By John Helmer, Moscow

The International Monetary Fund (IMF) is delaying a decision on Botswana by the Fund’s executive board and shareholders as IMF staff are discreetly encouraging the Botswana Government to reject a breach of contract claim by Norilsk Nickel.

The leading Russian mining company, and the world’s largest nickel producer, is suing in London, Botswana and South Africa after the Botswana government put its state mine holding BCL into bankruptcy last October, halting payment of $277.2 million which Botswana, BCL Investments (BCLI) and the BCL Ltd. holding company agreed to pay since their first contract of sale and purchase was signed with the Russians in 2014. The Norilsk Nickel default claim is one of the largest liabilities facing the Botswana state budget. The default is also casting a shadow over future foreign investment in the country, and the government’s credit rating for foreign loans.

An IMF team was in Gaborone, the Botswana capital, in May for a fact-finding mission and consultation with government officials, the first the IMF has held in the country since December 2015. The IMF requested and received briefings on the Norilsk Nickel case from government officials and also from the provisional liquidator, Nigel Dixon-Warren of the KPMG accounting firm. He was appointed last October by the Gaborone High Court to supervise liquidation, sale of assets, and debt recovery from the bankrupt BCL group of companies.

On June 15, the court ordered a six-month extension of time for negotiations — BCL went into final windup, while BCLI and Tati Nickel were kept in provisional liquidation for the dealmakers. According to a courtroom source, the extra time is for the government “to determine whether we can deal with those companies at the shareholding and creditor compromise level”. In short, for Dixon-Warren to strike a price for the nickel and copper reserves and mining assets which BCL owns in order to satisfy BCL’s creditors and cover BCL’s liabilities.

Anne-Marie Gulde-Wolf, who supervises Botswana at IMF headquarters in Washington, said after the IMF staff returned from Gaborone on May 16, that she was planning to finalize the Botswana report and submit it to the board for decisions planned for June. Gulde-Wolf was asked what the IMF was doing in the dispute between Botswana and Russia. “I have asked the mission chief for Botswana, Mr. Enrique Gelbard to look into the matter,” she replied. “He will be in touch should there be anything we can share. “

Asked to clarify why no report was submitted to the IMF board during last month and no decisions voted on IMF policy towards Botswana, Gulde-Wolf, Gelbard, and the IMF spokesman for Africa, Lucie Mboto Fouda, now refuse to say.

In Moscow, a source close to Norilsk Nickel said the company “has welcomed a statement by the Botswana government that it plans to resolve the issue with Norilsk Nickel. We look forward to the arrangements the government intends to make.” To date, the IMF had made no contact with the company either in Gaborone in May, or since then.

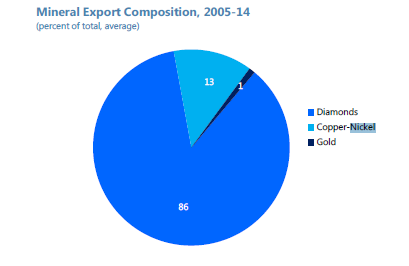

A British protectorate until 1966, Botswana is one of the most prosperous states in Africa because of mining. In 2015, the total value of the country’s exports came to $6.3 billion, according to World Bank figures. Exports from the country’s still rich diamond mines amounted to $5.2 billion (83%). Nickel came next for export value of $320.5 million (5%). Electrical equipment at $102.5 million and beef at $62.5 million came next, but trailing far behind in value.

Source: IMF Botswana Country Report No. 16/103, April 11, 2016, page 16. Click to read the full report.

Last year’s collapse of BCL has caused a drastic drop in nickel exports, according to the latest trade statistics. In March 2017, Botswana’s exports of nickel and copper were almost zero; in March 2016 they had totalled $33 million.

Diamond exports have plummeted by 40%, from $64 million in February to $38 million in March.

Winding up their visit to the country on May 16, the IMF inspectors issued a press release sounding optimistic for a diamond-led recovery in the economy. “Following a downturn in 2015, Botswana’s pace of economic activity recovered in 2016, supported by improvements in diamond sales…. Positive prospects for the diamond sector could lead to somewhat higher rates of GDP growth in 2017-19.”

