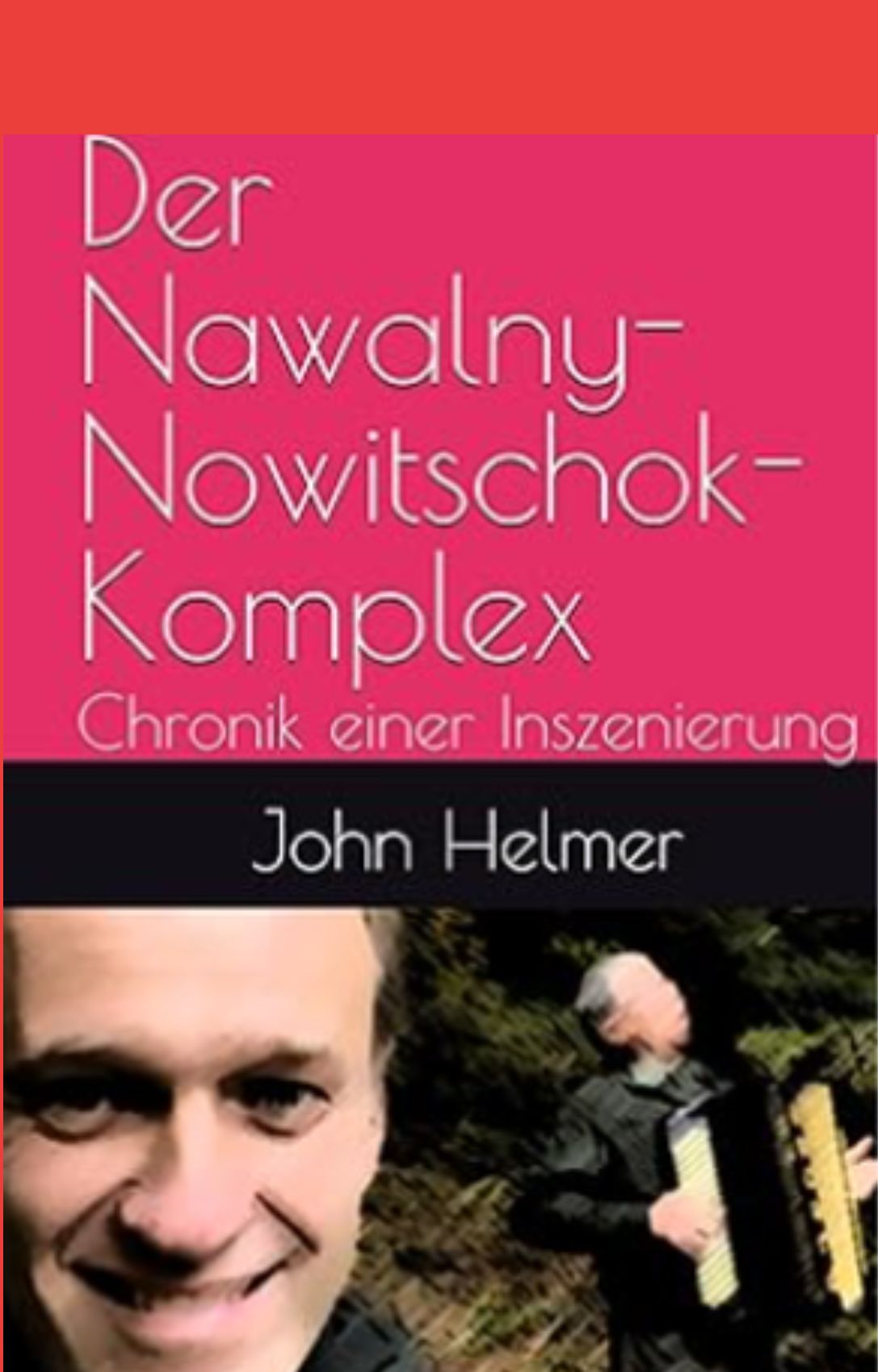

By John Helmer, Moscow

Last year the government of Botswana decided to halt a 2-year old, multimillion dollar contract for its state mining company to purchase a nickel mine from Norilsk Nickel, Russia’s largest mining company. The government also decided to put its state nickel mining company into bankruptcy to protect against court claims from Norilsk Nickel. At the same time, the Botswanans tried arranging a buyout of their mining company by a penniless investment group in the United Arab Emirates.

A document, drafted on March 13 and circulating since then among Botswana Government officials, reveals details of the buyout and confirms that the Norilsk Nickel deal was negotiated in bad faith by the Botswanans without the money to pay for it. The Botswanan Government then sought secret help from the South African Government to block the deal.

This sequence of events, decided behind closed doors, have so far cost Norilsk Nickel a contract worth $277.2 million, and the conviction that the Botswana Government cannot be trusted to honour either its obligations to foreign investors, or its promises of employment and prosperity to its own people. Mining sources in Gaborone, the Botswana capital, say it’s a case of politicians inexperienced in business “doing something either so clumsily they are culpably incompetent, or so cleverly they are corrupt. Either way the Norilsk Nickel case is a tragedy for the country.”

The deal was the last exit from Africa by the Russian company, convinced that Botswana is a much higher risk than has been admitted until now in reports of the International Monetary Fund, the World Bank, and Transparency International. As for the smoking-gun letter, Sadique Kebonang, the Botswana mining minister to whom it was addressed, says: “I am unaware of it. I will look for it since you have brought it to my attention.” He declined “to respond to matters that are before court and are subject to the sub judice rule.” (more…)