By John Helmer, Moscow

If Yandex, Russia’s leading search engine and internet portal, tells potential share buyers and investors that it is at risk of a hostile takeover by a man like Alisher Usmanov, who owns a stake in the competing Mail.ru portal, then the charge is a serious one. And if to that, Yandex adds the warning that the president of the country may be behind a scheme to consolidate competing public companies like Yandex into a national search engine, then the initial public offering (IPO), launched last week on the US NASDAQ exchange, is a unique test of what otherwise may be called Russian modernization – and the price of betting on it.

On the face of it, Yandex is a complex technology, but a simple business. It is growing fast, driven by the relative under-penetration in Russia of internet usage, and by the revenue value of advertising on the net. First established in 2000, its shareholdings reorganized in Dutch, Cyprus and other safe havens, Yandex is a dominant player in the Russian internet market. In terms of users, the Russian market has been growing at 16% per annum since 2005, and is expected to continue to grow at a rate of at least 8% per annum through 2013. The market is now at 45 million; it will be at least 60 million in three years’time. The Russian advertising market is growing even faster than the global benchmarks – at about 23% for the next three years. Offline advertising expenditure has been growing at 10% pa since 2005; online advertising has been growing at 53% pa in the same interval.

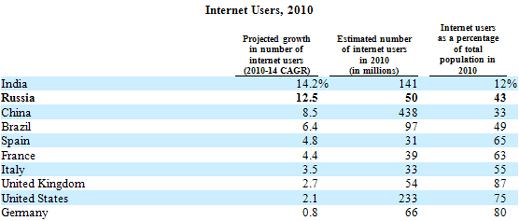

Noting the country comparative growth rates reported in column 1, and the percentage of internet users in column 3, here is how Russia measures up in the internet world:

Source: Russia: FOM, March 2011; all other countries, Euromonitor International, December 2010. FOM measures internet penetration as the number of internet users aged 18 and older as a percentage of the total population aged 18 and older. Euromonitor International defines internet users as those using the internet from any device (including mobile phones) in the past 12 months and generally covers users between the age of 15 and 74; in that population, Euromonitor International reports internet penetration in Russia of 33% in 2010.

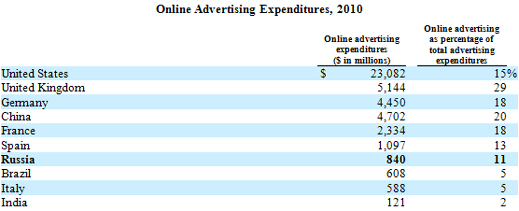

Because advertising is what turns this internet usage into cash, this is how Russia figures in the global process of monetizing the internet:

Source: ZenithOptimedia, April 2011.

It isn’t rocket science to realize that buying Yandex shares is a wager on Russia’s relative acceleration into more internet usage, and concomitantly more money spent on internet advertising.

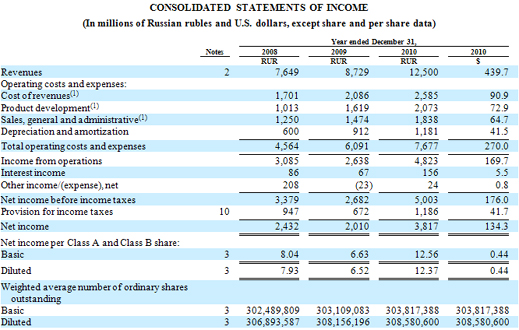

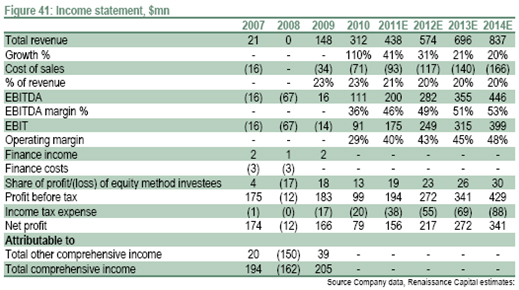

The financial tabulation shows how adept Yandex’s current owners and managers have been at turning their advertising revenues into new products garnering more users and more ads, and leaving a hefty bottom-line profit:

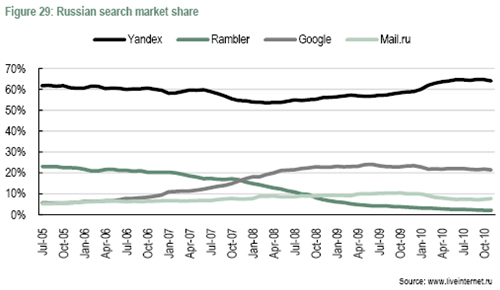

When you are on a good thing as good as this, the old slogan is STICK TO IT. Naturally, in a competitive world, this may not be so easy, even as Yandex points out, it is dominant in Russia with 65% of the internet search market. Its nearest competitor is Google, with 22% market share, with Rambler, Mail.ru, Yahoo and dozens of smaller portals trailing far behind.

