[1]

[1]

by John Helmer, Moscow

@bears_with [2]

US Congressmen have adopted [3] the unusual procedure of approving by voice vote – no tally — a ban on imports of Russian uranium to fuel US nuclear reactors. Hidden from the record are the Congressmen who insisted on including a loophole, Section 2, allowing a waiver of the law until January 2028 to keep the lightbulbs in their districts from blacking out.

The Pentagon also insisted on a loophole, Section 3A, allowing a waiver so that the manufacture of depleted uranium munitions for the Israeli [4], Ukrainian, and US armies, as well as nuclear warheads for tactical and strategic missiles aimed at Russia, will not be cut off from their Russian import source.

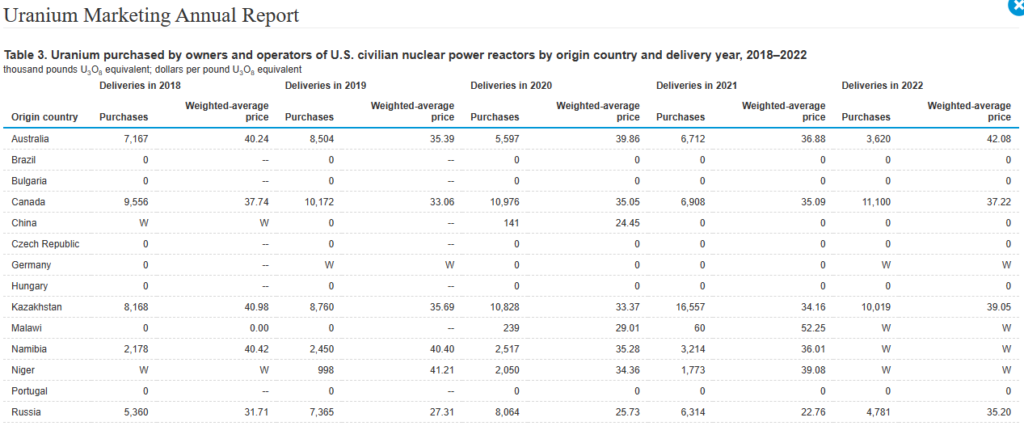

One-fifth of the US electricity supply is dependent on the special enrichment quality of imported Russian uranium, although the US Energy Information Administration (EIA) is reporting that as of June 2023, just 12% of imported enriched uranium fuel in total comes from Russia; 25% from Kazakhstan, where Russian companies hold a substantial stake [5]; and 27% from Canada [6].

In the first six months of last year, following the start of the Special Military Operation, US importers more than doubled their purchases of enriched uranium fuel from Rosatom, the state corporation which has not been sanctioned by the US, despite [7] appeals from Kiev and George Soros. Almost $700 million was paid [8] for the imports.

In 2022 the price of the Russian imports was $22.76 per pound. This was the lowest priced import of all US import sources — 62% below the Australian uranium delivery price; 54% below the Canadian price; 33% below the Kazakh price. Rosatom’s delivery quote to the US has been falling steadily; it’s down 39% since 2018 [9].

[10]

[10]Click on source for enlarged view: https://www.eia.gov/ [9]

