By John Helmer in Moscow

Russian public companies are special, and public shareholders are the last to know. But when Suleiman Kerimov is engaged in a deal, you can be certain of knowing one thing — nothing is what it seems. The brokerages egging the market on today to buy Uralkali shares at a premium, on the ground that Kerimov has just done so, are misled. The controlling shareholder of Uralkali has just been obliged to sell at a discount.

Uralkali is the second of Russia’s potash producers, and the power behind the Belarusian Potash Company (BPC), the swing seller and market maker in the global potash trade. Both have been controlled until now by Dmitry Rybolovlev, whose fear of what might happen to him in Russia has led him to make his permanent residence in Geneva; corporate residence in Cyprus; holiday home in Florida; and to negotiate for asylum wherever he could, including Minsk, Belarus. His management style with his subordinates at Uralkali’s headquarters in Moscow has been based on threat, intimidation, fear.

The company listed on the London Stock Exchange in 2007, creating a public float that is estimated today at about 33% of the issued shares. At peak in June 2008, Uralkali was valued in the stock markets at $34.3 billion. But after grain and fertilizer prices collapsed that autumn, Uralkali’s share price ended the year at just $3.8 billion. At the end of last week, it was worth $8 billion. According to the company’s disclosure last month, Rybolovlev has owned 65.63% of the shares through Madura Holding Ltd., a Cyprus-registered personal vehicle he probably shares with his wife Elena, who is divorcing him in the cantonal court of Geneva.

Uralkali claims on its website that it “communicates to its shareholders all necessary information in a timely manner”. Calling itself “Russia’s first company in the chemical sector, Uralkali seeks to adhere to leading global corporate governance standards…offering confidence to investors.” The company declared that it is “dedicated to… transparent and timely disclosure of information to our shareholders and the broader market.”

According to Monday’s announcement from Uralkali, “the company has been informed by Madura Holding Limited (“Madura”) that:

(1) Madura has disposed of 53.2% of the issued share capital of the Company (the “Disposal”) to Kaliha Finance Limited (“Kaliha”), Aerillia Investments Limited (“Aerellia”), and Becounioco Holdings Limited (“Becounioco”, and, together with Kaliha and Aerellia, the “Purchasers”) on 11 June 2010;

(2) Kaliha, Aerellia and Becounioco are beneficially owned by Mr Suleiman Kerimov, Mr Alexander Nesis, and Mr Filaret Galchev, respectively;

(3) In the course of the Disposal, the largest stake (25% of the Company’s share capital) was acquired by Kaliha.”

What this means is that Rybolovlev has given up control of Uralkali,, selling all but 12.4% of his stake. But who has really taken control remains concealed.

Kerimov never speaks about his business, part of which is conducted from the Moscow holding Nafta Moskva; part of which through Swiss holding companies; and part on the high seas aboard his motor yacht, Ice. Nor does Kerimov answer questions at the Moscow office he maintains as a senator, occupying a seat representing his home region of Dagestan in the Federation Council, as the upper house of the Russian parliament is called. Sources have also reported Kerimov as recently moving his business operations to Singapore. The Singapore authorities refuse to say whether they have issued him with a residence permit.

Kerimov appears to be the origin for a Moscow newspaper report claiming today that Rybolovlev sold Uralkali at the valuation he placed on the company of $10 billion, a 25% premium on the market price. The newspaper was then guided into reporting that Rybolovlev’s selling price for the 53.2% stake was $5.3 billion. Kerimov’s share of that, according to the source, was $1.3 billion. The two other buyers reportedly acquired 15% and 13.2% stakes, respectively.

| In fact, says a participant in the transaction, the reported premium is “nothing but a rumour.” He disclosed that the transaction valuation of Uralkali recognized the unpromising price dynamics of potash on the global spot market, since the Chinese stopped buying, and the declining trajectory of almost all potash miners listed through the London, Canadian and Australian stock exchanges in world markets. |  |

The new buyers of Uralkali bought at a discount, the source claimed. This means that Rybolovlev was a forced seller, with pressure coming from the highest levels of the Russian government.

It also means that the structure of the deal cost the buyers much less than the Moscow brokerages have been telling their clients. It appears that Rybolovlev has received less than $4 billion, and that accordingly, Kerimov has had to pay less than $1 billion. Little of that appears to have been proffered in cash. According to the newspaper leaks from the Kerimov circle, the state bank VTB has loaned three buyers $1 billion apiece to finance their payment to Rybolovlev, secured by a combination of Uralkali shares and other assets.

The transaction source says this is an exaggeration. In exchange for his Uralkali shares, Kerimov is reported to have given Rybolovlev the cash he has borrowed from VTB, which is secured bv a 10% stake of Polyus Gold, Russia’s leading goldminer, out of Kerimov’s 37% shareholding. At the current market price, one-tenth of Polyus Gold should be worth $1 billion. In addition, Kerimov has reportedly handed over 100% of his ownership of the Voyentorg Department Store in central Moscow; he reportedly bought that from the property magnate, Telman Ismailov, in mid-2009, when the latter was on the run from the Kremlin in Turkey. What value Voyentorg was exchanged for then, or is worth today, is difficult to say; press reports suggested Kerimov paid Ismailov about $300 million. Putting the two uncertainties together, however, it seems that Kerimov may have had to accept a discount on his asset value as well. Since it appears that Rytbolovlev has insisted on cash from the three purchasers, it appears to be VTB which has accepted the Polyus Gold, Voyentorg, and other assets as security for its loans.

