By John Helmer in Moscow

The announcement from Mechel on March 26 that it has agreed with its bankers on a 51-day extension of time to repay or refinance a $1.5 billion loan, which fell due on March 20, has exposed a grave failure of arithmetic in the marketplace. And that’s not all.

Headlined by Bloomberg and Reuters as a two-month extension, and repeated by rote in client bulletins from the principal Moscow brokerage and investment houses, the new loan payment deadline, which New York-listed Mechel reported to the Securities and Exchange Commission, is May 15. That was just 51 days away from the signing of the new agreement — not 60 or 61, as two months usually add up to. The nervousness of the banks in setting the short deadline seems to have been obscured by the unwillingness of the market-makers and media to take out their fingers and thumbs, and check the official release from Mechel itself.

That said: “On March, 25, 2009, following negotiations with the banking syndicate which provided Mechel a one-year loan for the Oriel Resources Ltd. (United Kingdom) acquisition, an agreement for a two month payment term extension was reached. The new payment date is May 15, 2009. The prolongation period will be used to complete negotiations with the bank participants of the syndicate aiming at refinancing the bridge loan with long term instruments.”

As has been reported in the archive, Oriel is a chrome miner and refiner. Since the takeover a year ago, it has been included in Mechel’s ferroalloy division, supplying chrome to Mechel’s specialty steel diivision for the production of nickel and chrome-plated products.

Bowing to the regulatory supervision of the Securities and Exchange Commission in Washington, Igor Zyuzin, Mechel’s controlling shareholder, allowed a public filing of this material change in the company’s financial ondition: http://idea.sec.gov/Archives/edgar/data/1302362/000130901409000215/htm_3813.htm

He did not make disclosures to the SEC when court claims in Geneva and Moscow recently threatened dozens of millions of dollars in Mechel bank accounts and forward delivery contracts. Nor was the market and the SEC informed when Mechel took over the West Virginia-based Bluestone Coal company for a cash down-payment of $425 million, and the issue of 80 million Mechel preference shares.

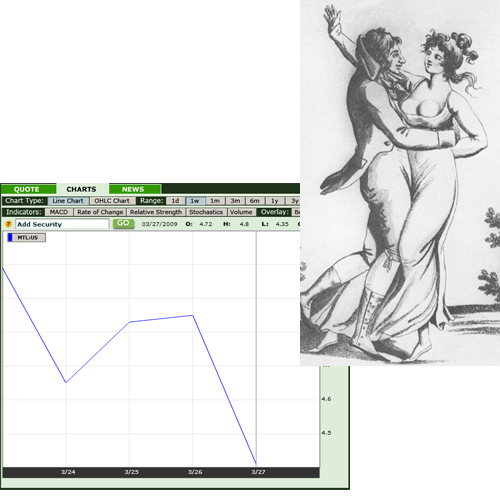

The possibility that Mechel might default on its $1.5 billion obligation on March 20, or that it might strip assets and dilute current shareholders to cover its obligations, may very well be untrue. The market has judged the likelihood improbable enough to trade Mechel’s share price 18% upwards in the week preceding the deadline day, including the 1% rise in price to $4.28 per share as the day’s deadline expired without word of what has happened.

In the days that followed, the thumbs and the fingers came out of investor pockets. On March 24, the share price went down 7% to $4.65. At close on the next day — the day the debt deferral was agreed with the banks, but before Mechel released any news, the volume of shares traded remained roughly the same as the day before (21-22 million), but the price went up 4% to $4.83. After reading the loan announcement, the volume of shares traded jumped by a third, but the price remained almost unchanged. Then last Friday, March 27, after a day of contemplation, the market woke up in a negative mood, and ended the day marking Mechel down 9% to $4.40.

Very few steel analysts had been willing to issue warnings before the debt deadline. Mechel refused to say anything at all, and would not even identify the lenders with whom it was in negotiation. These include Alfa Bank. Other banks in the original Oriel loan syndicate, when Mechel bought the chrome producer in March 2008, were ABN Amro, Merrill Lynch, and Royal Bank of Scotland, which subsequently absorbed ABN Amro’s loan book, and acted as agent for the syndicate. It is not clear which banks are currently exposed to Mechel for the $1.5 billion, and by how much. Mechel isn’t saying.l. An exception was Alfa Bank steel analyst Barry Ehrlich, who wrote that the current negotiations are focussing on “collateral and covenant restrictions, such as those restricting the sale or transfer of company assets.”

By the time the Moscow steel analysts got their pens out, there was a decidedly mixed reaction to the debt announcement from Mechel in the Moscow market. In its report to clients, Troika Dialog Bank said: “we think that the news falls short of market expectations, but it nevertheless indicates that the company has probably achieved some progress in negotiations.”

What appears to have been a Mechel-inspired press leak to a Moscow newspaper claims that Mechel is proposing to the banks that it pay $500 million in cash now, and extend repayment of the $1 billion balance for three years or more, deferring principal payback for one of those years. The newspaper report also claims that the interest rate for the rollover is in dispute between the London Inter-bank Lending Rate plus 2.9%, the rate charged by the maturing loan, and Libor plus 8%, the peak rate which Mechel has been offered. Mechel is reported in the market to have countered with an offer to pay Libor plus 3.3%.

