By John Helmer, Moscow

President Vladimir Putin’s summons to the oligarchs for dinner on December 18 turned out to be a teddy bears’ picnic. And why not – they got all they came for, and more. The country outside got decidedly less, but for the time being how little is a state secret.

In the authorized version, scribbled by Alisher Usmanov’s (lead image, left rear) reporter, Andrei Kolesnikov of Kommersant, Oleg Deripaska (left, front) was at his seat laughing at a joke he shared with the two on his left — Vladimir Yevtushenkov, the accused embezzler of state oil assets who was released from house arrest earlier in the day; and Suleiman Kerimov, the senator from Dagestan who controls Russia’s largest goldminer and potash producer, Polyus Gold and Uralkali, through a charitable foundation seated on the banks of Lake Lucerrne, Switzerland. The photograph shows wan smiles.

The joke, however, was real. In a regulation released on December 17, the Central Bank of Russia (CBR) ordered “a temporary moratorium on recognition of negative revaluation of securities portfolios of credit institutions and non-bank financial organisations that will decrease market participants’ sensitivity to market risk.” That’s an order to the Russian banking system not to issue margin calls to debtors who have pledged as security for their loans shares which have plummeted in value recently.

In case the meaning of this debt-relief favour wasn’t clear to the Russian banks, the CBR added in its regulation that it will top up with state cash any shortfall on the banks’ books. Here’s the money shot expressed by CBR in such a way as to encompass three different forms of financial benefit: “order to enhance credit risk management, the Bank of Russia intends to take the following measures: to enable credit institutions to refrain from decreasing debt service quality rating irrespective of the assessment of financial standing of a borrower regarding loans restructured due to, inter alia, loan currency change irrespective of the loan maturity (principal amount of debt and/or interests) and the interest rate; — to enable credit institutions to take a decision not to decrease the rating of the borrower’s financial standing for the purpose of loan loss provision accumulation if the financial standing changes due to the impact of restrictive economic and/or political measures imposed by certain foreign states… — to expand the term during which the credit institution is entitled to refrain from increasing the actual provision on loans extended to borrowers whose financial standing and/or debt servicing quality and /or quality of collateral deteriorated due to emergencies from one year to two years.”

The creditworthiness of Yevtushenkov’s and Kerimov’s borrowings has been hit by sharp declines in the market capitalization of their shareholdings. In the year to date market capitalization for Yevtushenkov’s Sistema has dropped 85%; click for the story. For more on Kerimov’s Polyus Gold, read this. Polyus Gold has lost 62% of its value; Uralkali, 56%.

Gennady Timchenko (left), the one oligarch at the table on Friday to have been sanctioned by the US as one of Putin’s “cronies”, also had reason to welcome the bailout as Usmanov (right) calculated the value on his fingers. So too, Leonid Mikhelson, at the same table, who is the control shareholder of Novatek, which has been sanctioned institutionally.

Gennady Timchenko (left), the one oligarch at the table on Friday to have been sanctioned by the US as one of Putin’s “cronies”, also had reason to welcome the bailout as Usmanov (right) calculated the value on his fingers. So too, Leonid Mikhelson, at the same table, who is the control shareholder of Novatek, which has been sanctioned institutionally.

If one can palm off the rise in CBR interest rates which was announced on December 16, one needs less than five fingers to calculate the size of the personal favour since Putin announced it publicly at his national press conference on December 18.

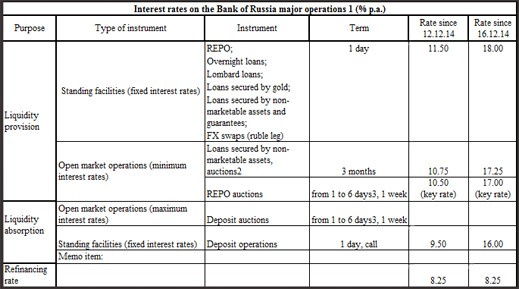

Here is the CBR rate card of December 16, with the key rate boosted to 17%, and effective interest rates for interbank, commercial and individual lending off the chart:

Source: http://www.cbr.ru

Then came Putin’s announcement, confirming the key rate decision, but changing it for the specially favoured: “the key interest rate was raised to maintain macroeconomic stability. This was the right thing to do, since it is by ensuring macroeconomic stability that we will be able to preserve a healthy economy. ..As you know, while raising the key interest rate, the Bank of Russia has maintained borrowing costs for small and medium-sized businesses at 6.5 percent, while all other businesses working on so-called projects, i.e. benefiting from project funding, have a rate of 9 percent. The only problem here is that the Government has yet to propose relevant projects, but this is how it should work.”

