[1]

[1]

by John Helmer, Moscow

@bears_with [2]

By Russian oligarch standards, Vladimir Lisin (lead image) – iron-ore and coalminer, steelmaker, land and sea transporter, shipbuilder — is the only honest one.

In the acquisition, enlargement, and protection of his asset holdings over thirty years, he has also managed to defeat the dishonest ones, starting with Oleg Deripaska [3], then Mikhail Prokhorov [4], then Victor Rashnikov [5], not to mention offshore raiders like George Soros and David Reuben of the Trans World Group.

Those who have known Lisin longest, including me, don’t put this down to his factory-floor origins, to his two PhDs and fluent English – Lisin is the best educated of the oligarchs — nor to his alliances with Soviet and Yeltsin-era politicians. “Straight and honest was his character”, says an American metals trader today, who worked with him in the 1990s. “The disputes [with Lisin] were not easy,” says Oleg Korolev, between 1998 and 2018 the governor of Lipetsk region, where Lisin’s main steel production is based, “but they always ended objectively and fairly.”

“[He is] one of the most original stars in the oligarchic firmament,” concludes [6] the latest business media profile published in Moscow a few days ago. “He has never aspired to power, like, for example, [Vladimir] Potanin, but has such an administrative resource that even [Anatoly] Chubais in exile, according to rumours, has been asking [Lisin] to intercede for him with the Kremlin’s decision makers. He hasn’t poked his nose into erstwhile political projects, like [Roman] Abramovich…He has not received any special state awards, unlike his colleague, Hero of Labor of Russia Rashnikov, but no one will deny his powerful personal contribution to the development of NLMK and to the country’s economy. He did not participate in the loans-for-shares schemes or in the semibankirschina [7]. Nevertheless, he has created one of the most advanced, diversified, and effective business empires which his colleagues on the Forbes list can envy.”

And yet, since the start of the Special Military Operation two years ago, Lisin has been stripping the assets of the group in which his shareholding control is about 80% [8]. He has been selling both steelmaking and transportation businesses to independent buyers, not nominees; from them in return he has received between $3.5 billion and $4 billion in cash from the deals.

At the same time, he has preserved the original Novolipetsk Steel Metallurgical Combine (NLMK), the core of his group, plus the coal and iron-ore mines and energy sources which supply NLMK, and enable it to produce cheaper steel than its domestic or foreign competitors.

This is what turf bookmakers call an each-way bet – on steelmaking in the domestic Russian market to support and profit from the Russian victory over the US and NATO in the Ukraine; and on cash banked through the UAE, outside the reach of US and European economic warfighters and sanctioneers, and also the Russian tax man.

Still at risk in this wager are Lisin’s castle and grouse shoot in Perthshire, Scotland; a home in Geneva; a motor yacht he calls Socrates, and a Bombardier airplane. Hedging that risk are his steel plants in Belgium, Denmark, France, Italy, and the US which continue to be so vital for the political survival of the regimes in those states, not to mention their defence industries, that they have secured quota-busting concessions until 2024 or longer, in order to keep importing Lisin’s Russian steel products for their production lines [9].

Lisin’s investment relations and press offices list eight analysts at Russian commercial and state banks who cover steelmaking and NLMK [10]. Every one of them refuses to say what he thinks is Lisin’s war strategy for the group or Moscow stock market pricing of his future inside Russia, and outside.

NLMK SHARE PRICE HISTORY, 2006-2024

[11]

[11]WAR IMPACT ON NLMK SHARE PRICE

[12]

[12]Source: https://markets.ft.com/ [13]

The share price responds to the financial results of the domestic steelmaking and mining divisions of the group. Publication of the details was suspended in February 2022, and this was the last production and trading report, issued for the first six months of 2022 and released on July 25, 2022 [14]. Some releases continue in the Russian press: a week ago, Interfax reported that in the first nine months of 2023 NLMK’s revenue amounted to Rb524.8 billion, cost of sales Rb355.1 billion, and after-tax profit Rb182.1 billion, calculated according to Russian Accounting Standards. These data [15] do not include the results of the Urals region steel plants, the mines or the offshore operations.

