By John Helmer, Moscow

Stealing diamonds is a common crime. Stealing diamond mines is not unheard of, particularly in Africa. But the Grib diamond mine in the Arkhangelsk region of Russia is the only diamond mine to have been stolen four times in just twenty years. This is a record in the history of the diamond world, and one which four well-known Russian men and one lady can be proud of, quietly.

Alisher Usmanov (lead image, in frame), Vagit Alekperov (under fedora hat), and Vadim Belyaev (kepi) were the culprits until August of this year, when Elvira Nabiullina, Governor of the Central Bank of Russia, and Andrei Kostin, chief executive of the VTB state bank , joined in the getaway. The value of the loot is now $1.45 billion.

At the start of this month the Central Bank of Russia announced that it intends to requisition assets which the largest of Russia’s bankrupt banks have owned in order to recoup part of the costs of the rescue and reorganization measures the Central Bank is taking. According [2] to Central Bank Deputy Governor Vasily Pozdyshev, the bailout of BiN (B&N) Bank, owned by Mikhail Gutseriev and his family, is conditional on the surrender to the Central Bank of BiN or Gutseriev stakes in the real estate developer Inteco, oil company Russneft and other companies. But there’s an exception to this rule, and Pozdyshev refuses to divulge the details.

This is the $1.45 billion company known as Otkritie Industrial Investments (Открытие промышленные инвестиции) which owns the Grib diamond mine in Arkhangelsk. The asset’s value is known because last December Otkritie Bank paid the money in cash to buy the diamond mine from Alekperov and his oil company, LUKoil. Otkritie reportedly [3] borrowed $1 billion from state bank VTB, a 10% shareholder in Otkritie at the time, to pay LUKoil, a 27% shareholder in Otkritie.

The announcement of the mine sale was made by LUKoil in a press release [4] on December 2. This claimed “spinning-off of this non-core asset allows us to effectively monetize the significant shareholder value that we have created over the past five years.” The press release also revealed that “Goldman Sachs acted as exclusive financial advisor to LUKOIL.”

[5]

[5]

The Grib diamond mine at Verkhotina in Arkhangelsk region. Source: http://www.omeg-a.com/news/element.php?ID=1597 [6]

Slightly more information was disclosed in LUKoil’s audited financial report for 2016, issued in March of this year. This [7]says “in December of 2016, the Company entered into a contract with a company of the “Otkrytie Holding” group to sell the Group’s 100% interest in JSC “Arkhangelskgeoldobycha” (“AGD”), a company exploring the diamond field named after V[ladimir] P. Grib located in Arkhangelsk region of Russia. The value of the transaction is the ruble equivalent of $1.45 billion, including debt repayment by AGD to the Company. This value may be adjusted for changes in working capital at the transaction closing date.”

Note this wording includes “debt repayment by AGD to the Company”.  [8]Despite repeated questioning over the past week, LUKoil refuses to say how much debt the diamond mine, or AGD, the proprietor company through which LUKoil owned the mine, has been carrying. Nor will VTB’s Kostin (right) answer questions about its loan exposure to Otkritie for the LUKoil sale, despite Russian press reports that one billion dollars equivalent of the transaction price had been loaned by VTB to Otkritie. No trace of this loan can be found in VTB’s financial reports or disclosures to the London Stock Exchange, where VTB shares are listed and trade.

[8]Despite repeated questioning over the past week, LUKoil refuses to say how much debt the diamond mine, or AGD, the proprietor company through which LUKoil owned the mine, has been carrying. Nor will VTB’s Kostin (right) answer questions about its loan exposure to Otkritie for the LUKoil sale, despite Russian press reports that one billion dollars equivalent of the transaction price had been loaned by VTB to Otkritie. No trace of this loan can be found in VTB’s financial reports or disclosures to the London Stock Exchange, where VTB shares are listed and trade.

The silence arouses suspicion that Alekperov was in cahoots with Kostin to extract cash out of Otkritie before the crash they believed was coming. The suspicion is fuelled by the market capitalization of Otkritie in December 2016, and the subsequent trajectory of the share price.