“Of the large global internet companies, we consider Google to be our principal competitor. We compete with Google in the market for internet search, text-based advertising and other services. Google launched its Russian-language search engine in 2001, and opened its first office in Russia and introduced Russian-language morphology-based search capabilities in 2006. It conducts extensive online and offline advertising campaigns in Russia. Google offers a competitive search engine, as well as online advertising solutions that compete with our Yandex.Direct service. ..We expect that Google will continue to use its brand recognition and financial and engineering resources to compete aggressively with us. For example, Google has introduced its own popular mobile platform, Android, which may allow it to exert significant influence over the introduction of mobile applications on Android-based devices, and to influence the mobile advertising market. In addition to Google, we also face competition from the Russian and international websites of Microsoft and Yahoo!”

“On the domestic level, our principal competitor is Mail.ru. We compete with Mail.ru in the market for text-based advertising, display advertising and other services. Mail.ru offers a wide range of internet services, including the most popular Russian web mail service, and many other services that are comparable to ours, including some services that are more widely used than ours. We also compete with Russian online advertising networks, such as Begun, which direct advertising to a number of popular Russian websites.

This looks like a conventional competitive market. So what are the particular Russian risks Yandex says it is facing?

There is, first of all, the trouble with Dmitry Medvedev, if he is re-elected, and the trouble with him if he isn’t. According to the prospectus – written apparently by the chief underwriters Morgan Stanley,. Deutsche Bank and Goldman Sachs – “the next presidential election in Russia is scheduled for March 2012 and we anticipate that there may be a degree of uncertainty regarding political, regulatory, administrative and commercial developments until that time. The effects of changes in government policy, if any, cannot be predicted, but could harm our business.”

That is boilerplate. But this statement from Yandex and its bankers is stunning: “representatives of the Russian government, including the president, have publicly stated as recently as January 2011 that the development of a “national” search engine is a government priority. Such a government-owned or -controlled search engine, if launched, could create additional competition for our search service, and could benefit from favorable governmental subsidies and other benefits and preferences not available to us.” Note that president goes unnamed.

Then there is the risk of trouble Medvedev used to say he would use all his Kremlin powers to stop – hostile asset raids, using corruption of the courts and administrative resources. Again, in Yandex’s own words, “well-funded, well-connected financial groups and so-called “oligarchs” have, from time to time, sought to obtain operational control and/or controlling or minority interests in attractive businesses in Russia by means that have been perceived as relying on economic or political influence or government connections. We may be subject to such efforts in the future and, depending on the political influence of the parties involved, our ability to thwart such efforts may be limited.”

Moscow bank analysts following Yandex and other listed media companies see nothing remarkable in this disclosure. According to Uralsib Bank’s Konstantin Belov, “the information Yandex published is of general character. NASDAQ’s rule is that all possible risks should be indicated, so Yandex mentioned the oligarch threat, too. I don’t think it should be attributed to Usmanov or anybody else. Yandex itself doesn’t list any such names.” Vladimir Kuznetsov of Unicredit concurs: “Yandex had to show all the risks they run, including those barely possible. There seems to be no real threat to Yandex. Moreover, the state holds the golden share, and that’s additional protection for the company.”

Yandex does not respond to questions officially on this point, but a source close to the company says there remains the threat of a state takeover orchestrated by an oligarch. As with the omission of Medvedev’s name (Putin’s too) from the 220 pages of text and financial tables, no oligarch names appear. However, the source idfentified Alisher Usmanov, owner of 29% of rival Mail.ru, as the oligarch whom Yandex is most concerned about. “Sberbank has the right to veto the sale of 25% shares of Yandex to a single buyer. The right has never been used, because there haven’t been such transactions yet. Yandex stated a number of risks, including those unlikely, and yes, a hostile takeover is one of them. Alisher Usmanov, a shareholder of Mail.ru, is a [risk]. If you have business, you should be careful with such people.”

According to Moscow reports, three years ago, before the crash, Usmanov tried to buy a 10% stake in Yandex. The control shareholders of Yandex – Andrei Volozh with 20% of the voting shares, Baring Vostok Capital Partners, with 24%, Charles Ryan with 8%, and Ilya Segalovich with 4% — refused to agree.