This year, the company says [16], $296 million worth of Eurobonds are due to mature, and must either be repaid in sanctioned currency or refinanced; another $1.1 billion in Eurobonds aren’t due until 2026. If Lisin can’t arrange Russian Central Bank permission to repay this year’s debt obligation with dollars converted from his rouble profits, he should be able to refinance it on the credit of his European and American businesses. For European banks to lend, the credit risk would be local, not Russian – unless Lisin decided to cut off his European plants from their Russian steel supplies. That, the European bankers would be telling themselves, would be like cutting off one of his own hands.

In the meantime, over the past several months Lisin has sold his Urals-based long steel plants which produce blooms, billets, wire, rod, rail, reinforcement bar (rebar), and sections, together with his hardware distributor, and Vtorchermet, the steel scrap processor which has been feeding the electric arc furnaces for longs production. There are no confirmed transaction details, but the cash proceeds for Lisin from selling these assets are reported [17] to have been between $550 million and $600 million. Industry reports have been saying Lisin has been trying to sell his long steel units since 2020 because they have represented the slowest to grow, least profitable to operate parts of his group.

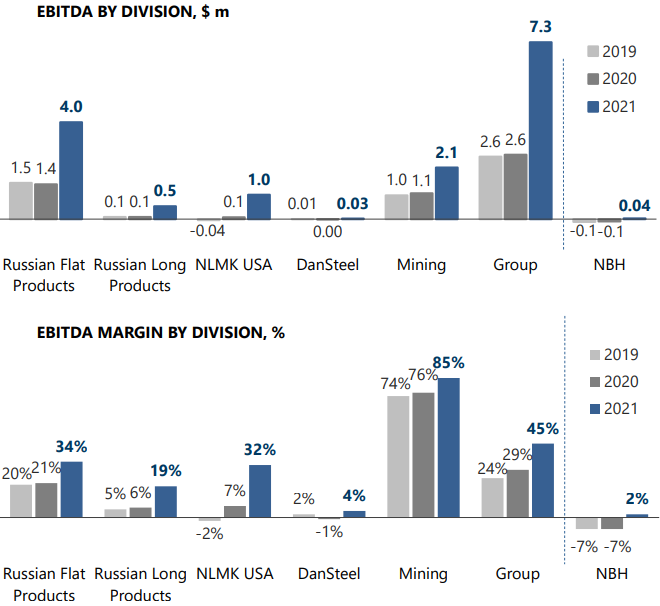

This is confirmed by the company’s last pre-war presentation, issued on February 3, 2022, although there is not a word in that report to acknowledge the intention to divest which was already in discussion [16] in the Moscow market.

NLMK EARNINGS AND PROFITABILITY BY DIVISION, 2021

[18]

[18]Source: https://nlmk.com/ [16] -- page 26. NBH stands for NLMK’s Belgian steelmills at La Louvière and Clabecq.

In November 2023 it was also announced that Lisin had sold the First Freight Company, aka Freight One, to the Babaev brothers for a price which has been reported between Rb200 billion [19] ($2.2 billion) and Rb270 billion [20] ($3 billion). In 2011, Lisin had won the privatization auction for Freight One, paying the state Russian Railways Rb126 billion (then $4.6 billion). Freight One is a railroad carrier.

Without it, Lisin’s transportation holding called United Cargo Logistics Holding Company (UCLH), registered in Amsterdam, has continued to keep shipping, shipbuilding, port logistics, and stevedoring companies based in Russia. These include terminals at St Petersburg port and Ust-Luga in the northwest, the southern ports of Tuapse and Taganrog, and shipyards. At one point in the business history, Lisin had been hoping to arrange an initial public offering of shares in UCLH in London, but this failed to materialize [21]. A month ago, Lisin arranged the sale of the Oka Shipyard in Nizhny Novgorod out of the UCLH group but no transaction value has been disclosed [20]; market estimates put the price tag at between $50 million and $90 million.

