By John Helmer, Moscow

Ekaterina Videman is the spokesman for Mechel and Mechel Mining, wealth accumulation vehicles controlled by Igor Zyuzin (left). What she and the company announce publicly is what they want public shareholders to think, and they do not respond readily to questions. This is allowable under the New York Stock Exchange rules for Mechel, because it is a foreign-domiciled listing on the US exchange, and that exempts it from disclosure requirements which apply to the domestic stocks on the same exchange.

Take the question of whether Mechel, its steel mills and coal mines are performing better or worse. That is usually an acid test for public shareholding companies – the basis on which it is valued and its shares fairly priced in the market place. The good news is easy to publish. But how do Zyuzin and Videman handle the not so good news? Hiding it is one method; disguising it another.

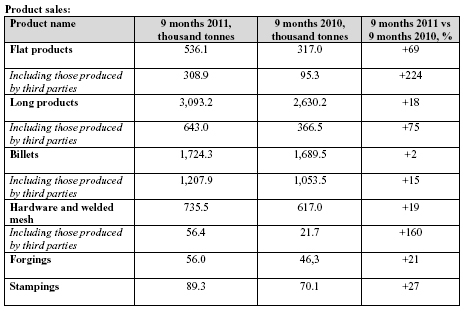

According to this week’s production and trading report from Mechel for the nine months to September 30, the bad news is that production is falling. The company release shows that crude steel output came to 4.5 million tonnes, virtually unchanged compared to the same period of 2010. Pig-iron production was down 13% to 2.7 million tonnes; and coal output was down 4% to 19.8 million tonnes. But at the same time, sales of every category of steel products were jumping upwards.

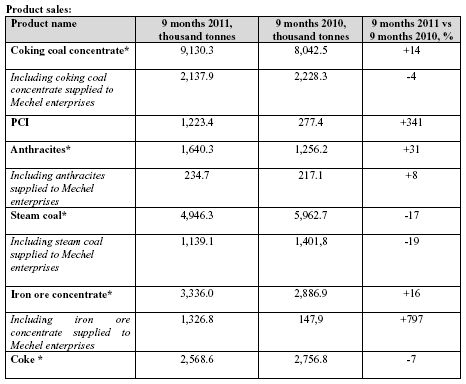

The news for coal and iron-ore is mixed:

The asterisk says: “Starting with this period, figures on product sales of Mechel OAO’s mining division include sales made within the Group.” What isn’t clear is what plants are included in “the Group”.

No quarter-on-quarter data have been released, however; and sales of steel from mills formerly owned by the Estar group of Vadim Varshavsky have been counted although they are not owned by Mechel. Sales of steel are reported for Mechel units, as well as by “third parties”, which the company does not identify in its report. These appear to include steel mills taken over for management from the bankrupt Estar group; these include Nytva, Zlatoust, Rostov, and Gurievsk in Russia, and Donetsk Electrometallurgical in Ukraine. How these assets have fallen out of Varshavsky’s hands and into Zyuzin’s has been documented, not in Mechel disclosures to the US Securities and Exchange Commission (SEC), but here [1].

Counting only the Mechel goods, and comparing like with like, flat steel sales came to 22,200 tonnes, almost unchanged from a year ago. Long product sales totaled 2.45 million tonnes, up 8% year on year. Billet sales were 516,000 tonnes, down 19%. Mechel is the virtual monopolist of nickel-alloyed stainless steel production in Russia, but it does not release production or sales results for this type of product. Spokesman Videman refuses to say why.

Yevgeny Mikhel, chief executive of the Mechel group, is reported in the November 14 release as saying: “In the steel division, over these nine months we managed to increase steel product sales by 16% compared to the same period last year, including sales of steel flats and longs which went up by 69% and 18% respectively thanks to our maintaining production volumes at the company’s plants and gaining partnership ties with third parties. Also, on the back of favorable market conditions the company increased hardware sales by 19% as compared to last year’s figures.”