ONE-YEAR SHARE PRICE TRAJECTORY OF OTKRITIE BANK ON THE MOSCOW STOCK EXCHANGE (MICEX)

[9]

[9]

Source: https://www.bloomberg.com/quote/OFCB:RM [10]

Two weeks after the announcement of the diamond mine deal, on December 16, Otkritie stock hit a peak of Rb1,546 per share. That meant a market capitalization of Rb322 billion, or at the prevailing rate of exchange, $5.37 billion. This in turn indicates that LUKoil’s 27% stake in Otkritie was worth $1.45 billion – the very amount Alekperov of LUKoil, Belyaev of Otkritie, and Kostin of VTB had just agreed on for the sale of the diamond mine.

Eight months after their diamond deal, Otkritie collapsed into bankruptcy and was taken over by the Central Bank. For details of that story, and the fraud between Otkritie Bank and Trust Bank over the two preceding years, read this [11]. Trust Bank control shareholder, Ilya Yurov — accused himself of looting Trust Bank before it collapsed into the Central Bank’s hands, then into Otkritie — charges the Central Bank with actively participating in a conspiracy with Belyaev to defraud Trust Bank’s shareholders, steal its cash and capital, and divert the Central Bank’s rescue financing for Trust into the pockets of Otkritie shareholders. For the charges against Yurov, here’s the backfile [12].

When the Central Bank took over Otkritie, Belyaev — nominally the bank’s largest shareholder with 29% — was removed, and replaced by a Central Bank appointee, Mikhail Zadornov. For the previous decade, and when VTB financed Belyaev to buy out Alekperov, Zadornov was Kostin’s subordinate as a senior executive at VTB. Since he moved over to Otkritie, Zadorov has kept Belyaev as chief executive of Otkritie Industrial Investments. From there Belyaev should be reporting to Zadornov on how he is managing the diamond mine, just as VTB keeps the mine shares as collateral for its loan, saving Kostin from having to declare a writedown of its value. “Note that sources point to a pledge of shares of Arkhangelskgeoldobycha in favor of VTB,” commented a Central Bank veteran this week. “I would watch VTB’s IFRS disclosure to detect the moment when they might lift the pledge. This method has been at the core of asset stripping of state-owned banks.”

[13]

[13]

From left to right: Central Bank Governor, Elvira Nabiullina; Deputy Governor Vasily Pozdyshev; and Otkritie sanitation administrator, Mikhail Zadornov

Neither Zadornov himself, nor Russian reporting of his supervision of Belyaev and the Grib diamond mine has identified the potential conflict of interest.

A month ago Zadornov told [14]a financial newspaper “the former owners of Russia’s Otkritie Bank will face new legal demands to surrender assets they bought with loans from the collapsed lender if they are needed to help recapitalise the bank.” The newspaper reporter didn’t know enough to ask Zadornov why Belyaev’s diamond mine has so far been exempted. Zadornov, who says he is planning to merge Otkritie with BiN Bank from which assets have already been seized, claims he will be treating the two banks’ non-core assets alike. “I don’t think the bank [Otkritie] . . . will have much desire for non-core activity, whether it’s mining diamonds or building offices”, Zadornov was reported as saying.

Last week Zadornov refused to clarify this claim, or repeat it.

The $1.45 billion deal between Belyaev and Alekperov is widely suspected of being an insider transaction at an inflated value amounting to an asset steal from the bank, in which buyer, seller and also financier were acting in concert. One reason for suspicion is that the price appears to most bank, mining and diamond analysts to have been inflated — too high for Alrosa, the state diamond-mining concern, to agree to pay, despite attempts by Alekperov to sell Grib to Alrosa for several years. Click for details [15].

Another reason for suspicion is that Alekperov and LUKoil have been concealing most financial details of the diamond mine, which began commercial operations in mid-2014. Otkritie and Belyaev are also concealing how they determined the value of the deal last December. So the question now arising is why the Central Bank appears to be keeping Belyaev in business, protecting him and his asset holding from takeover by the new state-run management of the bank he led into bankruptcy?

“It’s hard to talk about the real price of Grib [AGD] when it was sold by LUKoil”, a leading diamond industry figure in Moscow says. “That’s because there are too many factors such as debts, mining volume, losses, profits, etc. As far as I know, LUKoil had invested a large sum into this mine, so they wished to get this money back. About Alrosa – yes, they probably would buy AGD if the price suits them. Previously, the company was identified among the possible buyers, but Alrosa refused as the price was too high for them. Now they have some problems with [falling production in their own mines] so they can be interested in AGD — but not for such a valuation [$1.45 billion] as it was in December 2016.”

