By John Helmer, Moscow

The collapse of Otkritie Bank last month is the largest Russian bank failure since the collapse of National Bank Trust in December 2014. The Central Bank rescue of Trust made inevitable the much more costly bailout of Otrkitie, announced a fortnight ago on August 29, charges Ilya Yurov, the former control shareholder and chief executive of Trust, speaking from exile in the UK.

The reason, according to Yurov, is “the dishonest and deliberately malicious actions of the management and shareholders of Otkritie Bank, and also, unfortunately, a number of officials of the Central Bank of Russia and the Deposit Insurance Agency.” The state organizations, Yurov alleges, “continue to adopt dishonest practices when initiating their processes of ‘financial rehabilitation’ or the prevention of bankruptcy of the Russian banks, which inevitably lead to the violation of the rights of customers and bank lenders, and significantly worsen the situation of the financial industry as a whole.”

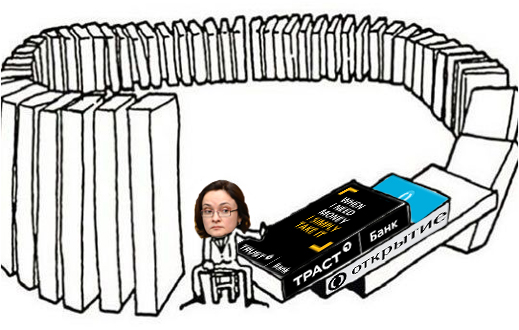

Bank analysts and investors in the Russian banks say the combination of failures reveals grave weaknesses in the Central Bank’s supervision. “The black holes in the Russian banking system are expanding,” believes a London banking source. “The more money the Central Bank lends to stop bankruptcy, the faster the cash disappears. Sooner or later, the falling dominoes will come down on [Central Bank Governor Elvira] Nabiullina [lead image] herself.”

Between December 2014 and May 2015 the Central Bank loaned Rb127 billion ($1.7 billion) to Otkritie for the takeover of Trust in what Russian bankers call a “sanitation” – a state funded bailout, administered by the Deposit Insurance Agency (DIA) which stops short of bankruptcy, court-ordered administration, or liquidation.

Then late last month, after Otkritie depositors lost confidence in the bank and withdrew Rb693 billion ($11.6 billion) from Otkritie accounts in June, July, and August, the Central Bank topped the senior management and board, froze transactions, and commenced fresh lending to preserve Otkritie’s solvency. In exchange for the new cash, the Central Bank now owns 75% of the bank’s shares. Over the coming weeks, from Rb250 billion ($4.3 billion) to Rb400 billion ($6.9 billion) will be the Central Bank bailout required, a deputy governor at the bank announced [2]on September 1.

Yurov has been charged in Russia with defrauding Trust, triggering the bank’s failure after related-party lending to a network of offshore companies, which Yurov controlled, drained the bank of its cash. Up to $1 billion has been reported as unaccounted for, if not exactly lost. Early this year two of Yurov’s subordinates at the bank were tried and convicted of embezzlement from the bank, using fake loan papers [3].

In London and New York Yurov is counter-charging the now ousted chief executive and control shareholder of Otkritie, Vadim Belyaev, and the next most powerful shareholder on the Otkritie board, Ruben Aganbegyan, with conspiracy to attack Trust, push it into sanitation, and withdraw Trust’s cash for themselves through Otkritie. Yurov is also accusing three Central Bank officials at the time of being participants in the cash-and-grab conspiracy.

“Yurov is not a credible accuser,” a Central Bank veteran commented in Moscow. “As the old Russian saying has it, Вор у вора дубинку украл – a thief is stealing a bludgeon from another thief.”

Yurov (below left) owned 42% of Trust until Otkritie took over; 26% of the shares were held by other Trust executives. At the time, and until this month, Belyaev (centre) owned 28.61% of Otkritie; Aganbegyan (right), 7.96% — they were the largest individual shareholders of Otkritie, and also indirectly of Otkritie Capital.

Yurov’s story has been told here [5]; Aganbegyan’s here [6].

On August 29 the Central Bank announced [7] it was taking over Otkritie. One of the reasons for Otkritie’s failure was what the Central Bank termed “the not entirely successful reorganization of Trust.” Central Bank Governor Nabiullina added [8] last week in Moscow: “[The takeover of Otkritie] is intended to quickly deal with the problems of the bank, to recapitalize it directly to develop a business model that will be transparent and generate revenue; be transparent to investors; and offer the bank [for resale] to the market. Not necessarily to a major strategic investor. We want to make it so transparent in order to be able to make this bank a public company and for us this is, of course, very important.”