A leading analyst of the Russian shipping sector explains that Lisin is exiting railroads because their tariffs are the most heavily state-regulated of the UCLH group, and thus the least likely to meet Lisin’s profitability target. He has let go the Oka shipyard for the same reason, the source believes.

That leaves Lisin still in command of a combination of flat steel fabrication [22], the electrical steel unit VIZ-Stal in Yekaterinburg, iron-ore and coal mining, and transport businesses.

[23]

[23]Click on source [24] to identify the units of the group in their country locations.

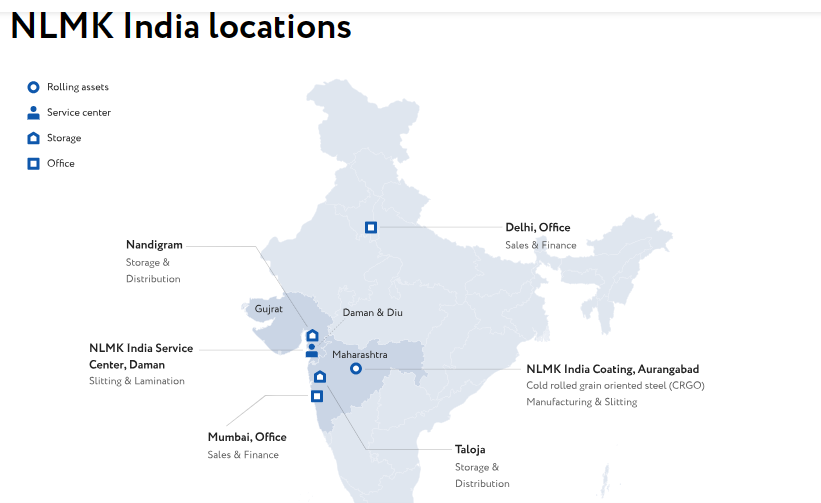

[25]

[25]The expansion of NLMK’s electrical steel businesses to India can be followed here [26]. Output capacity for the electrical steel plant now open in Maharashtra state is 64,000 tonnes and represents more than a fifth of the Indian market for the product which is used in motors, generators and transformers [27]. The group’s electrical steel producer, VIZ-Stal in Yekaterinburg, has been selling [28] about 300,000 tonnes per year of grain-oriented (GO) and 300,000 tonnes of non-grain oriented (NGO) products, which represent almost the entire Russian market.

There has been no comment in the Russian industry press or in NLMK releases on the fate of VIZ-Stal after the other NLMK Urals plants have changed hands. More broadly, NLMK has been saying nothing about divestment in Russia or expansion in India – and that was for several years before the war. The obvious impacts on Russian steelmaking of war industry mobilization and the reconstruction of the Donbass are secret.