Investment bank analysts in Moscow say Grib should have been worth its earnings (Ebitda) multiplied by 4, the multiple applied on the Moscow stock exchange for Alrosa. Although LUKoil has kept Grib’s earnings figure secret, it is believed by Russian diamond industry sources to have been about $150 million in 2016. So its sale price in December 2016 ought to have been close to $600 million.

Rough & Polished, the Russian diamond industry bible, valued Grib at the time of the Otkritie transaction between $500 million and $700 million. According [16] to the publication, “if Otkritie has bought this asset for itself, it is unclear where the upside is, and if for resale it is unclear who will buy at this price. Besides ALROSA, there are no other prospective buyers immediately evident, but ALROSA is hardly ready to foot such a bill. In its official press release, Otkritie stated it was not going to resell the Grib Mine, while ‘the acquisition of a 100% stake in Arkhangelskgeoldobycha is a strategic investment in an attractive asset with potential for further development.’” With hindsight, it’s obvious than when Belyaev authorized Otkritie to say this, he was lying.

An international diamond miner says fair value for Grib by his calculation would be $850 million at tops. “Mining projects should be valued using discounted cash flows to produce an NPV [net present value]. Besides revenues and operating costs, this method also takes into account the life of the mine and the capital expenditure required to keep it open, which an Ebitda [earnings] multiple does not. The problem is that you need more information to calculate an NPV, and there’s very little about Grib in the public domain.”

After reviewing press releases from Grib and LUKoil, and a valuation by De Beers and Grib’s initial Canadian owner in 2008, the source says: “ I reckon estimates of about $350 million of annual revenues and $150 million of annual Ebitda are about right. Take off income tax at the standard Russian rate of 24% (allowing for tax depreciation of the upfront capital expenditure) and allowing for around $150 million of additional capex in 2024-2026 to pay for the mine to go underground, then you get an NPV of around $850 million. You’d then need to subtract from this number whatever debt LUKoil stuffed into AGD to pay for the initial mine development. Who knows what the debt level is, but it doesn’t really matter — the justifiable purchase price would be considerably less than $1.45 billion.”

An international diamond mine expert says he believes LUKoil may have spent $1 billion on building the mine. “It was a ‘Rolls Royce’ development. No expense was spared. The accommodation blocks were easily the most luxurious I’ve seen in any mine. The immensely expensive generators, which were actually from Rolls Royce, were manufactured in Norway. The most expensive element in any new diamond mine is the processing plant. I don’t know how much that cost, but it would have been a significant percentage of the total. By comparison, the recent Gahcho Kué mine [part owned by De Beers] in Canada cost over $1 billion to develop. It has a similar (slightly higher) carat output and grade compared to Grib. The goods have similar characteristics, and the mines had to be built in similar northern conditions. No new mine in Canada has cost less than $1 billion.”

The history of the Grib diamond mine was not of Rolls Royce vintage. It began, shortly after the Soviet Union was replaced in Moscow by the financially and politically desperate administration of President Boris Yeltsin. Without money to continue geological exploration, let alone build new mines, the Arkhangelsk region state geology committee came up with the idea in 1993 of attracting money from Canadian mine investors into a scheme which wasn’t expected, at least not by the Russians, to find anything substantial.

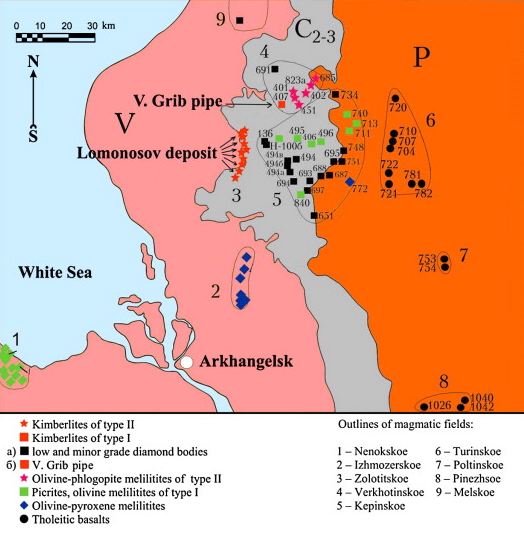

Diamond traces, including the occasional stone, have been found in northwestern Russia for almost 300 years. For the history since the first stone was found in 1730, start here [17]. Because the celebrated 18th century Russian polymath Mikhail Lomonosov, a native of Arkhangelsk region, reported on the first discovery, his name has been attached to a deposit now being mined in Arkhangelsk by Alrosa. Before Alrosa took control, it was owned by De Beers. Grib was discovered nearby in February 1996.