“Let me remind you and the entire business community how this mechanism works: if you have a sound, economically viable, profitable and sustainable project, you can present it to a private bank, the lender will have to receive approval from a Government commission, and this commission must confirm that the project is actually efficient and viable, after which the bank receives the necessary funding from the Central Bank at a rate of either 6.5 or 9 percent. This goes for small and medium-sized businesses and project financing. A similar scheme could be created for the mortgage market…”

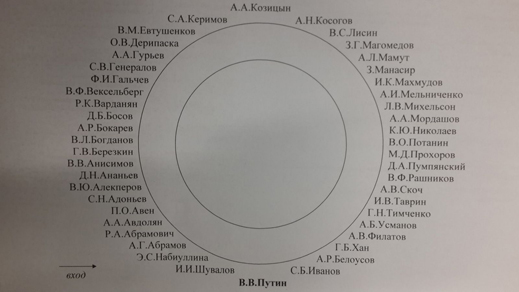

OFFICIAL TABLE SETTING FOR PUTIN’S MEETING WITH THE OLIGARCHS, DECEMBER 19

Source: http://tvrain.ru

The government commission, to which Putin refers, has not been officially gazetted yet, nor reported to the State Duma. It appears to include the two officials seated to Putin’s left at the table – First Deputy Prime Minister Igor Shuvalov and CBR Governor Elvira Nabiullina. From informal remarks by Prime Minister Dmitry Medvedev, Shuvalov appears to have been designated chairman in charge of assigning interest rates to applicants; Nabiullina’s job is to do what she’s told and pay out of CBR reserves on presentation of the approved invoice.

Look carefully at the official table chart, and then the real one: you can see that Nabiullina, officially second on the president’s left beside Shuvalov, was downgraded. When the music stopped and Putin sat down, Nabiullina was relegated to a seat between Pyotr Aven, Vagit Alekperov of LUKoil, and Dmitry Ananiev, one of the owners of Promsvyazbank, which failed to get its shares listed in London in 2012. For that story, read this.

That the special interest rate scheme will not apply to borrowers who can’t shake hands with Shuvalov is indicated by the state savings bank Sberbank’s decision this week to raise its home mortgage rate to 16%. Sberbank and VTB have also announced they are not accepting individual or small-sum loan applications for any price until next February, at the earliest.

Just who will qualify for a Shuvalov bailout is indicated on the list Putin invited to sit with him on Friday, who have never been there before. According to a source at the Russian Union for Industrialists and Entrepreneurs (RUIE), which has arranged these annual reunions in the past, Kerimov is not a member nor a past attender. Neither is Andrei Skoch, a 20% shareholder in Alisher Usmanov’s iron-ore and steelmaking holding, Metalloinvest. His record as an asset raider in the steel business has complicated every attempt Metalloinvest has made to list its shares on the London Stock Exchange (LSE). About Skoch, click.

Nor has Dmitry Bosov (lead image, right of Deripaska) been a Putin favourite before. He cut his teeth, so to speak, in the aluminium wars of the 1990s. Recently, he and his Alltech Group attempted but failed to achieve an initial public offering for Siberian Anthracite. For the Bosov file, read this. For Bosov’s inability to save his investment in Matra Petroleum from delisting from the Alternative Investment Market (AIM) earlier this year, read on.

One oligarch, who won’t be qualifying for the presidential interest rate and the Shuvalov handshake, is Igor Zyuzin (right), the control shareholder of specialty steelmaker and coalminer, Mechel. His company is being pushed into a state bank takeover on terms Zyuzin is proving too weak to resist. For that story, click. A source at RUIE confirms that Zyuzin was on the guest list for the 2013 picnic, but not this time round. He adds that he hopes such details won’t cast a negative shadow on this year’s affair.

One oligarch, who won’t be qualifying for the presidential interest rate and the Shuvalov handshake, is Igor Zyuzin (right), the control shareholder of specialty steelmaker and coalminer, Mechel. His company is being pushed into a state bank takeover on terms Zyuzin is proving too weak to resist. For that story, click. A source at RUIE confirms that Zyuzin was on the guest list for the 2013 picnic, but not this time round. He adds that he hopes such details won’t cast a negative shadow on this year’s affair.

Just how much of a shadow favouritism for the oligarchs casts was demonstrated during the presidential press conference. There reporter Yekaterina Vinokurova asked this question: “I would like to pick up on a topic that my colleagues started, the Fifth Column and enemies of Russia. I would like to ask you whether you consider certain categories of people to be Russia’s enemies, namely heads of state corporations who first ask to borrow trillions from the budget, then purchase iPhones for millions, who dump bonds on the country’s market but never fail to pay themselves bonuses in the millions. The officials, even some in your inner circle, who live in palaces considering that our elderly women are counting kopecks to buy bread.”

Putin’s answer started with a defence of Igor Sechin’s (below) salary at Rosneft, and the claim: “I don’t even know my own salary – they just give it to me, and I put it away in my account.”