To prevent another takeover from being attempted, Volozh and his partners devised a complex scheme of layered offshore shareholdings not easily attacked or acquired; invited the state savings bank Sberbank to hold a golden share and veto of any bidder seeking 25% or more of the shares; and put the Yeltsin-era influence-peddler Alexander Voloshin, on the board. The prospectus is forthright about their intention: “ In addition to the rights of our board and of the priority shareholder to approve the accumulation of stakes of 25% or more, as described above, our multiple class share structure may discourage others from initiating any potential merger, takeover or other change-of-control transaction that our public shareholders may view as beneficial. Our articles of association also contain additional provisions that may have the effect of making a takeover of our company more difficult or less attractive.”

The Sberbank golden share, transferred for one Euro in September of 2009, is an insurance premium against a raider making an alliance with some of Yandex’s shareholders to capture the stakes of the others. Voloshin has been hired to keep his ear to the ground in case higher officials are motivated by such a scheme.

But Yandex acknowledges that if the Kremlin decides in favour of a takeover, especially of a domestic one, the state bank is likely to go along, and the golden share will disappear. “As the holder of our priority share, Sberbank has the right to approve the accumulation by a party, group of related parties or parties acting in concert, of the legal or beneficial ownership of shares representing 25% or more, in number or by voting power, of our outstanding Class A and Class B shares (taken together), if our board of directors has otherwise approved such accumulation of shares. In addition, any decision by our board of directors to sell, transfer or otherwise dispose of, directly and indirectly, all or substantially all of our assets to one or more third parties in any transaction or series of related transactions, including the sale of our principal Russian operating subsidiary, is subject to the prior approval of the holder of our priority share. The priority share does not carry any rights to control the management or operations of our company, and its economic rights are limited to its pro rata entitlement to dividends and other distributions. Our articles of association provide that the priority share may only be held by a party that is specifically nominated by our board of directors for this purpose. The rights of the priority share would terminate if any law is adopted or amended in Russia that restricts the ownership by non-Russian parties of internet businesses in Russia.”

Yandex’s prospectus says it is aiming at a maximum share sale of $1 billion, and it remains unclear at this point what proportion of the existing shares will be sold. Press reports and market speculation suggest between 10% and 20% will be put on the market, and the reported valuations of the company range from $6 billion to $9 billion. Details of the size of the sell-off by the control shareholders are not disclosed yet in the US documents.

The Yandex launch has cast a shadow over Mail.ru, whose share price has been falling steadily since the first-flush enthusiasm surrounding its IPO in London last November evaporated in January of this year.

Mail.ru share price chart:

It is unclear at the moment whether there is a big difference in market perception of Mail.ru and Yandex. Anastasia Demidova, the media analyst for Renaissance Capital (RenCap), reported in January that her forecast of Mail.ru’s financial prospects looked like this:

Comparing their 2010 results, it is clear Yandex is the bigger and better of the two.

It is also plain that since January, Mail.ru’s financial prospects and share price have been dwindling. Instead of Rencap’s target share price of $43, the current share price is $31. Market capitalization has fallen from $8.1 billion in January to $6.2 billion today. The RenCap report of January acknowledged that compared to its Chinese peer Tencent, Mail.ru was over-valued by up to 25%. Since then the market has moved to cut Mail.ru’s absolute and relative valuations. Tencent, despite seesawing on the Hong Kong Stock Exchange, is currently up 30% in the year to date. Mail.ru is down 14%.

The intriguing question which the NASDAQ market, which rarely sees a Russian stock issue, will now decide is whether Yandex is suffering from the same Russian risks and uncertainties, and should be marked down. Not according to Demidova of RenCap: “The decrease of the Mail.ru share price is likely to be connected with the fact that the top managers of the company sold part of their shares. The market understood this move as a signal that the shares wouldn’t bring much profit. However, the top managers partly sold their shares because they needed money to invest in some different internet assets.” In the Yandex prospectus, only one of the control shareholders, Charles Ryan, appears to be cashing out (in part), while the company is pledging to re-invest most of the IPO proceeds “for general corporate purposes, including investments in technology infrastructure, particularly new servers and data centers. We may also use a portion of the net proceeds for the acquisition of, or investments in, technologies, teams or businesses that complement our business, although we have no present commitments or agreements to enter into any acquisitions or make any such investments…We will not receive any of the proceeds from the sale of Class A shares by the selling shareholders.”

Yandex does not reveal in its prospectus how much money will be realized by the sale of these Class A shares. But cashing out is what this means: “We are conducting this offering in order to provide liquidity for our existing shareholders, to enhance the profile of our company through a public market listing, and to raise funds that will increase our financial flexibility.”

Leave a Reply