Ahead of its failure in June, according to its second-quarter report Otkritie appeared to be the sixth largest Russian bank by volume of individual deposits (Rb573.8 billion), and the seventh largest by value of assets (Rb2.5 trillion). It was a bank of systemic importance in the Russian economy; it has also participated at the Kremlin’s request in highly controversial state financing transactions, such as last year’s privatization of Rosneft shares. However, although Otkritie’s shares are publicly listed on the Moscow exchange (MICEX), transparency has not been a feature of Otkritie’s business, so the recent rush to abandon the bank by depositors and shareholders followed speculation about its true condition which the bank was unable to rebut.

ONE-YEAR SHARE PRICE TRAJECTORY FOR OTKRITIE BANK

[9]

[9]

Source: https://www.bloomberg.com/quote/OFCB:RM [10]

The MICEX chart shows that Otkritie Bank share value jumped to Rb1,546, (market capitalization of Rb322 billion) close to its earlier historical high, after the Central Bank handed over Trust Bank in December 2014. The share continued climbing until it reached its all-time high above Rb1,600 during May of this year. Then the market began to have suspicions. Current market capitalization today is Rb245 billion – Rb77 billion has been lost in less than a month. The president of MICEX board between 2010 and 2012 was Aganbegyan, who then moved to become chairman of the board of Otkritie, and in 2016, also chairman of the Trust takeover board.

If not for litigation records from the courts of New York and London, the internal operations of Otkritie and Trust would not be so clear. Commencing on December 30, 2016, in the New York Supreme Court in Manhattan, Yurov filed suit against Belyaev, Aganbegyan and the Otkritie holding through a New York subsidiary. The court is still in the preliminary stages; the veracity of testimony has yet to be tested; no judgement has been issued. The docket for case no. 656788-2016 can be followed here [11].

Yurov’s case, presented in 25 pages, charges [12] Otkritie with “unlawful acquisition of his valuable shares in National Bank Trust (“NBT”), a leading Russian bank, without compensation in violation of their agreement, and as part of an overall scheme to enrich themselves at Yurov’s expense.” The scheme, according to Yurov, was that Belyaev and Aganbegyan “agreed to pay $50 million, the approximate value of the shares in NBT that they acquired, in exchange for Yurov’s and two other NBT executives’ causing Defendant Otkritie Holding JSC (“Otkritie”) to be appointed as NBT’s takeover partner and successor (and ultimate beneficial owner of the NBT shares) in a specialized Russian bankruptcy proceeding. Yurov and the other executives did exactly what they agreed to do, and ensured that Otkritie was duly appointed as NBT’s takeover partner.”

“However, despite acquiring ownership and control over NBT, Defendants [Belyaev, Aganbegyan, Otkritie] never compensated Yurov pursuant to their agreement. Instead, Defendants ended up with the entire value of Yurov’s NBT shares and then organized and implemented a smear campaign against him that resulted in the initiation of baseless criminal proceedings, designed to distract governmental and public attention from their wrongful conduct. As of the date of this Complaint, Yurov has not been paid any compensation from Defendants for the shares they received in NBT through the agreement. Instead, Yurov’s reputation is in tatters due to the smear campaign that Defendants organized, and Defendant Otkritie is currently the owner of NBT, as Defendants intended.”

Yurov alleges he was cornered into selling out of his bank by a series of actions he blames on Igor Sechin, chief executive of Rosneft. Between 2007 and 2009, Yurov says that Rosneft took Russian court action against Trust for allegedly unlawful financial operations on behalf of Mikhail Khodorkovsky, the owner of the bank before his arrest in 2003 and conviction in 2005. Rosneft obtained a court-ordered freeze of Trust shares, preventing Yurov from selling or pledging them for loans. Yurov says that in the second half of 2014 he was offered a buyout by Mikeil Shishkhanov (pictured below, left) of BIN Bank for $100 million. Sechin (centre) countered with an offer of one dollar, tabled, according to Yurov, by Rosneft’s chief financial officer, Pyotr Lazarev (right).