By the end of the Soviet period, state geologists had identified dozens, possibly hundreds of such traces in a belt running from the Perm region, in the Ural mountains, north and westward across Komi, Arkhangelsk and Karelia to the Finnish border, and into Finland itself.

[19]

[19]

Source: https://ars.els-cdn.com/content/image/1-s2.0-S0024493709001893-gr1.jpg [20]

The Grib diamond discovery, named after the Russian geologist working with the Canadians at the time, was assayed [21] by De Beers a decade ago; on those data it was one of the world’s largest undeveloped diamond deposits. Operational since June 2014 and selling its stones in Antwerp, it is now counted as the 8th largest diamond mine in the world; its diamond reserves are the 4th largest in Russia. Depending on valuations which move with oscillating prices for rough diamonds, the asset value of the diamonds to be mined at Grib has been projected between $4 billion and $10 billion.

Once the deposit had been discovered, the history of crooked dealings over the asset can be found in court papers in Sweden, the US and Russia. These commenced when Alisher Usmanov and Vagit Alekperov, acting in a business partnership they called (after their first names) VA Investment, manipulated the privatization of the state entity to become the private shareholding concern, Arkhangelskgeoldobycha (AGD). Usmanov wanted the diamond assets which AGD controlled through old state licences; Alekperov, AGD’s oil assets.

This duo then cancelled the agreement on a joint venture with the Canadian company, Archangel Diamond Corporation (ADC). The Usmanov-Alekperov business has been identified in court papers as “a scheme of fraud, breach of express and implied contract, civil conspiracy, intentional interference with contract, breach of fiduciary duty and unjust enrichment.” “As a result of the fraud and breach of contract,” the court papers claim ADC and its Canadian and US shareholders lost the value of $30 million they had already spent on finding and proving the diamond deposit, as well as $400 million in profits they expected to earn from ADC’s 40% stake in the mining venture, together with another $800 million in profits they believed would be generated from further diamond deposits in the territory covered by the disputed license.

Usmanov was identified in the court papers as the mastermind of the scheme by which ADC’s Russian partner, AGD, was first privatized, and then turned over to companies controlled by Usmanov himself and by LUKoil. For details, click to open [22].

Together, according to the court papers, Usmanov and Alekperov refused to transfer the license for the diamond mine to the joint venture with ADC. Their objective, ADC’s lawsuits and arbitration filings allege, was to drive ADC out of Russia and take over the diamond project for themselves. As evidence of fraud, the court papers cite and describe 19 communications from the Russians between August 1997 and April 2000, as well as 76 telecopy transmissions. Jurisdiction under the Colorado state and federal courts was claimed because ADC’s office was based there, and because LUKoil operated a retail petrol station and other business in the state. For the full court claim, read this [23].

Between 2000 and 2001 Alekperov says he bought Usmanov out, and LUKoil then began calling the shots. When ADC was driven to the brink of bankruptcy, De Beers acquired shareholding control. It subsequently tried resolving the court fight with LUKoil by negotiating a joint venture with Alekperov. This was inaugurated [24]officially in front of then-Prime Minister Vladimir Putin in April 2008.

[25]

[25]

Left: DeBeers chairman Nicholas Oppenheimer hosts President Putin in South Africa in 2006. Right: Oppenheimer, Alekperov and DeBeers chief executive Gareth Penny sign their Grib mining deal in Moscow in April 2008.

Within a year LUKoil, along with allies in the Russian government and at Alrosa, had sabotaged the DeBeers agreement, and retaken [26]the Grib mine for Alekperov. The court battle resumed in the US. LUKoil was charged with racketeering [27], but the evidence and claims were never tested. As LUKoil records in its annual reports, it won a series of state and federal court judgements dismissing ADC’s case on the ground that jurisdiction was lacking in the US. “The case is therefore over”, records [7]the latest LUKoil consolidated financial statement for 2016 at Note 29.