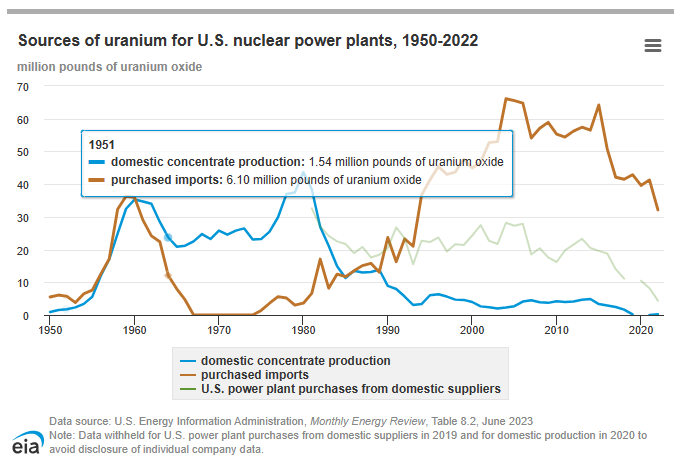

The high quality, low cost, and contract reliability of Russian and Kazakh uranium fuel have driven domestic American uranium processors out of the market since 1980, when the US-produced fuel amounted to almost 44 million pounds, and the imports just 4 million pounds. In 2022 the business had reversed. Imports totalled 32 million pounds; domestic supplies just 4 million pounds. [6]

[11]

[11]Source: https://www.eia.gov [12]

Reviving the fortunes of the domestic industry is one of the reasons for the promotion of the new Russia trade sanction by congressmen and senators from nuclear industry states.

“U.S. civilian nuclear reactor operators,” declared [13]the Breakthrough Institute in a press release on Monday, “providing a fifth of the nation’s electricity, are dependent on an international nuclear fuel supply chain. U.S. reactor developers will also struggle to market their products, both domestically and internationally, without stable fuel availability. Russia has a large influence on the global nuclear fuel supply chain—accounting for 35% of the world’s uranium enrichment capacity—and is the only country producing high-assay low-enriched uranium (HALEU) for commercial use that many advanced nuclear reactors require.” The Breakthrough Institute is financed [14] by Bill Gates [15] and the Pritzker family, well-known backers of Hillary Clinton.

“Without action, Russia will continue its hold on the global uranium market to the detriment of U.S. allies and partners,” declared the House sponsor of the new law, House Energy and Commerce Committee Chair Cathy McMorris Rodgers (Republican, Washington state). “One of the most urgent security threats America faces right now is our dangerous reliance on Russia’s supply of nuclear fuels for our nuclear fleet. This threat has intensified as a result of the war in Ukraine. American nuclear fuel infrastructure has been stunted by policies that Russia has exploited by flooding the U.S. market with its cheaper fuel. Today, that accounts for more than 20 percent of nuclear fuels for American reactors. Last year alone, our industry paid over $800 million to Russia’s state-owned nuclear energy corporation, Rosatom and its fuel subsidiaries. That number could be even higher this year and these resources are no doubt going towards funding Putin’s war efforts in Ukraine. Further, we’ve seen how Putin has weaponized Europe’s reliance on Russian natural gas. There’s no reason to believe Russia wouldn’t do the same with our nuclear fuel supply, if Putin saw an opportunity. Rosatom has also supported China’s nuclear energy ambitions. The risks of continuing this dependence on Russia for our nuclear fuels are simply too great. [16]”

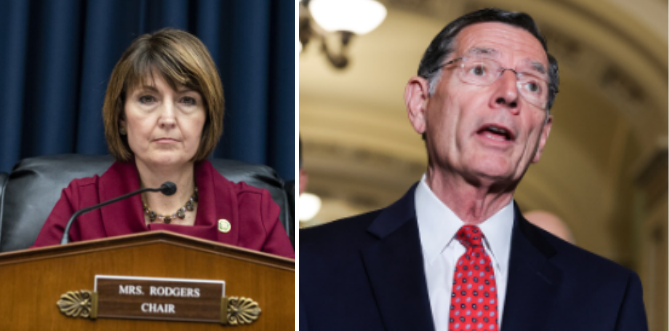

[17]

[17]Left: Congresswoman Rodgers; right, Senator Barrasso. The two leading uranium miners listed [18]on the New YHork Stock Exchange are both Canadian in operation – Cameco and NexGen Energy. Uranium Energy Corporation (UEC) comes third, ahead of Energy Fuels. The main uranium mining sites in the US are in Wyoming, Texas, Nebraska, and Utah.

