By John Helmer in Moscow

In case you haven’t realized, Russia is now running third in the league of world grain exporters, trailing the US and Canada, but ahead of Australia. (China remains the world’s largest producer of wheat, but eats it all up.)

With the aim of competing against government wheat marketing companies like the Canada Wheat Board and the now privatized Australian Wheat Board, and hoping to take 9% of the global grain trade for itself, Russia’s state-owned United Grain Company (OZK) has signed memoranda of intention for new grain loading terminals at seven ports, including two in Estonia. Established just over a year ago in Moscow by consolidating the state stakes in 31 domestic grain companies, OZK is also aiming to become the dominant Russian grain exporter, beating out the commercial traders with a target 40% of export volumes within five years.

A spokesman for OZK told Fairplay the company is currently in negotiation with Ust-Luga and Kaliningrad on the Baltic, Vanino and Vladivostok on the Sea of Japan, and Taman on the Sea of Azov. The two Estonian ports being considered are Sillamae and Muga. He added that “the agreements with two Estonian ports don’t mean that OZK is trying to exclude Russian variants. It only means that [OZK] has signed agreements with those ports which have wanted those agreements.”

The spokesman said more ports are being considered, but there will be no specific capacity or cost figures until detailed terminal contracts are signed.

The plans reflect OZK’s projection that it will quadruple export grain volume from 4 million tonnes in the 2009 season to 16 million tonnes by 2015. Of that, it is planned that 11.5 million tonnes will be shipped from the Azov and Black Sea ports; 4 million tonnes from the farastern ports; and 500,000 tonnes from the Baltic.

A source at the Russian Grain Union has confirmed the beckoning Asia market for Russian grain. If there were grain terminals on Russia’s eastern coast, the export capacity would run into millions of tonnes per annum, says Alexander Korbut, Vice President of the Union. In the grain season that ended on June 30 last, he said Bangladesh was the biggest Asian buyer from Russia, importing 509,000 tonnes over the year. India bought none this past year, he noted, but in the year before, 1 million tonnes. In 2007-2008, Japan bought 57,400 tonnes; this past year, just 4,800 tonnes. Malaysia is another potentially large importer of Russian wheat; this past season, it imported 10,000 tonnes. Korbut explained the dramatic fall-off in the past season’s exports to India and Japan as the result of falling wheat prices, and for Russia, rising shipment costs, making exports unprofitable. “Earlier there was a deficit of grain, now it’s rather cheap”, Korbut said.

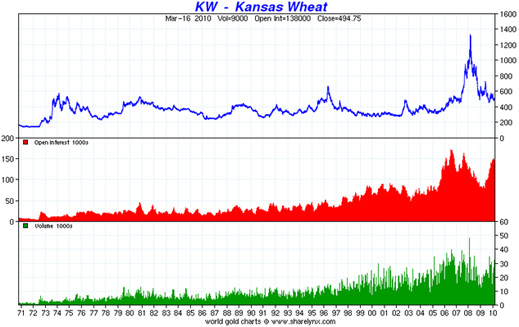

But if grain keeps falling from the 2007-2009 peak, towards the 30-year average illustrated in the chart, then either OZK’s sales targets are unlikely to be met; or else OZK will have to underprice the Americans and Australians, to take market share away from them. Building port terminals closer to the growing consumption markets than Canada’s or Australia’s ports is an obvious move.

But Alexei Bezborodov, a leading maritime analyst in Moscow, calls the OZK new terminal project a “fantasy”, because it fails to take account of the rapidly accumulating global glut of grain supplies and grain stocks. These, Bezborodov says, are bound to hold down prices, and limit the availability of the $3.4 billion in investment finance OZK says it requires to build the new shipping outlets.

Leave a Reply