By John Helmer, Moscow

Roman Abramovich was recently able to bamboozle a British judge with no experience of Russia, when the credibility standard was set by Boris Berezovsky. But can his winsome personality persuade President Vladimir Putin and energy chief Igor Sechin that Russia badly needs to acquire an Australian company that has adapted Soviet technology for turning coal into gas; should lend Abramovich up to $2 billion to buy the asset; and maybe several hundred more million dollars to flip the asset to Evraz, the Russian steel and coalmining group which Abramovich’s holding, Millhouse, already controls?

Abramovich’s last attempt at spending a Russian dividend stream on foreign assets was aborted when Evraz withdrew its bid to buy Scaw Metals, a South African steelmaker owned by Anglo American. That deal, worth between $500 million and $700 million, didn’t happen at the same time as Victor Rashnikov was extricating Magnitogorsk Metallurgical Combine from its $560 million commitment to buy Flinders Mining, an Australian iron-ore project.

Sitting on the buy and sell side of the table has been a lucrative sideline for Abramovich in the past. The Klen goldmining licence transaction with Highland Gold was a recent one, and it may have netted Abramovich more than $60 million. in 2003, in the better known sale of the Maiskoye gold deposit, the deal value to Abramovich was about $35 million. With time and experience Abramovich’s returns on the flipside are growing robustly. If he goes ahead with a takeover of Linc Energy at the Australians’ asking price, and then induces the Evraz board of directors to vote in favour of buying the asset from Abramovich, the multiple may be a personal payoff record.

According to the company’s reports to the Australian Stock Exchange, Linc Energy is currently operating in the red, with negative cashflow in the September quarter of A$32.7 million, and $215 million owed to Wells Fargo Bank of the US. In the financial year to June 30, the company recorded a loss of A$61.9 million. According to this week’s Australian reports, after Abramovich had flown off, its acquisition value is A$2.5 billion (US$2.6 billion).

In Brisbane Abramovich met with Linc Energy’s chief executive, Peter Bond, and toured a coal gasification test site in Queensland. Through a company called Newtron and other nominees, Bond is the dominant stakeholder in Linc Energy with a stake of 39.6%, according to company documents filed with the Australian Stock Exchange.

Linc Energy’s share price has been plummeting downwards for the past twelve months to less than a third of the A$2 it fetched in November 2011. That’s a contraction in market value from more than A$1 billion to just A$324 million today. The news of Abramovich’s visit lifted Linc Energy’s share price by 11% –7% on the day after the news became publicly known.

12-MONTH TRAJECTORY OF LINC ENERGY SHARE PRICE:

According to the Australian press leaks, which appear to have come from Bond or his associates, Abramovich flew to Australia on the weekend of November 3-4; had “confidential talks” with Bond; and together “were seen having dinner at Matt Moran’s ARIA restaurant in Brisbane, before the Russian billionaire had a private tour of the Chinchilla operations, about 300 kilometres west of Brisbane.” Bond isn’t commenting officially. The Australian Financial Review claims the visit was “confirmed by sources in the resources sector.” One of the sources also claimed for publication to know Abramovich’s motive. “There are common interests. They [Abramovich’s Sibneft] used to be big in oil and they want to be again because they sold out of their oil interests.” An equity investment or joint venture is “one of the deals being considered” by Abramovich, it was reported.

Bond has reportedly been trying to divide Linc Energy’s assets and spin off one or more of the divisions – oil and gas, coal, shale, and clean energy — or sell them in toto, if he can get his price. According to the Australian advertisements, one expert valuation of the group is A$2.5 billion. This is a slight premium above the one on the table in June, when a Chinese sugar-daddy, the Golden Concord Group subsidiary GCL Projects, agreed to set up a joint venture with Bond.

This is planned to turn Linc Energy’s technology claims into a China-based plant for generating gas from underground coal (UCG) and then converting the gas into liquid fuel (GTL). This deal reveals how short of cash Bond and his company are, and how dependent on the Chinese. For 33% of the joint venture company, Linc Energy will put up no money. The Chinese, by contrast, will take 67% of the venture and are committed – according to the Linc Energy release – to pay $20 million over three years to finance preliminaries and site test works; plus all the capital required for “the commercial projects the joint venture undertakes in China”; plus A$120 million “for an approximately 5% interest in the issued capital of Linc Energy.” The first share purchase for 2.5% would be arranged at a share price of $4.50 per share. “The subscription price per share for the second placement [2.5%] will be the higher of the subscription price per share of the first placement or 130% of the 30 day VWAP immediately preceding the second placement.”

In their first flush of enthusiasm, it looks like the Chinese agreed to pay for a minority stake in Linc Energy at a full asset valuation of A$2.3 billion. Since then, however, noone in the Australian stock market appeared to agree. Instead of the Golden Concord deal pulling Linc Energy’s share price upward, it started at $1.035 before the first press report, rising to $1.27 on April 16, then down to 61 cents on June 28, up again to 78c on July 4, before crashing again on July 30 to 48c. The gap between the Chinese and the market valuations is so large, it raises the usual questions of who benefits, and how lawfully. Why Abramovich’s dinner tete-a-tete last weekend could lift Linc Energy’s share price, after the Chinese transaction notice did not, is equally puzzling. Could Abramovich be promising Bond an even higher premium than Golden Concord’s offer?