Yurov has told the New York court that Aganbegyan then stepped in, along with Belyaev, and made Yurov an offer of $50 million. “In November 2014, Yurov received a call from Defendant Aganbegyan,” the court papers say, “about a possible friendly acquisition of NBT by Otkritie. During this call, Aganbegyan invited Yurov to meet with him and Defendant Belyaev in person to discuss the potential acquisition. Yurov trusted Aganbegyan because he had known him socially for over twenty years, during which time they both worked in the banking industry. Yurov knew that Belyaev also worked in the banking sector and believed that he had a reputation as a trustworthy and successful businessman. As a result of Yurov’s acquaintance with Aganbegyan and his familiarity with Belyaev’s reputation, when Defendants offered to acquire NBT, Yurov concluded that their offer was genuine.”

The scheme was designed to defeat Sechin and evade the Rosneft freeze order. “Under this proposal, NBT would file an application for financial rehabilitation with the Russian Central Bank (“RCB”) and request that Otkritie be appointed as the ‘takeover partner’ to acquire NBT’s shares. Through this process, the NBT shares that had been ‘frozen’ could be transferred or acquired in a way that a private acquisition could not effect.”

Yurov claims the scheme was also discussed and agreed with Alexei Simanovsky, [14] then the Central Bank’s supervisor of the banking sector, and with Yury Isaev (right), the DIA chief. Yurov, he told the New York court, “would have never taken any of these steps absent Defendants’ commitment to pay $50 million under the Agreement.”

[14] then the Central Bank’s supervisor of the banking sector, and with Yury Isaev (right), the DIA chief. Yurov, he told the New York court, “would have never taken any of these steps absent Defendants’ commitment to pay $50 million under the Agreement.”

He didn’t get his promised $10 million down payment or the remainder. Instead, Yurov says a campaign of “negative publicity” followed from the Central Bank and DIA, other government officials, and the press, which he claims was orchestrated by Aganbegyan and Belyaev. As this intensified, the takeover became an unfriendly one; Yurov’s shares were diluted in May of 2015; and by June, Otkritie had “acquired 99.99% of NBT’s shares through the financial rehabilitation process. As of the date of this Complaint [December 30, 2016], Yurov has not been paid any compensation from Defendants.”

Belyaev replied in court to Yurov’s claims on February 24 of this year. Without mentioning the one-dollar offer from Sechin, Belyaev’s testimony implies that might have been a get-out-of-jail free card for Yurov. Belyaev told [15] the court there had been no buyout deal with Yurov. “At the time, NBT had massive liabilities; the capital had been eroded; it was essentially bankrupt; and its shares were thus worthless. It would make no business sense at all for Otkritie to offer $50 million (or indeed any sizeable sum) for the assistance of NBT’s shareholders in helping Otkritie take over a bank that was about to collapse and had negative assets. We never made any such offer.”

Once the Central Bank and DIA had authorized Otkritie’s takeover, Belyaev says their combined investigations revealed “widespread wrongdoing by Mr Yurov and by the two former NBT shareholders… Nikolay Fetisov and Sergey Belyaev (who is not related to me)…” Belyaev summarized parallel litigation in the UK High Court in pursuit of $830 million in assets belonging to Yurov and his partners. “The amount,” says Belyaev, “represents the balance owed by companies owned or controlled by the NBT Shareholders.” He called Yurov’s operation of Trust a “Ponzi scheme with a fancy name.”

In the New York court papers Belyaev also reveals that he and Yurov have both exited from Russia. The two of them hold Cyprus citizenship, and while Belyaev owns a home north of Manhattan where his ex-wife and children live, Belyaev himself lives in London, while Yurov’s home is in Kent. According to Belyaev, Yurov should have brought his case in the UK where “he and I both live”. Papers filed in recent weeks by the Otkritie lawyers argue that Yurov’s claim should be dismissed [16]because there is no jurisdiction in the US. “Nothing in plaintiff Ilya Yurov’s opposition papers changes the fact that this case involves exclusively foreign parties and depends entirely on events said to have taken place in Russia.”

