By John Helmer, Moscow

Barry Cheung (second left), the new board chairman of United Company Rusal and the first non-Russian chairman of a Russian monopoly, is viewed by his countrymen and business peers as a technocrat, a politician, and a businessman, in that order.

The one business he reports in the curriculum vitae released by Rusal is the Bermuda-registered, Hong Kong-listed Titan Petrochemicals Group Limited. This company says it has concentrated on selling floating and land-based oil storage services for Chinese oil buyers, as well as bunker fuel for vessels, after dropping out of the business of oil trading in 2008. Cheung says he was chief executive officer between July 2004 and January 2008, and then vice chairman of the Titan board. A search of Titan’s annual reports from 2008 to 2011 reveals that Cheung was replaced as chief executive in 2007 and moved to deputy chairman of the board; but he resigned from that post in June 2008.

The financial performance of Titan while Cheung was in charge may be one reason for his departure. It’s a record that has not been released by Rusal. In 2000 and 2001, Titan was loss-making. In 2003, it recorded a bottom-line profit of HK$100.5 million (US$13 million), which rose to HK$400.5 million ($52 million) in 2004. But so did Titan’s obligations to its bankers – about HK$1.6 billion ($206 million) is recorded in the annual report for 2004.

The rest of Cheung’s turn at the capstan is a story of taking on water and sinking beneath the waves. In 2005, profit was HK$303 million ($39 million); bank loans HK$420.5 million ($54 million). In 2006, profit of HK96.5 million ($13 million), loans of HK$642.9 million ($83 million). In 2007 Titan reported a loss of HK$31 million ($4 million), while loans more than tripled to HK$1.9 billion ($245 million). In 2008, the loss was HK$1.6 billion ($206 million), debt HK$624.5 million ($81 million). Since Cheung’s exit from operations and then from the board, Titan has recorded a loss every year, including last year. Debt has also come down to HK$666.9 million ($86 million) as of June 30, 2011.

In 2010, the company was on the verge of bankruptcy, as this report reveals. At the moment, Titan has requested a halt to trading of its shares on the Hong Kong Stock Exchange. Serene Goh, the company’s manager for corporate affairs, declined to explain the reason for the halt, saying “I really can’t remember.” Market sources believe more loss-making news for the full financial year to December 31 is coming.

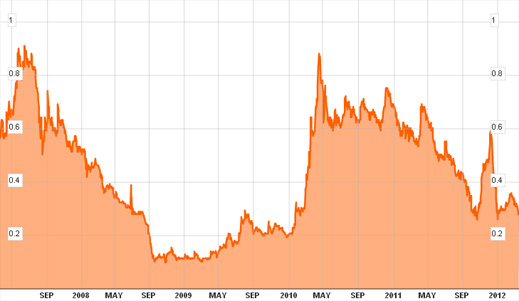

Titan’s current market capitalization is HK$2.2 billion ($284 million). Cheung is reported as holding share options from Titan after he left the board, but Goh would not say what stake he may continue to hold in Titan. Titan’s business and share value should have moved in line with China’s demand for imported crude oil and oil products, as Cheung himself claimed in one chief executive’s message. But the 5-year Titan stock price chart, provided by Bloomberg, shows a different story:

Cheung reported in his resume in Titan’s annual reports that he had pursued two lines of business before he took charge of Titan’s fortunes. These disclosures have been omitted from the Rusal reports. “Prior to joining the Company [Titan], he [Cheung] was the Chief Executive Officer of Camelot Asset Management Limited (1999–2004) and Chief Executive Officer of Fortune Oil Plc (1994–1999).”

Fortune Oil was in a similar line of oil transportation, storage and trading with Chinese oil buyers as Cheung went on to manage at Titan. The Fortune Oil website does not preserve its financial reports before 2004, so it isn’t possible to estimate what Cheung added to or subtracted from the balance-sheet when he was in charge. The available data indicate that at the time Cheung was running the company, it was turning over a small amount of revenue at a modest profit. Even today, long after Cheung moved on, Fortune Oil’s market capitalization on the London Stock Exchange is ₤213.7 million ($338 million).

Camelot Asset Management was founded in 1999 and dissolved in 2009, according to the Hong Kong market source, Webb-Site.com. Cheung is the only executive in the leftover record.