Russian oligarchs don’t usually display the willingness to offer over-market premiums unless they have a resell target in mind, with the means to pay even more.

In the Russian coal industry there is next to no expert sentiment in favour. A source at Siberian Coal and Energy Company (SUEK), one of the dominant steam-coal miners and exporters (owned by Andrei Melnichenko and Sergei Popov), says that technologies for underground coal gasification were tried in the Soviet era, and subsequently abandoned in Russian coalmining practice.

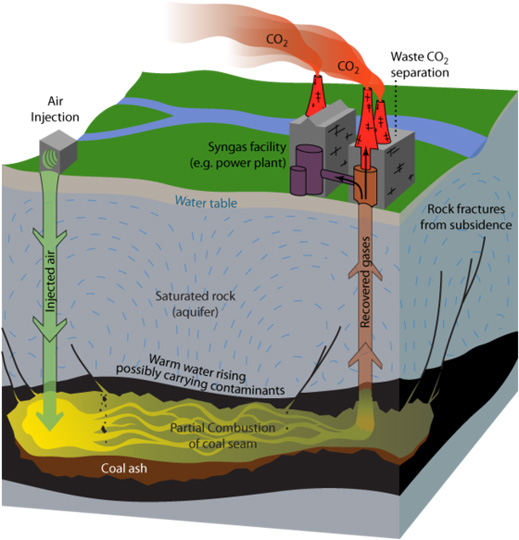

The technology in use by Linc Energy is reportedly derived from the Soviet designs and well tests. The process is highly volatile, using high pressure combustion at temperatures ranging from 700 °C to 1,500 °C. Contamination of the acquifer and subsidence are also risks.

At Mechel Mining, Russia’s leading producer of coking coal, a source explains that in new mine planning in the Kuzbass region, and in Mechel’s new projects in Yakutia, there has been no exploitation of the gasification technology. “As far as I know, no one in Russia is engaged in it. So it is difficult to suggest what the demand is [for coal gasification in Russia]. In the former Soviet Union, there is one company that uses this technology – JSC Erostigaz in Uzbekistan. Maybe they have something to be able to comment.” Erostigas has no internet profile and is uncontactable.

Anatoly Skryl, head of the Russian coal industry think-tank RosInformUgol, is sceptical on cost. “[This technology] is nowhere available on a broad industrial scale. It would be good – not to go down into the earth, but fire up and get out the gas out to produce energy. But there are no cheap and effective technologies, though attempts are being made to find them.”

Alexei Kokin, energy analyst at Uralsib Bank in Moscow, says that such a search makes sense in countries which are short of gas, but not in Russia. “We have plenty of cheap gas. It might be interesting only for some coal companies which want to take some extra profit. In Australia, as in America, there is a very different situation. Therefore, these technologies will be used in Australia, maybe in the United States and China. It is irrelevant in our country, and will be irrelevant for another 20 years.”

Vyacheslav Bunkov, energy analyst at Aton, warns that the technology is “one of the most dangerous mining methods, because there is a high risk of explosion. And it is very expensive. We have growth in our gas production and we have many traditional gas fields, where significantly higher costs are not required, compared to alternative gas production, such as shale or coal bed gas.” He added that the Ukraine has been considering coal gasification “as they try to reduce their dependence on Russian gas. They have wanted to develop it [for this purpose]. It applies to countries where gas production is at a low level, where almost no natural gas resources are available at all.”

It would be surprising if Abramovich and Evraz, which already has steelmaking and iron-ore mining operations in the Ukraine, intend to apply to the Kremlin for permission and state loans to invest in a Ukrainian alternative to Gazprom’s natural gas supplies. Asked to say whether the group has an interest in coal gasification or Linc energy, an Evraz spokesman said the question will be answered in time by the company’s experts.

At Raspadskaya, the coking coal miner recently taken over by Evraz, a spokesman said that for the answer to the same question, application should be made next week. Another source said he knew of no discussion of coal gasification by Raspadskaya in recent years.

Abramovich’s spokesman in Moscow, John Mann, was asked what coal or gas interests Millhouse currently holds. “We do not have a direct stake in Raspadskaya”, he replied. “We do have a non-controlling (something you often get wrong!) stake in Evraz. That has – very transparently – been disclosed in full on many occasions.” He added that Abramovich and Millhouse have no other coal and gas interests.

He was also asked for details of Abramovich’s meeting with Bond; specifically, do Mr Abramovich and Millhouse believe that an Australian acquisition of this type has Kremlin approval, and would not go the way of the proposed Flinders Mining (MMK) or Scaw Metals (Evraz) attempts early this year? Mann replied: “We have no comment at this time.”

Leave a Reply