Putin also claimed: “There are no officials in my inner circle, and I hope there will never be any. They are all colleagues, but I do not build close relationships with anybody nor do I intend to. There is a certain state function that is almost impossible to perform effectively with a close personal relationship. I realised this, I understood it long ago, and so I seek to maintain a certain distance with everyone, but also be sympathetic and work with the full understanding of the responsibility involved. Of course, these officials could be constantly harassed, but don’t forget that their effective performance is crucial for the fate of millions of our citizens, for their social and economic wellbeing.”

Putin did not respond to the view, widespread in the business media and in the Moscow market, that he and Sechin obliged Nabiullina to fund Rosneft’s Rb625 billion bond issue this month at an especially favourable interest rate. The allegation is also that they then allowed the conversion of the proceeds for Rosneft’s debt instalment repayment in US dollars without regard for the impact the transaction would have on the rouble exchange rate on December 16, Black Tuesday. One commercial banker in Moscow alleges also there was a form of insider trading of the bonds called “front-running”, which is illegal in most markets.

Another source in a position to know says there was no favouritism. Once the Kremlin had decided Rosneft would meet its foreign debts on schedule, without declaring force majeure in relation to the US sanctions, he says the financing of this week’s repayment was a standard, and a legal, operation.

A veteran of the CBR says: “Rosneft are influential insiders, so they would not buy dollars at inflated rates if they know that a massive CBR action is in the pipeline. Just wait a while, and the dollars will cost less, so why rush to the exit – this doesn’t look likely to me. In a situation like this, those who buy foreign currency at its peak — and then blame everyone around — are the speculators who have submitted unlimited buy orders, meaning they are prepared to buy regardless of the exact quotation.”

Another source claims the Rosneft bond interest rate was so attractive “at least one other party bought its way into the buyers’ club. “ An insider close to Rusal claims Deripaska found extra cash the day after Black Tuesday to boost the share price of Rusal with an unusual volume of rouble turnover on the Moscow exchange — at the same time as the hard currency share price was diving on the Hong Kong Stock Exchange.

INTRADAY SHARE PRICE AND VOLUME FOR RUSAL, MOSCOW MARKET (MICEX) DECEMBER 17, 2014

The chart indicates that during Wednesday, December 17, trading on MICEX there were several spikes in the volume of share turnover as Rusal’s share price jumped 4.47%. The Hong Kong trajectory was in the opposite direction, in line with the commodity price of aluminium, dropping by 4.55% on the day. “I’ve been told,” claims the Rusal insider, “that Deripaska knew about Sechin’s operation, so the guys changed some dollars very favourably, which they then invested in their own shares for rouble cash.”

“It is not a crime to play on the currency market,” Putin announced the next day at his press conference. “These market players can be foreigners or various funds, which are present on the Russian market and have been operating quite actively there. Or they can be Russian companies. Overall, as I said at the beginning of this meeting, this is an accepted practice in a market economy. Profiteers always appear when there is a chance to make some money. They don’t show up to steal or to cheat but to make some money in the market by creating favourable conditions, by pushing, for example, as was done in the beginning of this process, like, in this particular case, the Central Bank of Russia was pushed to enter the market and start selling gold and foreign currency reserves in the hope of intervening and supporting the national currency. But the Central Bank stopped, and it was the right thing to do.”

Alexei Kudrin, the former finance minister (right), started by criticizing Putin and Nabiullina last week for their timing on managing the rouble crisis. For Kudrin’s tweets, click. This week Kudrin has announced through the Financial Times that Putin is obliged to choose between capitulation in eastern Ukraine and capitulation on the home front. “As for what the president and government must do now,” Kudrin declared, “the most important factor is the normalisation of Russia’s relations with its business partners, above all in Europe, the US and other countries.” Kudrin claimed to the newspaper that 40% of the rouble depreciation is due to the sanctions war.

Alexei Kudrin, the former finance minister (right), started by criticizing Putin and Nabiullina last week for their timing on managing the rouble crisis. For Kudrin’s tweets, click. This week Kudrin has announced through the Financial Times that Putin is obliged to choose between capitulation in eastern Ukraine and capitulation on the home front. “As for what the president and government must do now,” Kudrin declared, “the most important factor is the normalisation of Russia’s relations with its business partners, above all in Europe, the US and other countries.” Kudrin claimed to the newspaper that 40% of the rouble depreciation is due to the sanctions war.

Kudrin announced his candidacy for prime minister in Washington in September of 2011, before he was fired; Putin said at the time that Kudrin had suffered a breakdown. This time Kudrin’s candidacy to run Russia is sponsored from London, as he places himself at the head of what the Kremlin faction of security officials is calling the Fifth Column. The security faction is led by chief of staff Sergei Ivanov; it is represented in public by the Novorussian commander Igor Strelkov. Read more.

Look back at the table setting — at Friday’s meeting with the oligarchs, Ivanov was in first place on Putin’s right.

Kudrin’s declaration is against Ivanov, the accession of Crimea, and the Ukraine campaign. He is bidding the oligarchs to join him. So is Putin.

This dance will resume after Old New Year.

Leave a Reply