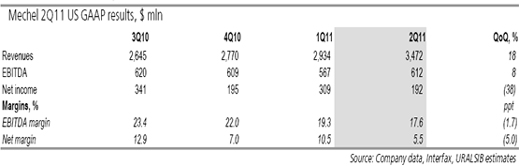

Since other Russian steelmakers are reporting that from the second to the third quarters, steel production and sales were weakening, not reporting the quarterly comparisons may be Mechel’s method for camouflaging the negative trend. Mechel was asked why it is not releasing these quarterly data. Videman replies: “In 2009 the company did disclose quarter to quarter changes in order to better describe recovery of capacity utilization during the crisis time. Now, as you can see, we have moved to a new disclosure format, and we show not only production but also sales, since it is more convenient to assess the financial condition of the company by this indicator. Since the beginning of this year we have been showing a comparison of the current period to the same period last year.” Note the term “convenient” – no prize for guessing whose convenience is intended.

Uralsib Bank published this estimate of the quarterly financial trends for Mechel through the second quarter. As can be seen, the net income line had moved sharply towards the red by June 30. The bank hasn’t updated the tabulation for the latest third-quarter data:

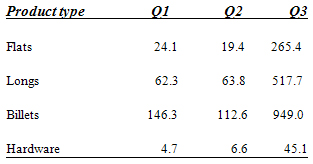

So has Mechel tried to disguise a worsening sales and profit picture in the third quarter by adding in raw material sales to the Estar plants, and sales of the Estar steel products, without saying so? Who are the “third parties” referred to in the latest report, Videman was asked: “Among the third parties are the mills of Estar, Mechel’s strategic partner”, she replied.

Mechel’s financial report for the first half of the year provides first and second-quarter data for sales volumes from these third parties; and if these totals are subtracted from the latest 9-month figures, it is possible to calculate what the third-quarter performance of the Estar plants must have been (sales in thousand tonnes):

But here’s another puzzle — either there has been spectacular growth on the part of the Estar plants, or there have been counting changes. Videman was asked to explain. She confirmed the accuracy of the numbers in this table, but not the reason for them.

There are problems too with Mechel’s coal division – until recently, a candidate for a separate initial public offering (IPO). In his assessment of the Mechel results, Alfa Bank steel analyst Barry Ehrlich, notes that coal production will not grow at the speed which has been previously suggested, while the new Elga coal mine in fareastern Sakha, heavily subsidized for Zyuzin by the state banks, is not going to come close to its production targets. “Coking coal concentrate sales in 3Q11 rose to 4.7mt and 9M11 sales volumes of 9.1mt exceeded 9M10 numbers by 14%. Steam coal output declined by 3% as compared to 1H11, while quarterly average and 9M11 figures came out 17% lower y/y. Overall 9M11 coal production was 4% lower y/y…Although raw coal output of 2mt for next year is in line with the company’s previous guidance, the product mix between metallurgical and thermal coal is significantly weaker than we expected. Elga is scheduled to produce only 0.3mt of higher marginal met coal in 2012 (and 1mt of thermal coal) and only 0.5mt in 2013. Alfa was expecting 1mt of coking coal from Elga in 2012, and this forecast was reduced in January from a previous expected level of 2mt.”

Because the international market has judged that most of Mechel’s share value is in its coal-mining prospects, it is to be expected that as its coal picture darkens, the Mechel share price will go down. Mechel’s share price was already down 57% in the year to date, before the latest report. In the day since it was issued, the share price has fallen another 6%.

From coalmining to goldming. Dmitry Yakushkin is the spokesman for Highland Gold, which has been owned by Roman Abramovich and his partners and through Barrick Gold, the Canadian goldminer, by its chairman Peter Munk. Abramovich and Munk have been business pals ever since 2003, when Munk quietly agreed to give Abramovich a lot of money for the goldminer, keeping the deal secret from his senior executives. After they found out, they were flabbergasted by the misjudgement, and also by the excessive price Munk gave Abramovich. Munk’s subordinates took months to undo the boss’s mistakes. Other shenanigans followed [2].

These days Abramovich’s holding is represented on the Highland Gold board by Eugene Shvidler and Eugene Tenenbaum. The company describes its stakeholders as Primerod International ltd, with 32%; Barrick Gold with 20.4%; and management with 8%. The free float is just over 39%. