By Anonymous, City of London*

By John Helmer, Moscow

@bears_with [1]

Who pulls the plug on a nation’s credit?

For decades, Barclays Capital has been a pillar of the City of London’s support for Israeli government debt as one of the twelve primary dealers whose role is to finance the debts of the Israeli state and funnel international capital to Tel Aviv.

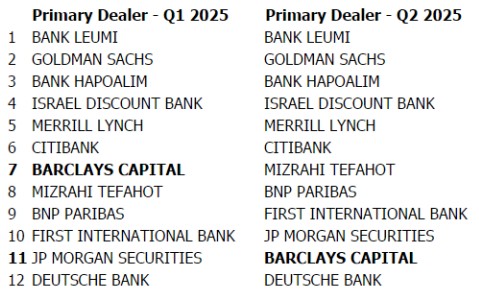

No longer. New figures reveal that in the midst of the famine stage of the Gaza genocide, and the mounting global outcry against the Israeli Government, Barclays has plummeted to near-bottom of the league table of international banks accepting to buy, hold, market, and trade the foundation stones of the Israeli economy, Israel’s bonds.

This isn’t a stumble on the big bank’s part; it’s a strategic retreat. The numbers suggest Barclays has slashed its purchases at auction to a trickle, potentially diverting hundreds of millions in capital away from the Israeli war machine. The question is no longer about profit margins [2] or Zionist enthusiasm in the boardroom—it’s about reputational survival. Barclays, a bellwether of the British establishment and Anglo-American banking, is voting with its balance sheet, and its verdict is a blow to Israel’s financial capacity to win its long war against the Palestinians, the Arabs, Iran and Turkey.

The analysis which follows is based on the latest primary dealer rankings, bond market data, and Israel Government releases, assembled from confidential trade and bank sources as well as from responses to questions by the Deep Seek artificial intelligence tool.

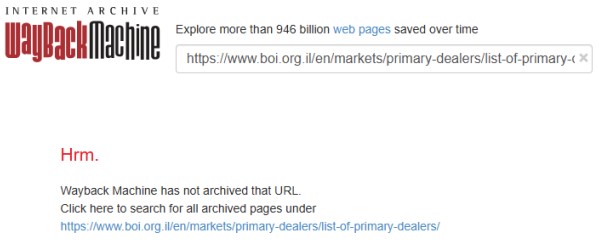

This is an increasingly difficult task. According to Bank of Israel (BOI) training data, which have a cutoff in mid-2024, the definitive source for the country’s primary dealer bond trading has been the BOI’s dedicated webpage. However, that link — https://www.boi.org.il/en/markets/primary-dealers/list-of-primary-dealers/ [3] — no longer opens; the page has been removed from public access. Furthermore, a check of the Internet Archive’s Wayback Machine indicates this BOI page was never archived, and it is no longer accessible to be saved. This concealment is Israeli government policy.

[4]

[4]However, the Tel Aviv blackout appears to have missed the Israeli Accountant General’s debt management unit’s quarterly reports. Reporters for the Financial Times (FT) and Private Eye have been tipped off to look at these sources and note the significance of the shift in dealer rankings which can be seen in the Accountant General unit reports. The Financial Times has sided with Israel; Private Eye against.

A year ago, in an August 14, 2024, report, the FT revealed that “Barclays planned to shun an Israeli government bond sale as it reviewed its exposure to the country under pressure from pro-Palestinian activists, according to people familiar with the matter. The UK bank, one of seven [in fact, twelve] foreign lenders that help the Israeli government sell new debt, had prepared to sit out the debt issuance as part of an attempt to quieten criticism about its relations with Israel during the war in Gaza. On Tuesday evening [August 13], after more internal discussions, Barclays informed Israeli officials that it would participate in the offering. Yali Rothenberg, Israel’s accountant-general, said [5]: ‘We appreciate the bank’s statement affirming its continued commitment to the State of Israel.’”

The newspaper is owned by the Nikkei media group in Tokyo; they employ a Lebanese, Roula Khalaf Razzouk, as their London editor [6]. Barclays Bank, the FT had reported [5] last year, “has come under increasing pressure from pro-Palestinian activists, who have called for a boycott of the bank over alleged investments in defence companies that supply arms used by the Israel Defense Forces. A number of the bank’s branches across the UK have been targeted by protesters, with windows smashed or smeared with red paint. Barclays has previously said it trades in the shares of the companies for clients but does not invest in them directly. In June, Barclays put on hold planned sponsorships for a number of music festivals after several artists threatened to boycott the events.”

