation in the next few years and require tighter monetary policy, as compared to the baseline scenario. Inflation will return to the target later than in the baseline scenario” -- page 3.

Nabiullina’s announcement last week that “our GDP growth forecast in the baseline scenario has remained unchanged” means she has been telling Putin that there is no likelihood of any improvement in the economy between now and the elections in September.

In her risk warnings, however, Nabiullina was saying there is increasing likelihood of what she called “proinflationary risks”; in CBR-speak that means “external conditions” which is the official euphemism for Trump sanctions. “Crude oil prices also involve serious risks. If oil prices do not rebound from their current levels to those assumed in our baseline scenario, this might accelerate inflation through the exchange rate channel.”

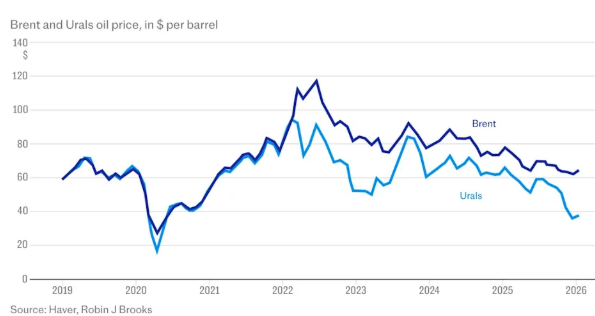

The average oil price for this year in the CBR baseline scenario is $55 per barrel, rising to $60 in 2027. In the risk scenario, the forecast oil price is $55 this year, the same next year. But Russian oil market sources believe the price trajectory this year will be much worse with the actual, after- discount price already one-third lower than the CBR levels.

Nabiullina has not been asked by the press or by Duma deputies to comment on White House and US Treasury policy to drive the discounted price of sanctioned Russian oil downwards, and trigger a combination of domestic inflation and public discontent when Russian voters go to the polls in the autumn.

Source: https://finance.yahoo.com/news/steepest-ever-discounts-russian-oil-160942772.html

Market reports in January indicate that Russian oil is being sold at the steepest discount on record as the Urals crude marker has now dropped to an average of $37.50. The oil market forecast is for deepening discounts as Indian oil orders dwindle and China’s refineries reach their limit in accumulating Russian oil stocks.

“The key trends in the economy have generally stayed the same” – Nabiullina’s public reassurance last week is a political shot aimed at Putin’s election campaign calculation. The Dmitriev plan is his only option for preserving domestic stability, Nabiullina is saying.

View now or listen to the hour-long discussion of the Kremlin crisis provoked by the Dmitriev plan. Glenn Diesen invited the discussion in his Greater Eurasia Podcast and recorded it on Saturday morning (Moscow time). In the first segment, Diesen and I discussed the disclosures in the Epstein files which have been released by the US Department of Justice. The evidence of the Trump Administration’s cover-up of Epstein’s financial schemes was then put into the context of the US war plan against Russia.

When the podcast is published, click on this link.

Leave a Reply