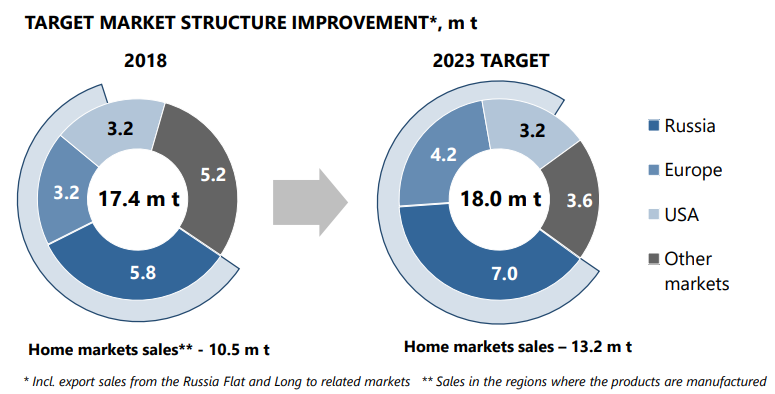

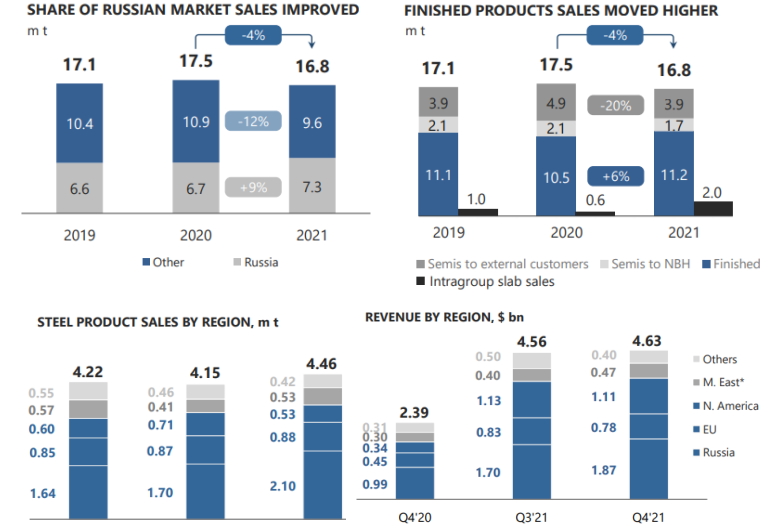

In 2019, the group announced [29] it was launching NLMK’s steel strategy to the year 2023. This emphasized growth of earnings from lowering costs of energy and raw materials, improving efficiencies in steel production, reducing debt, and increasing free cash. Most of the earnings growth, the company report said, would occur in Russia (60%), less in Europe and the US. For an overall increase in steel sales across the group, NLMK claimed that growth in the domestic Russian market would be 22%, resulting in a growth of the Russian proportion of total group sales from 33% in 2018 to 39% in 2022. European sales were to grow by 32%; sales in the US were projected to remain flat. Not a word was said [29] about selling off the long steel and scrap businesses.

[30]

[30]Source: NLMK’s five-year plan for 2018-2022 [29].

In the last open presentation to investors and shareholders by NLMK, which was issued [16] on February 3, 2022, the company said almost nothing about its future strategy, except to note that its Russian flat steel and coal and iron-ore mining divisions were contributing much more to the group’s earnings and profitability than its long steel division.

The presentation also reveals that NLMK’s Russian operations were performing far better in output, sales and profit than the European and American steel plants.

[31]

[31]Source: https://nlmk.com/ [16] -- pages 23, 25

For the time being, Lisin is not sanctioned by the US or by the European Union and UK, despite active efforts [32] by US and Ukrainian state propaganda organs [33], and by the Baltic states to force [34] the EU to act. Lisin was, however, ousted from his presidency of the International Shooting Sport Federation (ISSF) in December 2022 [35]; the result was that he took [36] his Olympic prize sponsorships and money with him.

The EU has announced a sharp cutback in Russian (and Belarus) steel imports since March 2022. In theory, this was “to further isolate Russia and drain the resources it uses to finance this barbaric war,” according [37]to the German European Commission President, Ursula von der Leyen. In practice, she was impotent as the steel industries of Denmark, Belgium, France, and Italy, where Lisin owns and operates steelmills, have forced lengthy extensions of time until 2028 [38]. Without NLMK’s steel, there can be no NATO rearmament in those states, especially shipbuilding, tank and armoured vehicle construction, like the French Caesars and AMXs, which the Russian army is defeating in the Ukraine.