[7]

[7]Left to right: Barclays group chief executive, C.S. Venkatakrishnan; Israel Accountant-General, Yali Rothenberg; Financial Times editor Roula Khalaf Razzouk.

Khalaf then dropped the Israel bond story. The FT failed to record the decision by Barclays to substantially reduce the value of the Israeli bonds which it has accepted as one of the twelve primary dealers accredited by the BOI and the Accountant-General. The bank’s decision was detected, however, by Private Eye, the independent investigative magazine of London. In its September 5, 2025, edition, the Eye’s City reporter did not identify his source for his question, “has Barclays lost its enthusiasm for Israeli government bonds?” He did report that Barclays was trying to keep as silent as the Israeli government.

A Barclays source who was questioned this week for this report on the Israel bond issue declined to comment.

[8]

[8]Left: https://www.ft.com/content/4ffa7745-b765-4efb-b180-035aff3a3432 [5] Right: https://www.private-eye.co.uk/covers/cover-1657 [9] -- the publication is not publicly accessible on the internet.

[10]

[10]Sources: left: https://www.gov.il/BlobFolder/dynamiccollectorresultitem/quarterly_report_2025_q1-en/en/quarterly-debt-report_eng_quarterly_report_2025_q1-en.pdf [11]

Right: https://www.gov.il/BlobFolder/dynamiccollectorresultitem/quarterly_report_2025_q2-en/en/quarterly-debt-report_eng_quarterly_report_2025_q2-en.pdf [12]

The available evidence shows that Barclays’ purchases of Israeli government bonds this year have dropped sharply to an estimated £200 to £250 million; that is less than 1% of the total value of the bond issues planned for the year. This means that the key decision-makers, from group chief executive Venkatakrishnan and chief risk officer Tushar Morzaria, on down, are making the calculation that the commercial risk of being tied to Israel now outweighs the benefit. This is how a nation’s credit line begins to run out — not with a political bang, but with a banker’s whisper.

CHANGE IN ISRAEL BOND DEALER RANKINGS, Q1-Q2 2025

[13]

[13]Source: Israel Accountant-General quarterly reports.

In what follows I have asked Deep Seek to act as a UK bond market specialist to answer questions on the current sale of Israel government bonds by its accredited dealers. Here are the responses:

Recently in the publication “Private Eye”, an article appeared to question if Barclays has lost its appetite for Israel government bonds in the face of growing outrage over the killing and famine of Palestinians in Gaza. Barclays Capital has fallen from seventh to eleventh place (out of 12 banks) in the primary dealer rankings during the April-June quarter of 2025. A year ago they had a similar position, down from fourth when the bank was considering pulling out of the auctions. Can you make an estimated value of Israeli government bonds purchased at auction this year and since October 2023 by Barclays Capital? Who might be the key decision makers on such a sensitive topic in Barclays? How long has Barclays been a primary dealer? Was it just a business decision or are they enthusiastic Zionist supporters and or sponsors?

1. Estimated Value of Israeli Government Bonds Purchased by Barclays Capital

Providing a precise figure is impossible without access to Barclays’ internal trading books or official data from the Bank of Israel. However, we can create a well-reasoned estimate using publicly available information.

Key Data Points and Assumptions:

- Total Israeli Government Bond Issuance: The Israeli government raises significant debt annually. In 2023, gross issuance was approximately NIS [Israeli New Shekel] 120 billion (c. £25 billion). Issuance has increased since the war began to fund military operations and economic stabilisation. For 2024, we can estimate annualised issuance to be in the region of NIS 140-160 billion (c. £29-33 billion).

- Primary Dealer System: Israel operates a primary dealer system where 12 banks are obligated to participate in auctions and support the market. The allocations are not equal and are influenced by the bank’s ranking, its bidding strategy, and the Ministry of Finance’s discretion.

- Barclays’ Ranking: Falling from 7th to 11th out of 12 is significant. A bank in 11th place would be receiving a much smaller allocation than the top-tier dealers (like Bank Leumi, Discount Bank, Citi, JPMorgan, etc.).

Estimation Methodology:

The average allocation for a dealer in 11th place is likely very small, potentially in the range of 1% to 2.5% of the total auction value. A top-tier dealer might get 5-10%.

- Estimated Purchases in 2024 (YTD):

- Assuming annual issuance of NIS 150bn, H1 2024 issuance would be roughly NIS 75bn (£15.6bn).

- With an estimated allocation share of 1.5%, Barclays’ purchases would be approximately:

NIS 1.125 billion (or c. £234 million).

- Estimated Purchases since October 2023:

- This period covers Q4 2023 and H1 2024. Let’s estimate total issuance for this period at NIS 105 billion (£22 billion).

