By John Helmer, Moscow

Mechel, the steelmaker and coalminer owned by Igor Zyuzin, is the dominant producer in Russia of the type of alloyed steel known in the English-speaking world as stainless. In French, it is known as inox (inoxydable).

Neither term is quite accurate, but what is meant is everywhere clear. Because the steel includes chrome alloy, it is more resistant to corrosion and discolouration (effects of oxidation). Adding nickel and manganese alloys also helps this resistance and preserves the sheen of the steel.

|

Standard cutlery like this is usually made of steel with 18% chrome and 10% nickel. |

The technology for producing stainless steel has been well known for more than a century. And this is how it works in a mill producing stainless steel products.

What remains a mystery is why Mechel refuses to identify its stainless steel production when it issues its quarterly, half-yearly and annual production and trading reports. That doesn’t, however, mean that nothing can be known about this branch of the Russian steel business, which was in line for takeover from Mechel by the state conglomerate, Russian Technologies, in 2008. That year the global metals trade collapsed; the Russian steelmakers were on the edge of insolvency; and the contraction of the state budget and banking system forced a postponement of the planned buyout.

Into this information gap has stepped an association of the stainless steel producers of Russia called Spetsstal; naturally Mechel is one of the prominent members. Last week, Spetsstal issued an annual report on the output and trade performance of the stainless sector for 2011. This discloses substantial growth in export shipments of stainless billets and long products. The statistics also reported by Spetsstal indicate parallel growth in imports, and at much greater volumes. The big story is that with Mechel in the lead, production of stainless steel has been stagnating in Russia for several years. When domestic Russian demand grows, imports must jump to keep up.

The Spetsstal report made available to CRU Steel News reveals that domestic output of all stainless came to 135,200 tonnes, up 10% on the year. Imports totaled 244,500t, up 25%. Exports grew by 34% to 7,860t.

Despite Mechel’s role as lead producer of stainless steel in Russia, it has declined to respond to requests for details of this output or trends in sales. Nor will the company explain why it is holding this information back.

In point of fact, because Mechel lists and trades its shares on the New York Stock Exchange, the disclosure and reporting rules of the US Securities and Exchange Commission (SEC), disallow withholding the stainless steel results. Accordingly, it is possible to retrieve the SEC’s Form 20F which Mechel submits each year; put “stainless” in the search box; and find out what the company routinely refuses to admit to in Moscow.

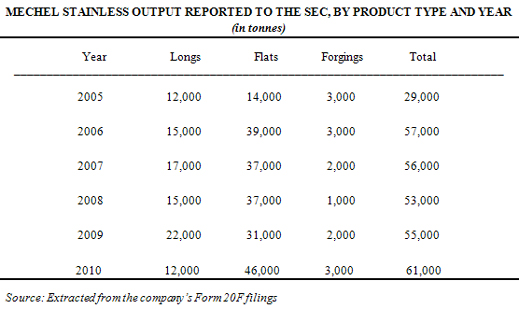

Mechel’s accountants generally take five months into the new year before they lodge Form 20F for the previous one. For the time being, therefore, it is too soon to know what happened at Mechel’s stainless division during 2011. In 2010, according to Form 20F filed on May 12, 2011, the company turned out 12,000t of stainless longs, a decline of 46% from the 2009 volume. Output of stainless flat products in 2010 came to 46,000t, up 48% on the previous year. Stainless forgings totaled 3,000t, up 50% on 2009. The Chelyabinsk mill is the sole source identified in the US reports for Mechel’s stainless production. Sales of stainless longs amounted to $52.5 million in 2010, less than 1% of the company’s total revenues that year. Revenues for the sale of stainless flats in the same period were $203.9m, 3.6% of the revenue aggregate.

According to the company, “we were one of the leading producers in Russia of specialty long steel products (bearing, tool, high-speed and stainless steel) in 2010, producing 14.8% of the total Russian output by volume, and we had significant shares of Russian 2010 production volumes of stainless long products (41.7%).”

Mechel reports that in 2010 it held a 76% market share for domestic production of stainless flat products. Other Russian producers of stainless flats include the Volgograd Metal Works (Red October), Serp i Molot Moscow (Hammer & Sickle), and Severstal. The last of these produced just 4,000t of stainless in 2010, according to the Mechel report. The all-Russia total for stainless flats for 2010 came to 60,100t.

Here is a tabulation of the data Mechel issues each year to the SEC:

The same source reports that Mechel’s sales of stainless steel products more than doubled between 2005 and 2007, peaking at $264.8 million before diving to $158.8 million in 2009, and recovering again in 2010 to $279.2 million. As a proportion of Mechel’s steel sale revenues each year, stainless has remained constant at about 5%.

In company accounting, that might be thought too small to warrant special reporting, except for the fact that before the bust in 2008, there were signs the Kremlin believed that stainless steel production was sufficiently strategic in economy-wide terms to warrant stimulation of production growth and substitution for imports. Zyuzin, however, has other priorities.

The new disclosures by Spetsstal for 2011 indicate that stainless imports exceeded domestic output by almost 2 tonnes to 1. The newly released statistics reveal that for the 11 months to November 30, the largest-volume import was stainless flats at 152,275t, up 29% on the same period of 2010. Stainless longs came next in volume, with imports aggregating to 34,797t, up 55%. Stainless welded tubes ranked third in volume of imports at 14,949t, down almost 2% on 2010. According to Mechel’s 20F report to the SEC, higher import volumes have been encouraged by a reduction in the import duty from 15% to 10% commencing January 1, 2010.

For the full year, according to Spetsstal, Russian stainless exports rose 34% on the year to 7860t; stainless billets rose more than threefold to 1380t; stainless longs jumped 38% to 2930t. There were small-volume exports too of stainless wire and seamless pipes. Roughly three-quarters of these exports went to CIS countries.

Maxim Ovchinnikov, head of the industry department of the Federal Antimonopoly Service (FAS) in Moscow, said that because of its dominant position in the stainless steel market, the FAS monitors Mechel. But he was unaware that the company is not publishing quarterly production or stainless sales information alongside other product and sales results. Refusal to publish the information is not a violation of Russia’s competition law, he added. “Many companies are doing this in the same way. In Russia they are not obliged to publish all this information, as well as in the United States. But they are doing it there for greater transparency.”

A member of the Mechel press service responded: “Alas: we do not disclose this information.” Asked why Mechel does provide the information in Washington, but not in Moscow, there was no reply.

Leave a Reply