According to Troika, “should these negotiations be successfully completed, which we think is likely, this will be a major victory for Mechel and a major positive for the market.”

Uralsib Bank has been more skeptical. ” In our view, the news is slightly negative for the stock, as at this stage the market already expected Mechel to refinance the loan without an extension period.” Uralsib’s report claims Mechel baulked at accepting the peak interest rate proposal. it is unclear whether this was the commercial syndicate’s offer, and thus whether Mechel could do better with funds on offer from Vnesheconbank (VEB), the state bailout bank chaired by Prime Minister Vladimir Putin.

Last July and August, Putin demonstrated that he and Zyuzin are not exactly wellwishers. Putin’s public attack on Zyuzin triggered a price-rigging investigation for coking coal by the Federal Antimonopoly Service (FAS), and a 38% drop in Mechel’s share price in one week.

Recognizing what had happened, and Zyuzin’s suspicion of Putin’s intentions, should VEB get its hands on Zyuzin’s shares as collateral for money to cover the $1.5 billion loan, Uralsib Bank analyst Michael Kavanagh has noted that the security required by VEB was not only the chrome mine and refining assets of Oriel Resources, plus 50% of Mechel’s other Russian mining assets — coal mines, iron-ore mines, and nickel mines. When the going was good last year, Zyuzin had been hoping to spin off these assets as a separately listed company, substantially multiplying the market capitalization of his stakes, and his personal fortune.

Notwithstanding Zyuzin’s shyness towards VEB, Kavanagh’s conclusion is that there’s no reason the commercial banks will not prove softer than Putin. “The fact that the banking syndicate entered the negotiations with Mechel,” he reports, “shows that the company has a high chance to refinance the loan at attractive interest rate.”

Renaissance Capital, the Moscow investment bank now controlled by Mikhail Prokhorov, is more skeptical towards Mechel’s latest announcement. “The news would be more supportive for Mechel if the company were able to refinance the loan without an extension period. In any case, we do not expect refinancing negotiations with the banking syndicate to be an easy process for Mechel.”

Unicredit, the Italian bank which has taken over the Aton brokerage in Moscow, has adopted a Vita e bella approach — without disclosing whether it is holding any Mechel debt, and might be vulnerable to a balance-sheet loss, if there were a default. “We expect,” reports Unicredit’s Moscow office, “the company to be able to refinance the loan, once the standstill period ends, and note that the banks’ willingness to compromise with Russian mining majors could send a strong signal to the market and alleviate concerns about the ability of other leveraged companies to refinance their debt.”

Alfa takes an easy each-way bet. According to Ehrlich, “it looks likely that the company is now close to completing the restructuring with a significant duration extension. However, some uncertainty remains that an agreement might not be reached with the syndicate, and if this happens there is no certainty that VEB funds would still be available.”

At the same time as Mechel has announced bank approval for the deferral, it has also told the market it is planning to start selling 139 million preferred shares, commencing on April 1. The SEC filing calls this a “public offering”, and notes that earlier plans to sell the shares commenced in May of last, only to be amended several times, and then postponed. The offer price has not been fixed yet.

This increase in Mechel’s capital — one new preferred share for three common shares already on issue –appears to be intended to pay for Zyuzin’s fancy for Bluestone Coal. An estimated 80 million preferred shares — 58% of the proposed issue — have been designated for the completion of this deal. Since Bluestone has reportedly been valued at $870 million for the Mechel takeover, and $425 million has already been paid in cash, 80 million preferred shares appear to be priced by Mechel at $5.31 per share. That’s a premium of 21% over the current price of Mechel’s ordinary shares.

Sergey Donskoi, the steel analyst for Troika, assumes that, apart from the transfer of shares to the seller of Bluestone, James Justice, there will be no public sale of these new shares. “The balance will probably remain on the company’s balance sheet as treasury stock,” according to Donskoi, “which may be used in the future for M&A transactions or, more likely, placed on the market. In the medium term, this overhang may weigh on the share price, but we think it should be priced in already.”

Itr is unclear who or what will be buying these shares. Justice issued a statement to local West Virginia newspapers last month, saying: “while a sale of Bluestone Coal Corporation has been the subject of much speculation over the last several months, it is not constructive for us to comment at this time. The transaction is with the global steel, coal and iron ore producer, MECHEL, OAO. Our formal announcement along with detailed comments will be made at the appropriate time.”

According to Kavanagh of Uralsib, “we view the [preference share issue] news as technical and do not expect Mechel’s prefs to be placed in public offering at this stage.” He believes there is an agreement with Justice that the shares he is being given in exchange for his coal company must be publicly traded. However, that may not be just yet. According to Kavanagh, the buyer of the preference share issue is likely to one of Mechel’s subsidiary companies.

Because Mechel will not respond to questions, it also isn’t clear whether the price at which this transaction may be carried out, and the fact of the share sale itself, may challenge Mechel’s lending banks to tighten the collateral and covenant restrictions attached to the Oriel loan. The bankers do not have to be geniuses at arithmetic to detect, and disapprove, a dilution in value of the company assets that must be pledged to secure Mechel’s repayment.

Leave a Reply