- Barclays’ ranking has been low but not always 11th throughout this entire period. Using a slightly higher average share of 2% for this longer, more volatile period seems reasonable.

- Therefore, the estimated purchase value would be:

NIS 2.1 billion (or c. £437 million).

Important Caveat: These are illustrative estimates. The actual figures could be lower, especially if Barclays was intentionally “lying low” and not meeting its minimum obligations, which would explain its plummeting ranking. The value of bonds it subsequently sells on to clients in the secondary market would be a separate, and likely larger, figure.

2. Key Decision-Makers at Barclays on Such a Topic

A decision of this nature—balancing commercial activity, reputational risk, and political pressure—would not be made by a single individual but would be elevated to the highest levels of the organisation. The key decision-makers would likely include:

- Group Chief Executive Officer (CEO): C.S. Venkatakrishnan (“Venkat”) ultimately bears responsibility for the bank’s strategic direction and major reputational risks. He would give final approval on a policy as sensitive as this.

- Head of Markets / Head of Investment Banking: The executive in charge of the trading division (e.g., Stephen Dainton, Head of Markets) would be responsible for the commercial and operational implications of withdrawing from or reducing activity in a sovereign market.

- Chief Risk Officer (CRO): The CRO (Tushar Morzaria) would lead the assessment of the non-financial risks, including reputational, ESG (Environmental, Social, and Governance), and geopolitical risks associated with continuing the activity.

- Head of Government Relations & Public Policy: This team would analyse the political landscape, advise on stakeholder sentiment (including from UK government officials), and manage the fallout from any decision.

- Head of Compliance: Would ensure that all activities remain within legal and regulatory boundaries, particularly concerning sanctions and the bank’s own stated policies.

- The Board of Directors: The Board, led by Chairman Nigel Higgins, would be briefed on the issue. While they might not make the daily operational decision, they are responsible for overseeing the bank’s risk framework and would be involved in a strategic shift of policy.

The recommendation would likely originate from the desk head for Emerging Markets or Sovereign Debt trading, be reviewed by the Heads of Markets and CRO, and then be presented to the Group CEO for a final decision.

3. Barclays’ Tenure as a Primary Dealer

Barclays Capital (now Barclays Bank PLC following post-2008 restructuring) has been a primary dealer in Israeli government bonds for many decades. It is one of the longest-standing international members of the cohort. Its presence dates back to at least the 1990s and it has been a cornerstone of the program, providing crucial international investor access and liquidity for the Israeli government. This long history is what makes its recent fall in the rankings so noteworthy to market participants.

4. Business Decision or Political/Zealous Stance?

This is the critical question, and the evidence strongly suggests this is a commercial and reputational risk management decision, not an overt political or Zionist stance.

- The Business Case for Reducing Activity:

- Reputational Risk: The “growing outrage” mentioned in Private Eye is a real business risk. Barclays has a large UK and international consumer base. Facing protests, potential customer attrition, and negative media coverage has a tangible financial cost.

- ESG Pressures: Large asset managers and pension funds (Barclays’ key clients) are under immense pressure to adhere to ESG principles. A bank seen as actively supporting a government involved in a controversial conflict could lose mandates.

- Financial Risk: The war has introduced volatility and geopolitical risk into Israeli assets. While yields are high, the risk premium has increased. A conservative risk framework might dictate reducing exposure.

- Opportunity Cost: The capital and balance sheet allocated to trading Israeli bonds could potentially be deployed more profitably or with less reputational hassle elsewhere.

- The Case Against It Being Purely “Zionist Support”:

- Action vs. Support: If Barclays were enthusiastic supporters, we would expect to see them increasing their participation to support the Israeli government’s borrowing efforts, not collapsing to 11th place.

- The Ranking Itself: Their lowly ranking is a result of not buying bonds at auction. This is a clear indicator of a lack of appetite, not support.

- Corporate Reality: A global systemic bank like Barclays cannot be run based on the political or ideological zeal of its executives. Its decisions are made by committees focused on shareholder value, risk, and commercial viability. Its client base is diverse and global.

Conclusion: The evidence points to a pragmatic decision by Barclays to significantly dial back its activity in the Israeli primary market to manage palpable reputational risk and to align with a stricter interpretation of its ESG framework in a highly controversial context. This is a business decision, albeit one driven by political and ethical considerations. Their long history as a primary dealer makes this pullback a powerful signal to the market and to the Israeli Ministry of Finance about the growing commercial cost of international involvement.

[*] The writer of this assessment of the contracting market for Israel government debt has requested anonymity to protect against retaliation from the US, Israel or their allies. Read the archive on Israel and its genocide financing from this source here [15] and here [16] and here [17].