By John Helmer, Moscow

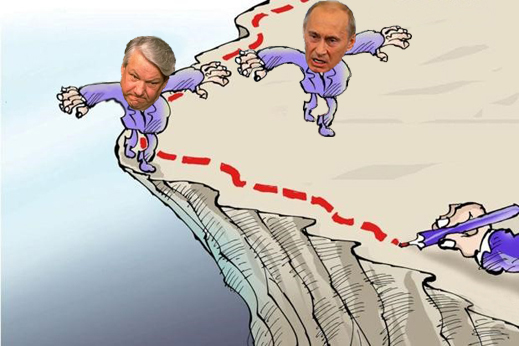

President Vladimir Putin has lost the war. Not the one with Washington for the future of Europe, eastern Ukraine, and the Kremlin itself. That war isn’t going so badly for Putin. The one he is losing is with the Russian oligarchs on whether they will repatriate their assets from their offshore havens, subject themselves to genuine auditors, and pay Russian tax.

Putin conceded defeat, a powerful international banker believes, when the president announced late last month that he accepts the establishment of Russian trusts to hold assets and income onshore and offshore without liability to pay domestic tax. According to Putin on March 25, “this is an innovation in our legislation, which before we didn’t have.”

“Russian capital,” the banker says, “has been saying from the beginning of the conflict in Ukraine that it wants Putin to abandon his deoffshorization plan. It’s going to succeed because the sanctions imposed since the conflict began have cut off the regular supply of capital to Russia. Capital isn’t patriotic, at least not in Russia. Putin is obliged to pretend he can persuade the oligarchs to act in the country’s interest. But he’s pretending. The proposed new law on trusts shows it.”

(more…)