No Russian source in the steel business believes Lisin’s decision to sell assets has been forced domestically by either a political or business rival. No source who knows will say what and where he is banking the proceeds. Not a single Moscow analyst whose job it is to monitor Lisin’s NLMK group dares to guess, even off the record, what Lisin’s divestment strategy means for the future. Lisin himself isn’t saying. He isn’t paying journalists and their editors to float balloons, drop hints, or attack his rivals with kompromat.

Lisin’s first statement on the Ukraine war, issued on March 7, 2022, was a letter to the steelworkers of his group: “I would like to begin by expressing my deepest compassion to all the victims of the armed conflict in Ukraine, the families and relatives of those who died,” Lisin wrote [39]. “Lost lives are always a huge tragedy that is impossible to justify. I am convinced that peaceful diplomatic conflict resolution is always preferable to the use of force.”

A month later, on April 5, 2022, Lisin said significantly more in an interview with Kommersant. His intended audience this time was the Kremlin. In retrospect, he appears to have been under-estimating how long the war would last, and to have failed to understand that the US and NATO intended the war against Russia.

[40]

[40]President Putin meeting Lisin for a discussion of NLMK on June 22, 2007 [41]. This is the last one-on-one meeting the two have had, according to the Kremlin archive. However, Lisin has been a regular attender and speaker at Putin’s annual meetings with the Russian Union of Industrialists and Entrepreneurs (RUIE in English, RSPP in Russian [42]) and the Kremlin’s Christmas dinner for the oligarchs. In March 2023 Lisin resigned from the RSPP board [43].

Lisin told Kommersant he was opposed to all measures to put the Russian economy on a war footing. “The situation is more than another economic crisis…Supply chains formed over the years are being destroyed, logistics, payment and financial infrastructure are failing. And against this background, the rules of the game change daily, new restrictions appear. In conditions of high uncertainty, we are changing business processes and trying to fulfill our social obligations…Obviously, many measures are being taken rapidly now, their consequences have not been fully analyzed. It seems to me that speed should give way to precision, adequacy, so that the consequences do not turn out to be devastating for the domestic industry, where millions of people are employed.”

Lisin said nothing critical of the sanctions regime, nor anything at all about the long-term security of Russia’s strategic industries, like steelmaking, under US and NATO economic warfare. By contrast, he was critical of Russian government measures for converting Russia’s economy to self-sufficiency, reoriented markets, and de-dollarisation in trade payments.

“It is difficult to imagine what can convince our customers to switch to settlements in roubles and bear currency risks. Logistical problems have already complicated the delivery of products to the consumer. Switching to payments in rubles will simply throw us out of international markets… I see that, for example, ministries are working on issues of supporting infrastructure projects for the development of domestic consumption, the possibility of a preferential mortgage stimulating construction is being discussed, a moratorium on inspections has been introduced. These are useful, but local initiatives…”

“Don’t try to administer everything down to the nuts and bolts – this only harms business,” Lisin said, declaring this to be an “ill-considered idea.” Although this was “the first time NLMK’s main shareholder Vladimir Lisin publicly shares his opinion on the issues related to the Ukraine crisis and the sanctions imposed on Russia,” the only war he acknowledged he and his businesses were facing was with Moscow where the enemies were state regulation, price fixing, rail access quotas, and foreign currency controls. Lisin was so confident of this, he arranged for his interview to be published in English on the NLMK website [44].

“The current situation is more than just another economic crisis that we have faced before. It requires a much more serious approach and high-quality, balanced decisions…We see, for example, that in recent weeks suppliers of materials, equipment, and components have raised prices significantly. In such conditions, the freezing of prices for final products will lead to the fact that its production will simply stop due to losses.”

“We can already see how the cost of transportation is growing. As soon as the proposal of JSC Russian Railways appeared to increase the tariff for export transportation of metals by 30%, a new proposal has already been announced — to index tariffs quarterly by the amount of inflation and exchange rate difference. In general, the idea of indexing transport tariffs while fixing prices for everything else will lead to the fact that only metal and fertilizers can be transported by rail, the rest only by trucks. It will be a complete collapse for agriculture in general.”