According [19]to Senator John Barrasso, Republican from Wyoming, “the inclusion of this legislation…is the first step towards taking uranium production out from under the thumb of Vladimir Putin and his corrupt regime. Russian energy has no place in the American marketplace.” Barrasso represents the financial interests of several uranium mining and processing operations in his state, including [20] TerraPower and the Uranium Energy Corporation (UEC) in a coal-to-nuclear conversion project, the first of its kind in the US. Although there is a Senate majority for the bill, it is unlikely to be voted until the new year.

The share price of UEC, which is listed on the New York Stock Exchange, is currently recovering from a 15-year slump [21], and is now worth $2.7 billion in market capitalization. War against Russia is very good for UEC’s shareholders: since the start of the Special Military Operation, UEC’s market cap and share price have almost tripled [21].

Russian analysts are more than sanguine about the uranium import ban. If and when the sanction starts without the waivers, they are forecasting a rise in global uranium fuel prices and increase in Rosatom’s revenues.

Here [22] is the report of this assessment, published yesterday in Vzglyad, the Moscow-based security analysis platform. The text has been translated verbatim without editing; illustrations and URLs have been added.

[23]

[23]Source: https://vz.ru/ [22]

What will the US rejection of Russian nuclear fuel mean?

Giving up Russian nuclear fuel is much harder for the United

States than giving up oil

by Olga Samofalova

The United States plans to ban the import of Russian uranium for twenty years ahead. At the same time, the United States is now completely dependent on imported nuclear fuel. The consequences for the nuclear market from such an embargo may be even more severe than for the global oil market, experts say.

A draft law banning the import of low-enriched uranium of Russian origin until 2040 has been approved by the House of Representatives of the US Congress, news agencies report. The bill proposes to ban the purchase of uranium that was produced in Russia or by one of the enterprises registered in Russia.

However, the main point of the bill is different: it proposes to prescribe the possibility to lift the ban if there are no other sources of supply or “for the sake of the national interests of the United States.” This can be done jointly by the US Secretary of Energy in coordination with the State Department and the Secretary of Commerce. Moreover, the US Department of Energy will be able to issue permits for the import of Russian uranium in the amounts permitted by current American legislation.

If this law is passed, the [United] States themselves will suffer the most. “Russia still remains a critically important supplier of nuclear fuel to the United States and the global market. If the United States intervenes so abruptly in the nuclear sector, the consequences will be more severe and complex than the consequences for the global oil market after the imposition of oil sanctions. The nuclear market is more focused on long-term contracts than the oil market. In addition, the nuclear sector has a higher concentration, and this is a problem.”

“Russia controls 11% to 12% of the world’s production capacity in the global oil market, and Russia occupies more than 40% of the market for uranium enrichment services. For the nuclear fuel market, this can be a game with completely unpredictable consequences, primarily for the American market itself,” said Sergei Kondratiev (right), deputy head of the Economic Department of the Institute of Energy and Finance. [26]

Once upon a time, the United States was a leader in nuclear energy and, along with the Soviet Union, controlled most of the sphere of uranium enrichment and fabrication of nuclear fuel. But the situation has been different for a long time.

According to the World Nuclear Association, 17 thousand tons of uranium are required annually for the operation of American nuclear reactors, but uranium production in the States themselves last year amounted to less than 100 tons. Only one uranium enrichment plant in New Mexico remains operational in the United States, and it belongs to the European consortium Urenco (Great Britain, Germany, The Netherlands). All raw materials are imported. The United States is forced to import fuel, in particular from Urenco, which supplies fuel to the United States from European plants, and from Rosatom.

According to the expert, an attempt to limit such a major player in the nuclear market as Russia is, will inevitably lead to an increase in fuel costs and prices around the world, and it will be American consumers who will have to pay the most.