But what of the case of the $1.45 billion transaction for Grib between LUKoil and Otkritie last December — was that the fourth steal? To answer requires more financial information than LUKoil has disclosed about its investment in, and operation of the Grib mine.

LUKoil’s financial report [28]for 2012 makes no mention of the mine and identifies no expenditure on it. In fact, later LUKoil financial statements reveal, the company says it spent $277 million on the mine that year, and $224 million the year before, in 2011.

According to the 2013 report [29], LUKoil disclosed: “Other capital expenditures refer to investments of OAO Arkhangelskgeoldobycha, a Group company, involved in diamond deposits development in the Arkhangelsk region of Russia.” The total spent on the mine in 2013 was $513 million.” But before the year was out and the money spent, Alekperov met Putin at the Kremlin on October 10, 2013, and answered the president’s questions about the diamond project.

[30]

[30]

President Putin meets Alekperov to “discuss LUKOIL’s operations in Russia and abroad, as well as the diversification of the company’s activities.” Source: http://en.kremlin.ru/events/president/news/19396 [31]

The Kremlin transcript reads as follows: “Vagit Alekperov: You believed in us when you took the decision to entrust us [sic] with building a facility to extract diamonds. The construction of such a facility on a kimberlite pipe is in its initial stages at the Vladimir Grib diamond mine. Together with the best international experts, we have reached a point where a new complex has been fully established. I want to invite you to visit in November, to open the processing plant and to receive the first diamonds that are mined. Here everything is based on the highest standards, the best practices throughout the world (we visited sites in South Africa and Canada). The best technologies and best principles are being used.”

“Vladimir Putin: How much has been invested? Vagit Alekperov: About $1.05 billion. This will be one of the largest [diamond] pipes currently being mined in the world. We have agreed on all issues with the Ministry of Finance and the [State Precious Metals and Gems Repository] Gokhran. In other words we have a new business, so for that reason we took absolutely all steps necessary to exploit the diamond field. We work closely with the diamond company ALROSA, which is beginning production nearby, eight kilometres away. We would both like to invite you to visit Arkhangelsk Region and to take part in launching this unique project. More than 3,500 people will work there. We will not only sort at the field, but also in Arkhangelsk; all this has been agreed with all the regulatory authorities of the Russian Federation. Vladimir Putin: Good, thank you very much.”

The following year, according to LUKoil’s financial report [32] (page 172), another $125 million was spent. The mine was officially inaugurated at a ceremony presided over by Putin on June 9, 2014. Total capital expenditure on the mine, according to LUKoil, $1.139 billion.

[33]

[33]

President Putin inaugurates the Grib mine on June 9, 2014. Left, Putin is briefed on the mine design by Grib company chief executive, Maxim Meshcheryakov. Right: Alekperov with Putin at the edge of the pit. Source: http://en.kremlin.ru/events/president/news/45878 [34]

At the inauguration ceremony and in the subsequent financial statement for the year, the company claimed it was aiming at peak production of 4.5 million carats per year. That was the last time LUKoil revealed its mine production; in fact, it has not revealed diamond output at all.

Last year, LUKoil’s company financial reports indicate that Grib sales revenue came to Rb20 billion ($336 million). This was almost double the 2015 revenue figure of Rb11 billion; the first half-year in 2014 resulted [35]in sales of Rb1 billion. These figures also appear in the company’s annual financial reports [36]. In the first half of this year, press reports indicate [37]that Grib’s diamond sales have plummeted by 45%. Requests to obtain more financial data on the mine, and an explanation for the abrupt decline in performance since the sale, have been rejected by Belyaev, Zadornov, and the Central Bank.

“After what happened to ADC and De Beers,” comments a Moscow diamond industry veteran, “no foreign diamond miner or investor will consider buying into the Grib mine. Alrosa has made clear it wouldn’t pay Alekperov’s asking price. Alrosa remains the only buyer, so the price must fall if the Central Bank tries to sell the asset. Maybe Alekperov spent too much on the mine but he did that out of confidence he would find a Russian buyer. And he has, hasn’t he? A case of secret self-dealing, financed in the end by the state.”