By John Helmer, Moscow

United Company Rusal, the Russian aluminium monopoly, has announced it has won a judgement of the London Court of International Arbitration (LCIA) confirming its shareholding control of the Aluminium Smelter Company of Nigeria (Alscon), the only aluminium producer in the west African state. The LCIA, Rusal claims, has defeated the Nigerian Government’s challenge to the legality of the privatization of the plant in Rusal’s favour in 2004, and Rusal’s subsequent purchase of Alscon shares in 2006.

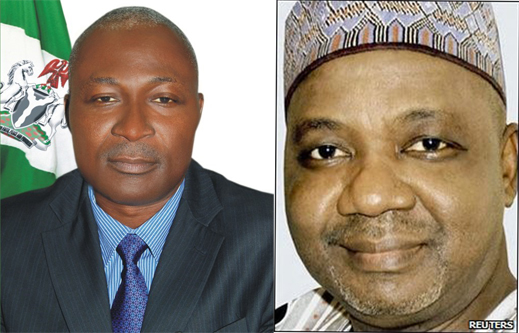

Because the LCIA proceeding is a closed-door arbitration, no text of the October 15 ruling has been released. But Nigerian sources and lawyers close to the case say the London tribunal has made no findings of fact in the case; and that it has done no more than accept an out-of-court settlement Rusal has signed with the Nigerian Bureau of Public Enterprises (BPE). The terms of this settlement, the Nigerian sources are emphatic, have not been approved by the Nigerian Government’s authority for state property, the National Council on Privatisation (NCP). It is headed by Vice President Namadi Sambo (lead image, right).

“This is not really a judgement,” said Jimmie Williams, US attorney for Bancorp Financial Investment Group Divino Corporation (BFIG), whose $410 million bid for Alscon in 2004 was rejected by BPE in favour of the offer of $250 million from Rusal control shareholder, Oleg Deripaska (lead image, left). “What it means is that BPE, which was overseeing the matter, agreed to a settlement. But the left hand doesn’t know what the right hand is doing. BPE is subordinate to the NCP. The NCP did not approve the settlement.”

In a press release issued on October 16 Deripaska’s company said the LCIA has “rendered an award in favour of UC RUSAL in its case against four Nigerian state entities: the Bureau of Public Enterprises, the Federal Government of Nigeria, the Ministry of Finance, and the National Council for Privatisation… In the consent award of 15 October 2014 the tribunal confirmed the parties’ agreement to the effect, inter alia, that the share purchase agreement between the Company and the respondents of 3 February 2006 (“SPA”) is valid, binding, and in full force and effect according to its terms; that under the SPA the Company acquired full legal and beneficial title to the relevant ALSCON shares free and clear of all encumbrances; and that the respondents’ counterclaims are dismissed [1].”

The Alscon smelter has never been fully operational since it was first designed and partially completed in 1997. Its value has dropped from more than $1 billion at commissioning to $60 million now. Several recent attempts by Rusal to sell half or more of its shareholding have failed to find buyers. The full story can be followed here [2].

The last Rusal financial report, issued [3] on August 28, reported that operations are suspended at Alscon. Rusal’s annual reports indicate that design production capacity of the smelter was 197,000 tonnes of aluminium per annum. In 2010, production was 18,000 tonnes; in 2011, 15,000 tonnes; in 2012, 22,000 tonnes; and in 2013, 2,000 tonnes. According to last week’s Rusal press statement by Alexei Arnautov (right), director for new projects, Rusal “has put greatefforts into turning the smelter, which had previously sat idle for 10, years into a modern, technologically advanced manufacturing enterprise…we are making every effort to ensure that ALSCON will be ready to recommence production once the aluminium market improves.”

The last Rusal financial report, issued [3] on August 28, reported that operations are suspended at Alscon. Rusal’s annual reports indicate that design production capacity of the smelter was 197,000 tonnes of aluminium per annum. In 2010, production was 18,000 tonnes; in 2011, 15,000 tonnes; in 2012, 22,000 tonnes; and in 2013, 2,000 tonnes. According to last week’s Rusal press statement by Alexei Arnautov (right), director for new projects, Rusal “has put greatefforts into turning the smelter, which had previously sat idle for 10, years into a modern, technologically advanced manufacturing enterprise…we are making every effort to ensure that ALSCON will be ready to recommence production once the aluminium market improves.”

Through a decade of proceedings in US and Nigerian courts BFIG has tried to recover Alscon, and reinstate its original privatisation deal. In July 2012, the Supreme Court, Nigeria’s highest court, ruled unanimously in BFIG’s favour [4]. This cannot be appealed. The out-of-court settlement in London last week sidestepped the Nigerian government’s and BFIG’s case that the LCIA lacked jurisdiction to overturn the Supreme Court’s judgement.