“We can see a situation similar to the situation on the oil market, when Russian oil began to be sold at a discount after the imposition of sanctions. The new consumer will sign contracts for the supply of Russian nuclear fuel at a discount. But since prices in the world will rise very significantly, even with a discount, our fuel will cost higher than the prices that are now. In fact, the American consumer, who will pay the highest price, will pay for these sanctions,” Kondratiev argues.

URANIUM FUEL PRICE TAKEOFF AFTER THE WAR BEGAN

[27]

[27]Uranium fuel delivery price, USD per pound (lb), source: https://tradingeconomics.com [28]

“Uranium prices in the US surged past $82 per pound for the first time since January 2008, soaring past pre-Fukushima disaster levels as high demand was met with increasing supply risks. The US lower house passed a bill to ban the import of nuclear fuel from Russia, the world’s top producer of enriched uranium and the biggest US supplier, magnifying supply risks following European utility's partial shunning of Russian nuclear fuel. The developments added to supply risks from elsewhere, including uncertainty from Niger’s military coup and lower output from Canada. In the meantime, fossil fuel volatility and de-carbonization goals drove countries to extend the life of existing generators and increase investments in new plants, led by China's pledge to build another 32 nuclear reactors by the end of the decade. The optimistic demand outlook aligned with lower nuclear fuel inventories for utilities, resulting in large-scale near-term purchasing activity.”

At the same time, unlike the oil market, the nuclear market is unlikely to have intermediaries – traders who will resell Russian nuclear fuel to American companies. “This is another market where it is difficult to carry out trading activities. Given the scale of the American market, they will rush all over the market and try to find other suppliers. For the moment this looks like an almost impossible task. This is because long-term contracts for fuel supplies are valid for decades. It seems to me that it will be very difficult to find consumers in the market who will be ready to allocate their volumes to the Americans. The current capacity structure does not imply the possibility of choice. It was possible in the early 1990s, but a lot has changed since then. There is no such surplus of capacities in the Western world now,” the expert of the Institute of Energy and Finance believes.

It is difficult for the United States to count even on its European friends. “Right now France does not fully supply itself and depends on supplies from Russia. If French companies start working on the American market, it will mean even greater dependence of French consumers on Russia. I am not sure that the French government will go for it, or that the United States will be ready for such a scenario,” says Kondratiev.

In Asian countries, in India for example, Rosatom is also active. China has a lot of its own facilities, but it will be very difficult for the United States to negotiate with Beijing. “I do not believe that such a global redistribution would happen for everyone to agree to supply uranium to the United States to replace supplies from Russia, and for all of this to go relatively quickly and according to plan,” the industry expert believes.

Therefore, these potential sanctions are more like an element of political bargaining within the United States between different political forces. “The generating companies that operate nuclear power plants in the United States usually support the Republicans. The Democratic Party is more likely to receive support from the renewable energy companies. Probably the Democrats are trying to play the Russian card here, which they have been doing often in recent years, and imposing sanctions against the Russian nuclear industry. Their political opponents, in order not to be accused of sympathizing with Russia, are often forced to support the strangest anti-Russian measures. Therefore, this could potentially lead to such sanctions being adopted,” Kondratiev does not rule out.

However, the most likely scenario is that a decision will be made at the congressional level for political reasons, but then the US administration will act rationally and freeze or suspend these restrictions, the expert adds. This scenario has played out more than once.

Nevertheless, the expert does not rule out that something will go wrong in the US government — and sanctions will really begin to take effect. But in this case, there is a high probability that after some time – conditionally a year – they will be suspended.

The peculiarity of the nuclear industry is that there are large reserves of nuclear fuel for several months or even years ahead. And the fuel itself is poured into the reactors every few months. Therefore, the imposition of sanctions will not lead to the rapid closure of nuclear power plants in the United States: they will continue to purchase stored fuel, simply at a higher price. And when the reserves run out, the US authorities will be able to lift the ban on the import of Russian fuel. It is no coincidence that this possibility is clearly spelled out in the bill.”