[45]

[45]Source: https://www.kommersant.ru/ [46]

“Private companies supported the domestic engineering industry and bought new [rail] wagons worth 2 trillion roubles, now more than 70% of the total fleet. Now it is proposed to transfer them to the management of Russian Railways. What for? Apparently, the times of chronic shortage of wagons have been forgotten. At the same time, Russian Railways already has the largest rolling stock operator in the country, FGC [Federal Freight Company]. It can be used to solve all government tasks.”

Lisin revealed in the interview that he thinks he and his companies are “caught in the crossfire between regulatory initiatives from the [Russian] authorities on the one hand, and the constant threat of Western sanctions, including personal ones, on the other.”

“It is difficult to reduce my attitude to the topic of personal sanctions to any one simple emotion or thought… On the one hand…they directly or indirectly affect a lot of people who now have to try to work and live in a new reality. It is clear…that this need cannot but cause alarm, because sanctions are capable of destroying everything that has been created over the years…this is not so much about personal well-being, as about a cascade of negative consequences for tens of thousands of employees and tens, maybe hundreds of thousands more employees of various partner companies and customers.”

“On the other hand, and this is an important part of my attitude, it is a shame to complain about personal problems in a humanitarian disaster situation. Sanctions may seem unfair as much as you like, with elements of collective responsibility, if you want, but people will try to stop the death of people and the destruction of cities by any available means…in the current conditions, economic measures can be treated as an alternative to military action, which gives the situation a chance not to escalate into a global conflict that can turn into a disaster for everyone.”

Almost two years have now elapsed since Lisin’s public statement. In the interval what he has done is to have converted into cash the least profitable of his steel plants and those of his transportation businesses most subject to state price, route and cargo quota control. He has withdrawn the profit accounting centre he used to run in Cyprus, but he has not returned to Russia. Instead, the group has re-registered in the United Arab Emirates. The Fletcher front in Cyprus [47], which has been targeted [48] by Kiev, has turned into Serenity II Holdings and Nebula II Holdings, registered in Abu Dhabi by June of 2023 [49].

What remains in the Lisin group is steel production most likely to benefit from military production mobilization and post-war reconstruction, the likes of which Russia has not seen since World War II, plus the geographical reorientation of trade which has never happened before. For an oligarch, these are strategic opportunities, and also future risks, which have never been calculated before.

Lisin’s calculation is a two-way wager. If the Forbes Russia estimate [50] of his wealth as of this month is on the high side at $25 billion, and the cash proceeds of his asset sell-off is on the low side at $4 billion, Lisin is betting less than 20% of his position in an offshore haven in case both the military and economic wars go badly for Russia.

As for Lisin’s personal exposure to sanctions and the vulnerability of his steelmills in Europe and the US, there is a kicker which Lisin doesn’t have to announce. This is because he has already demonstrated inside Russia what he will do, and what he did when he was sanctioned by the International Shooting Sport Federation. This is to cancel his business, pick up his money, and walk away.

According to domestic press reporting, after the new Lipetsk region governor, Igor Artamonov (right), took power in September 2019, there were several political and personal clashes with Lisin. Lisin’s reaction was that in 2021 he cancelled his tax residence in Lipetsk and re-registered in the Moscow region. An estimated billion roubles in personal income tax which Lisin had been paying annually to the Lipetsk administration was gone [52].

Last month, a Lipetsk region deputy and television journalist explained [52] in print: “A handshake means a lot to him [Lisin]. The political events of 2021 showed that some people in Lipetsk do not take much account of NLMK’s position and with him personally. I do not exclude that the change of residence permit, followed by the removal from the tax register of citizen Lisin, was a reaction to the actions or words carelessly tossed by the head of the region [Artamonov]. He [Lisin] is very emotional here. So you see, Vladimir Sergeyevich is not alien to anything human.”