Last month, the Nigerian High Court ordered [5] the government to implement the Supreme Court order, accept BFIG’s payment, and proceed with the transfer of the plant. According to this order, BFIG’s “employees and agents shall forthwith have full, uninterrupted and unrestricted access to ALSCON to conduct a firsthand assessment of the business affairs of the Company, including engineering, technical, financial, accounting, facility, environmental, personnel, dredging and legal records pursuant to the decisions of the NCP [National Council on Privatisation].”

A spokesman for BFE said last week, a day ahead of the London settlement, that the High Court enforcement order was an “error”, and it is appealing. BFE also said it is refusing to hand over Alscon to the management of any company except Rusal.

[6]According to the Nigerian statutes and regulations, BPE (Abuja office, right) is a “secretariat” of the privatisation council [7] which is “the apex body charged with the overall responsibility of formulating and approving policies on privatisation and commercialisation.” The Public Enterprises (Privatisation and Commercialisation) Act of 1999-2004 “establishes a council [NCP] to determine political, economic and social objectives for privatisation and commercialisation of public enterprises.” BPE reports to the council, according to the 1999 law [8], and is “subject to the overall supervision of the Council”.

[6]According to the Nigerian statutes and regulations, BPE (Abuja office, right) is a “secretariat” of the privatisation council [7] which is “the apex body charged with the overall responsibility of formulating and approving policies on privatisation and commercialisation.” The Public Enterprises (Privatisation and Commercialisation) Act of 1999-2004 “establishes a council [NCP] to determine political, economic and social objectives for privatisation and commercialisation of public enterprises.” BPE reports to the council, according to the 1999 law [8], and is “subject to the overall supervision of the Council”.

BPE’s chief executive is Benjamin Ezra Dikki. On the BPE website he says he was a stockbroker and investment banker before he took over at the Bureau. His first brokerage, First Atlantic Securities, lost its licence in 2012 [9]. His second brokerage, Galaxie Securities Limited, leaves no internet trace. Dikki (below left) is a member of the NCP, but as a secretary of the council he is outranked by the chairman, Vice President Sambo (right), several government ministers, and the Central Bank governor.

Last week, according to BPE, “BFIG has not paid a kobo. As a result, BPE’s position has long been that BPE performed its obligations under the Supreme Court decision of July 6, 2012 but BFIG failed to perform its part of the obligations, the result being, in our opinion, that BFIG has no right to the said shares.”

Next Friday, October 24, is the deadline set by the Nigerian courts for BFIG to make a 10% down-payment of $41 million, and commence its takeover. The payment balance of $369 million is due after KPMG completes an audit of Alscon’s books and of the condition of the plant.

According to Williams, police and court marshals will accompany Alscon representatives during the takeover. “We are giving [BPE] the opportunity to save face, save legality. We will pay the money [$41 million] by Friday. BPE should then sign the [share transfer] agreement. If they don’t sign the agreement, we will go into the plant with police escort.”

Following last week’s London settlement, the Rusal press release implies that “the consent award” signed with BPE includes a Rusal claim for compensation, should it lose Alscon to BFIG. Williams for BFIG says the “agreement appears to include a compensation payment.” A source close to Rusal claims that “Deripaska doesn’t want to spend on Alscon, and Rusal doesn’t have the cash to restart the lossmaking plant. The London proceeding is an attempt to get the Nigerian government to pay compensation.”

Until BFIG and auditors from KPMG can assess the operability of the plant and its assets, it is not clear what, if anything, the Nigerian government might owe Rusal. Rusal and Alscon reports claim the plant has an outstanding debt to other Rusal group companies of at least $135 million. Rusal says the control shareholding is worth what Rusal paid in 2006 — $250 million – plus Rusal’s subsequent investment of $76 million. Total, $461 million.

BFIG claims that Rusal paid no more than $140 million for its privatisation shares, and is challenging BPE to prove what Rusal actually paid in cash between 2004 and 2006.

For BFIG Williams says: “According to the terms of reference of the NCP, undertakings in the agreement signed by BPE with Rusal last week in London are subject to review and approval by the finance and legal committees [7] of the NCP.” According to Williams, “the agreement is subject to Nigerian law, and the [LCIA] ruling has to be presented [by BPE] in a Nigerian court, which is bound by the Supreme Court. We aren’t concerned about what the outcome will be. BPE can’t spend a kobo on Rusal [compensation].”