By John Helmer, Moscow

As famous hoaxers go, Igor Sechin (lead image, centre), the chief executive of Rosneft, Russia’s largest oil company, is at least as clever as Clever Hans (right), a German horse of the late 19th century.

Hans was apparently good at arithmetic. If his owner asked him to multiply three by four, he would tap his hoof twelve times. He could tell the square root of sixteen by tapping four times. He was also able to give answers to questions he hadn’t heard before. So he was a very famous horse in Germany. That was until a sceptical psychologist realized Hans would only get the answers right if his owner also knew the answers, and if the horse could see him when the questions were asked. If the owner or another questioner was invisible to the horse’s eye, Hans would fail. He even bit the psychologist after a string of tests produced wrong answers. The psychologist’s conclusion was that the horse was gifted, but not at arithmetic. Hans could detect the visual cues his questioner would give out when the horse was reaching the correct number of hoof taps, and he would stop. The owner wasn’t attempting a fraud, and Hans was exceptionally intelligent. But his calculations were a hoax.

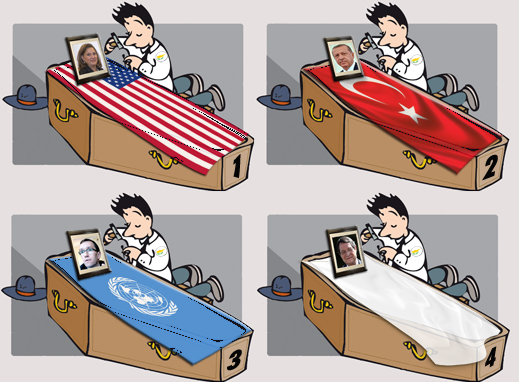

In last week’s Rosneft share sale — the deal President Vladimir Putin has called the biggest privatization in Russia, and also the biggest oil sector sell-off in the world this year — clever Igor, like clever Hans, has proved his indubitable intelligence. But the arithmetic which the president has announced — €10.5 billion paid into the Russian state budget – is a hoax. That’s because a curtain has been drawn across all questions of where the money has come from.

In fact, Kremlin and Russian banking sources acknowledge, the money originated from the Central Bank of Russia, recycled through the Russian state banks to Rosneft and back, and finally concealed inside secret fiduciary agreements with a consortium of Glencore, the Swiss trading company, and the Qatar Investment Authority (QIA), an Arabian Gulf state agency. The agreements appear to make Glencore and QIA the owners of a 19.5% shareholding in Rosneft – when they are fiduciary shareholders – and that’s not the same thing as owners.

“The transaction has been financed by money creation by the Central Bank”, said a source close to the dealmakers. “The Central Bank can’t simply print money and give it to the federal budget. So this deal was engineered for Glencore and the Qataris to appear to be buying shares when the terms of the agreement reward them for acting as fiduciaries, but ensure they cannot vote the shares without instruction from the Russian state; that’s Mr Sechin. This means the privatization of the shares isn’t genuine. Also, three-quarters of the money going into the state budget is coming from the Central Bank.”

A Russian banker in London comments: “There’s a golden rule in Russian banking. If you fiddle around, never involve foreigners because in the end they will expose you. The announced terms of the Rosneft deal cannot stand the light of day. Inevitably, the truth will come out.” According to Swiss sources, the truth has already been demanded by the US Government of the Swiss Government, which will obtain the contracts from Glencore.