Gelbard said the IMF had met with senior officials of several ministries, the Central Bank, and “representatives of the private sector and development partners.” Government sources in Gaborone say diamond mining executives were consulted, but Norilsk Nickel was not. Instead, Gelbard (pictured below, left) met with Dixon-Warren (right), the liquidator of the nickel mines in the BCL holding.

Gelbard, who ran IMF business in Afghanistan before his posting for Botswana, recommended the sell-off of state-owned mines and other state-funded enterprises. The government should “proceed with the privatization process,” Gelbard declared, and “reduce bureaucratic procedures for private businesses.” Gelbard was not endorsing completion of the state buyout of Norilsk Nickel. His statement also mentioned that “the financial sector has remained well capitalized, profitable, and stable, despite a small increase in non-performing loans associated with the liquidation of the state-owned BCL copper and nickel mine.”

Norilsk Nickel is suing the government and BCL for $277.2 million. The original contract between them called for $337 million. For the full story, read this.

BCL’s liabilities and debts currently include $70 million owed for energy supplies when the mine and concentrator were in full swing, plus $3 million in costs every month for mine security, care and maintenance. Altogether, the cost of the BCL collapse exceeds the entire value of nickel exports of the country.

Minimizing this isn’t all that Gelbard and the IMF staff are doing, Botswana sources say. In Gaborone, officials report Gelbard as “telling them the government has very little liability to the Russian mining company.” The IMF, the sources add, also appears to have taken the side of Mining Minister Sadique Kebonang.

Mining Minister Kebonang. He has told the Sunday Standard Reporter that BCL owes various creditors including the Botswana Power Corporation and Water Utilities Corporation, as well as banks, up to Pula 1 billion (US$100 million). That is not counting the Norilsk Nickel liability of $277 million. Kebonang told the newspaper he expects to pay that with the sale of BCL for $300 million (P3 billion). In that deal he included BCL Mine and BCL Investments (BCLI), as well as an 85 percent stake in Tati Nickel Mining Company. At his last press conference in Gaborone three weeks ago Kebonang declined to answer questions about his negotiations to sell BCL.

Kebonang’s position is unclear. He told the press on June 27 that the government wants to “solve the matter with Norilsk so that [we] can maintain [our] international relations and ratings intact.” Off record, the minister is also saying he does not intend to negotiate with Norilsk Nickel until his preferred buyer, Emirates Investment House (EIH) from Dubai, can raise the money for its takeover of BCL.

Skepticism about the terms of the EIH offer to buy BCL, discharge (or avoid) its liabilities, and revive nickel mining in Botswana have been expressed by government officials, by Botswana mining sources, and by Dixon-Warren, BCL’s bankruptcy administrator. Brian Benza, business editor for Mmegi, the independent daily newspaper in Gaborone, has reported that “doubts have emerged from industry players about the Emirati firm’s financial and technical capability to pull the deal through.”

In July, another IMF staff report warned against non-transparent  deals like the one Kebonang has been promoting. “Projects classified as large and mega,” according to this IMF report, “should be subject to different procedures and higher standards to ensure that the spending is efficient and fiscal risk is minimized”. Kebonang refuses requests by Botswanan and South African reporters to give details of the EIH deal. The chief executive of EIH, Abullda Mangoosh (right), is also silent.

deals like the one Kebonang has been promoting. “Projects classified as large and mega,” according to this IMF report, “should be subject to different procedures and higher standards to ensure that the spending is efficient and fiscal risk is minimized”. Kebonang refuses requests by Botswanan and South African reporters to give details of the EIH deal. The chief executive of EIH, Abullda Mangoosh (right), is also silent.

Lawyers, miners and government officials suspect Kebonang of ” stitching up” the BCL asset sale so as to benefit EIH. Despite Mangoosh’s failure to submit a bid for BCL by the June 15 court deadline, the government told the court it had received a letter from EIH requesting more time. Dixon-Warren is barred from commenting on the details, but it appears from court testimony that EIH has not convinced the liquidator that it has the financial means to develop BCL’s unmined nickel and copper reserves, let alone revive operations and employment at the shuttered mine.

The court’s June 15 ruling was to keep open the liquidation process for BCL and the associated Tati mining company, which is also included in the Norilsk Nickel sale. The new deadline is December 15. Two mining companies, as yet unidentified, have submitted bids for the unmined nickel and copper in what have been known as the Selkirk and Phoenix minefields around Tati. Earlier interest by the US-owned copper miner Cupric Canyon Capital has faded.