The VTB loans to the second and third purchasers – the ICT group of Alexander Nesis with a 15% shareholding of Uralkali, and Eurocement owner Filaret Galchev with 13.2% — are likely to amount to $575 million for the former, $506 million for latter. Nesis has substantial and diversified interests after successfully selling Polymetal to Kerimov, then buying it back; and owning Nomos Bank. Galchev’s principal asset is the unlisted Eurocement group.

Troika Dialog specialist on fertilizer Mikhail Stiskin trumpets the deal. “We adamantly believe,” he reported to clients this morning, “that Kerimov is a nearly ideal candidate to acquire Uralkali, in terms of both political leverage and his future position at the company, which will be relegated to the role of a financial investor with no direct interference in operations, as has been the case with Polymetal and Polyus Gold. As a result, the current management team, which we hold in high esteem, should remain in place.”

Uralsib Bank analyst Anna Kupriyanova is more cautious. Counting that Rybolovlev has also sold 15% of his 20% stake in rival potash miner Silvinit, she warns that, on the prices leaked from the Kerimov camp, the transaction is “supportive in the short term, but risky over the longer term for Uralkali; the opposite for Silvinit. A fair premium to the market for Uralkali [should] be a good support for its shares. Regarding Silvinit, the price of the deal was unfairly low, and should not be considered as a guidance for the company’s fair value, in our view as: (1) we assume the sale of the 20% stake in Silvinit was simply part of the deal with Rybolovlev, and (2) further potential negotiations regarding the sale of a controlling stake in Silvinit, once agreed, will likely suggest a good premium to the market. However, we are cautious on Uralkali shares over the longer term, as the company’s future role in a potentially bigger holding as well as the terms of any consolidation remain unclear.”

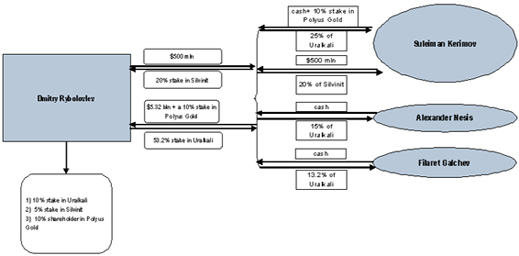

Kupriyanova’s diagram of the transaction also assumes that Kerimov had to pay both cash and his Polyus Gold stake to Rybolovlev:

Silvinit is not commenting on the transaction’s reported terms, and will not say for the time being what it believes to have happened to its shares. According to Silvinit spokesman, Anton Subbotin: “We don’t know who now owns Rybolovlev’s stake. Vedomosti say it is Kerimov, but I can’t confirm this information for you. Minority stakes [of Silvinit] are sold and bought every now and then, and we basically don’t follow this process. We haven’t received a merger proposal from Uralkali, so there is nothing to discuss yet. As you know, there have been speculations over a possible merger for about a decade already.”

The transaction participant reveals that the objective of the transaction series, including the VTB financing, is the “creation of a national potash monopoly”. He means that the so-called Kerimov deal is a transitional one, the outcome of which will see Uralkali united with Silvinit on terms to be approved by the deputy prime minister in charge of .Russian resources, Igor Sechin. It has been Sechin’s cold war with Rybolovlev since 2008 which has pressed down on the Uralkali share price. The latest deal announcement – albeit less than half the real deal – removes the uncertainty over whether Rybolovlev would survive Sechin. He hasn’t. Or as Renaissance Capital analyst Marina Alexeenkova reports to clients: “We believe investors associated the government’s pressure on Uralkali with Rybolovlev, so the change in shareholder structure is seen as eliminating political risk.”

The transaction source said it is too early to judge exactly how Uralkali will be merged with Silvinit; whether the two companies will retain separate identities and managements; and whether additional cash will be required to effect the merger. He dismissed the speculation in the media and the brokerage reports that there is any plan to tie Uralkali to a non-potash mining company.

According to Kupriyanova of Uralsib Bank, “further development of the consolidation story might be also positive, as a consolidated Uralkali and Silvinit would be comparable to PotashCorp in terms of capacity and production (11.5mnt capacity and, potentially, 9-10mnt of production), on our estimates. In trading, if BPC consolidated Silvinit, it would become the market leader in Asia, Brazil and some other markets, in our view.” Canada’s Potash Corporation is the dominant potash share in the stock market, with current market value of US$29.3 billion.

But Kupriyanova’s assessment assumes that Rybolovlev’s hold on BPC will be acceptable to Silvinit, which has long traded potash through its own trading system, and has no interest in doing so through Uralkali’s half-share in BPC. Far more likely is it that the Russian and Belarus potash monopolies will cease trading through the BPC channel, and become autonomous of one another, and possibly trade rivals.

Behind the scenes, Chinese buyers of potash have been pursuing their own interest in securing long-term supplies of the fertilizer without exposing themselves to the price bubble that benefited BPC, Uralkali, and Rybolovlev between 2007 and the crash of autumn 2008. Suspicion that Kerimov may be fronting for a Chinese equity interest in Uralkali has been dispelled by others involved in the latest deal. But that still leaves the Chinese to pursue their potash ambitions with Belaruskali, the Belarus stakeholder in the BPC.

A revolution in potash is now under way. For as long as that remains undisclosed to the potash commodity markets, or to the stock markets in which the fertilizer companies are listed, this is a revolution that is under the table where public shareholders aren’t likely to benefit from it.

Leave a Reply