Webb-Site reveals a longer list of Cheung’s business associations than he has volunteered to Rusal shareholders or to Russian analysis. These include A.R.Evans Capital Partners Ltd, which appears to be registered in the Bahamas and to have traded under other names; Camelot Oil Company, which is now defunct; and Cinderella Media Group Ltd., a Bermuda registrant. Cheung left the Cinderella board in 2003. Here is the full Cheung curriculum vitae, according to Webb.

| Organisation | Position | From | Until | |

| 1 | A R EVANS CAPITAL PARTNERS LIMITED | Dir | ||

| 2 | CAMELOT ASSET MANAGEMENT LIMITED | CEO | ||

| 3 | CAMELOT OIL COMPANY LIMITED | CEO | ||

| 4 | * Cinderella Media Group Limited | INED | 19-Apr-2000 | 15-May-2003 |

| 5 | Fortune Oil Plc | CEO | 1994 | 1999 |

| 6 | HKSAR Central Policy Unit | Member | 1993 | 1994 |

| 7 | HKSAR Commission on Strategic Development | Member | 1-Jul-2009 | 1-Jul-2012 |

| 8 | HKSAR Energy Advisory Committee | Member | 22-Nov-2000 | 15-Jul-2006 |

| 9 | HKSAR Justices of the Peace (non-gov) | Member | 1-Jul-2000 | |

| 10 | HKSAR Standing Commission on Civil Service Salaries and Conditions of Service | Member | 1-Jan-2008 | 1-Jan-2014 |

| 11 | HKSAR Standing Committee on Disciplined Services Salaries and Conditions of Service | Member | 1-Jan-2007 | 1-Jan-2009 |

| Ch | 1-Jan-2009 | 1-Jan-2013 | ||

| 12 | Hong Kong Mercantile Exchange Limited | Ch | ||

| 13 | ICAC Advisory Committee on Corruption | Member | 1-Jan-2001 | 1-Jan-2006 |

| 14 | ICAC Corruption Prevention Advisory Committee | Member | 1-Jan-1999 | 1-Jan-2001 |

| Ch | 1-Jan-2001 | 1-Jan-2006 | ||

| 15 | INDEPENDENT POLICE COMPLAINTS COUNCIL | Member | 1-Jan-2007 | 1-Jan-2009 |

| 16 | Titan Oil Pte. Ltd. | Dep Ch | ||

| 17 | * TITAN PETROCHEMICALS GROUP LIMITED | CEO | 9-Jul-2004 | 3-Jan-2008 |

| 18 | * UNITED COMPANY RUSAL PLC | INED | 27-Jan-2010 | 16-Mar-2012 |

| INED,Ch | 16-Mar-2012 | |||

| 19 | URBAN RENEWAL AUTHORITY | NED | 1995 | 1-May-2007 |

| Ch | 1-May-2007 | 1-May-2013 |

Awards

| Organisation | Position | From | Until | |

| 1 | Gold Bauhinia Star | Award | 1-Jul-2010 |

* = currently HK primary-listed.

Source: http://webb-site.com/dbpub/positions.asp?p=10909.

Two years on a municipal police complaints committee, and seven years on a committee providing advice on corruption may be learner qualifications for the more controversial aspects of Rusal’s business. Both Hong Kong organizations carry the title “independent”, which is the qualification that promoted Cheung to the chairman’s seat on the Rusal after the resignation of Victor Vekselberg (far right image)last week. But does Cheung have a career record that might make him independent of Rusal’s chief executive, Oleg Deripaska (second from right)?

An influential Hong Kong market source, requesting anonymity, is sceptical. He notes that Cheung is currently running the election campaign of Leung Chun-ying for Hong Kong’s top elected post. “Barry is nothing if not politically astute. He was close to Hong Kong’s Chief Executive Donald Tsang for a long while, which is presumably why he is chairman of the Urban Renewal Authority. [Tsang] also helped him with the Hong Kong Mercantile Exchange. At the same time he is chairman of the election campaign for CY Leung in the chief executive’s contest [scheduled for vote on March 25]. Leung is opposed by [former Chief Secretary Henry] Tang. He is one of those guys who’s able to float around the upper echelons of Hong Kong without ruffling too many feathers. The other thing about Barry is that he struggles to get the Mercantile Exchange going. It was announced in 2008 and was supposed to be up and running in 2009. But it was delayed repeatedly until its opening in December 2011.”

In Rusal’s appointment announcement, Deripaska said: “We are thrilled to have someone of Barry’s caliber leading us as Chairman. The advice he has given in his role as an independent director has been highly valuable and insightful. We are confident that his extensive experience and diverse expertise will continue to add considerable value to our future development in Asia and globally.”

Leave a Reply