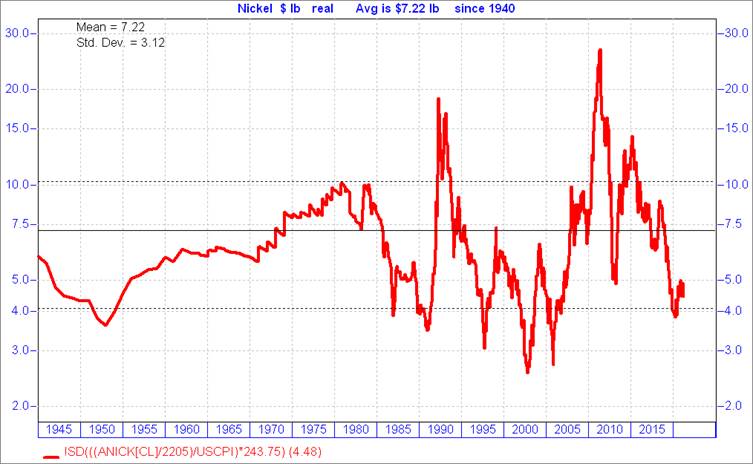

Miners and mine analysts in South Africa say the bidding is a wager on the recovery of the global nickel price. Peter Major, head of mining at Cadiz Corporate Solutions in Cape Town, says he is predicting the nickel price will move upwards to its historical mean of around $7 per pound. With that target price in prospect, Major believes the assets Norilsk Nickel has contracted to sell to BCL, and which BCL is now looking to resell through EIH as intermediary, ought to find willing buyers with the money to invest for the price takeoff to come.

Norilsk Nickel warned Kebonang in a lawyers’ letter on April 27 that “the government has displayed a complete disregard for the fair, frank and reasonable dealing with outsiders which BCL and [associated investment holding] BCLI’s insolvent circumstances demanded.” The Russian company offered the government the opportunity “to engage constructively to resolve these matters” with a state-financed buyout of the still profitable nickel mines and reserves remaining. If Kebonang and his fellow ministers refuse, the Russian company warned it “will have little choice but to commence legal proceedings.”

Foreground: Mercury City Tower in Moscow, Norilsk Nickel’s corporate headquarters

This week Norilsk Nickel indicated it is counting on Botswanan officials to finalize “the arrangements the government intends to make.”

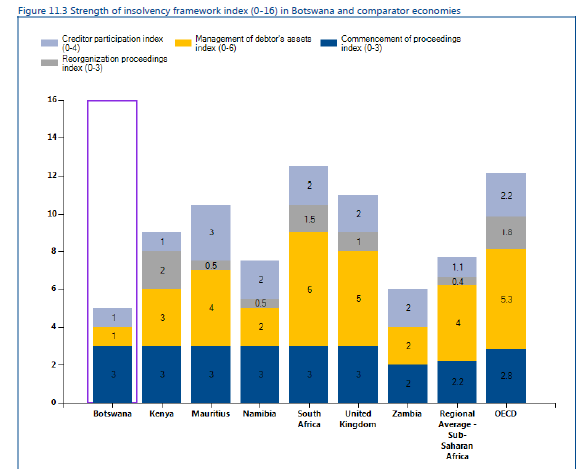

A report issued in January by Transparency International congratulated Botswana on obtaining the highest cleanliness rating in Africa for its performance to combat corruption; Botswana’s score was not only ahead of South Africa but also cleaner than the measurement of corruption in Spain and Italy. Notwithstanding, Transparency International (TI) warned that Botswana’s anti-corruption record has been steadily slipping since 2012. And when it comes to dealing with insolvency and recovery of debts, the TI report concluded that Botswana is performing much worse than its African peers.

In the weeks ahead, officials and mining sources in Gaborone say they will be looking to the IMF and other international banks for guidance on how to resolve the Norilsk Nickel dispute. “The Russians have got the government panicked,” says one official. “It’s a question of price of nickel in the future market. Bureaucrats from the IMF don’t count,” adds a miner in Gaborone. “There is an amicable solution for Norilsk and the government. That’s if they are willing to walk away for $150 million.”

Leave a Reply