A year ago in the High Court in London, Justice Sir Stephen Males (right)  [17]ruled [18]that on the admissions of Yurov himself, and on evidence presented by Otkritie, there had been massive recycling of Trust Bank’s funds through offshore companies controlled by Yurov, and back to the bank “in order to disguise the bank’s insolvency (1) the defendant [Yurov] was paid over US $12 million in salary and bonuses, (2) the shareholders had the benefit of a loan to Willow River and RCP which those companies used to acquire assets which are now worth some US $100 million, (3) the shareholders had the benefit of other loans of some US $70 million to companies whose ownership they admit which have not been repaid, and (4) the shareholders came close to selling their shares in the bank (which were in fact worthless) to a third party for US $100 million. During this same period the bank, under the shareholders’ management, was actively encouraging deposits by new customers. On any view, therefore, the shareholders have benefited handsomely from what appears to be their dishonest stewardship of an insolvent bank. Indeed, it appears that the Willow River and RCP shares were the subject of a pledge to the bank which the shareholders caused the bank to release for no consideration on 17 December 2014, only a few days before the bank’s collapse, thus further enriching themselves. All this was at the expense of the bank’s retail customers and ultimately, through the bailout, the Russian taxpayer.”

[17]ruled [18]that on the admissions of Yurov himself, and on evidence presented by Otkritie, there had been massive recycling of Trust Bank’s funds through offshore companies controlled by Yurov, and back to the bank “in order to disguise the bank’s insolvency (1) the defendant [Yurov] was paid over US $12 million in salary and bonuses, (2) the shareholders had the benefit of a loan to Willow River and RCP which those companies used to acquire assets which are now worth some US $100 million, (3) the shareholders had the benefit of other loans of some US $70 million to companies whose ownership they admit which have not been repaid, and (4) the shareholders came close to selling their shares in the bank (which were in fact worthless) to a third party for US $100 million. During this same period the bank, under the shareholders’ management, was actively encouraging deposits by new customers. On any view, therefore, the shareholders have benefited handsomely from what appears to be their dishonest stewardship of an insolvent bank. Indeed, it appears that the Willow River and RCP shares were the subject of a pledge to the bank which the shareholders caused the bank to release for no consideration on 17 December 2014, only a few days before the bank’s collapse, thus further enriching themselves. All this was at the expense of the bank’s retail customers and ultimately, through the bailout, the Russian taxpayer.”

Yurov has argued in court, as well as in letters to the General Prosecutor in Moscow, to the Central Bank and to the DIA, that the extent of the recycling was exaggerated by Otkritie, in order to seize control of the loan funds as they were repaid to Trust, after the takeover. He has also testified in Moscow that the related-party loans for recycling came to no more than 13% of Trust’s loan-book at the start of the sanitation process.

The High Court judge has ruled that Yurov’s “own account involves the acceptance of what appears to be dishonest conduct on his part involving concealment of the bank’s true financial position through a network of offshore companies. I emphasise that this latter point does not involve the determination of any disputed issue of fact. It is simply the consequence of what the defendant himself says.”

For details of the tracing of the Trust funds through the offshore network by Benedict Worsley (right)  [19]a one-time employee of Yurov’s, now turned informer for Otkritie, read this archive [20]. According to the Males judgement, Worsley is a bounty hunter. “The payments due to Mr Worsley were not merely by way of monthly retainer [$32,000] but included substantial sums (running to several hundred thousand dollars) for the provision of various services as well as a percentage of between 1.5% and 4% of the net value of certain assets recovered.”

[19]a one-time employee of Yurov’s, now turned informer for Otkritie, read this archive [20]. According to the Males judgement, Worsley is a bounty hunter. “The payments due to Mr Worsley were not merely by way of monthly retainer [$32,000] but included substantial sums (running to several hundred thousand dollars) for the provision of various services as well as a percentage of between 1.5% and 4% of the net value of certain assets recovered.”

Detailed accounting of Otkritie’s handling of Trust Bank’s funds, its cash position at the start of the takeover, and the cash recovered from the offshore “recycling” between 2015 and 2017, has been reported by Yurov to law enforcement and Central Bank officials in Moscow, where Yurov is represented by the politically influential law firm, Yegorov Puginsky and Afanasiev. So far, there has been no High Court trial or judgement on this evidence, nor of Yurov’s claims that he was more victim of fraud than perpetrator.

Yurov has named three Central Bank officials as alleged accomplices in the Otkritie takeover and in the subsequent coverup of diversion of funds from Trust’s balance-sheet to Otkritie’s. They are Alexei Simanovsky [21], who was First Deputy Governor from 2012; Mikhail Sukhov [22], a deputy governor from 2012; and Azer Talybov, head of Nabiullina’s secretariat. No wrongdoing has been charged against the men in a Russian court.

[23]

[23]

Ousted up, sideways, and out -- left, Alexei Simanovsky was promoted to be advisor to Nabiullina; right, Mikhail Sukhov has left the bank; and Azer Talybov was appointed [24]deputy minister of economic development, taking with him a Kremlin medal for his good works at the bank. The new running orders [25]from the Central Bank put Dmitry Tulin as first deputy governor of the bank in charge of “developing and implementing measures to mitigate systemic banking risks and to ensure banking sector consolidation”.

In mid-October 2016, Simanovsky and Sukhov were replaced at the Central Bank and Talybov was gone. A source close to the Central Bank says there had been a “purge”. Dmitry Tulin [26], a First Deputy Governor since 2015, took over their functions and he now heads supervision [27]of the Russian banking sector. Tulin is also in charge of a new Central Bank fund [28] for replenishing the capital of failed banks like Otkritie.

Boris Titov, a Krasnodar winemaker turned Kremlin-appointed ombudsman for Russian business, last week attacked [29] the new fund and the decision to shut down Otkritie, calling the latter “murder” of the bank. “And this centralization, or consolidation, of the banking system is also murder…The very name [of the Central Bank’s new fund for consolidation of the banking sector] is awful. It is not our goal — to consolidate the banking sector. On the contrary, there should be competition in the banking sector. All the time we are exhausting everything in the big banks.”

[30]

[30]

Left, Boris Titov; right, Veronika Dolenko.

Yurov’s case in New York, London and Moscow is that until the Tulin purge last year, the Central Bank was in cahoots with favourites in the private banks, conspiring with them to rig balance-sheets, and then cover up the disappearance of the Central Bank’s sanitation loans. In court papers Yurov has accused Veronika Dolenko, the chief financial officer at Otkritie, of conflict of interest as she doubled as both an officer of the takeover bank and as an advisor to the DIA, during the investigation of Trust’s accounts.

Dolenko’s past career [31]reveals a string of directorships with notorious banks — Conversbank, Snoras Bank, and MDM. Justice Males in the High Court directly addressed Dolenko’s performance. “Mr Belyaev’s evidence is that during the temporary administration of distressed banks by the DIA, only DIA employees can be appointed to manage the bank concerned, and that it is usual practice for an employee of the institution assisting with the rehabilitation (in this case Otkritie) to second an employee to the DIA to be appointed as a manager of the distressed bank; and that Ms Dolenko’s secondment to the DIA for this purpose was in accordance with this normal practice. He confirms also that the investigation which resulted in the DIA report was carried out by a team comprising both DIA and Otkritie staff. There is no reason to doubt this evidence.”

In a second ruling Males has issued [32]a costs penalty against Otkritie for failing to make the required disclosures of material evidence.

A source close to the Central Bank comments: “I doubt that current developments are a product of Nabiullina’s ill will or conflict of interest. If there was wrongdoing, it had happened before, when Otkritie was allowed to grow too fast via doubtful schemes and under direct sponsorship of the government. For that, the Central Bank should thank the liberal lobby in the government, including [Rusnano chairman Anatoly] Chubais. Maybe it was a case of the Central Bank leaders having no guts to stand up against the pressures coming from the roof [krysha] of Otkritie. Then and now.”

As Yurov claimed in his court filings, Belyaev and Aganbegyan too blame the demise of their bank on negative press leaks. Belyaev said [29]: “The catalyst of this process was the fall of Yugra [Bank], and the active dissemination of various rumours through SMS campaigns and social networking… We see a very strong campaign of information pressure. There is a sense that this doesn’t happen by accident. It seems there have been someone’s orders, I don’t know whose.”

Russian press reports [33] claim the orchestration of the depositors’  [34]run against Otkritie was the doing of Alexei Khotin (right), co- owner with his family of Yugra Bank. It was put into temporary administration by DIA in July, and after investigation of the bank’s books, Tulin gave the order to revoke Yugra’s licence [35] on July 28. Khotin and his father, Yury Khotin, avoid speaking to the press. Their business record was analysed here [36], in June 2016.

[34]run against Otkritie was the doing of Alexei Khotin (right), co- owner with his family of Yugra Bank. It was put into temporary administration by DIA in July, and after investigation of the bank’s books, Tulin gave the order to revoke Yugra’s licence [35] on July 28. Khotin and his father, Yury Khotin, avoid speaking to the press. Their business record was analysed here [36], in June 2016.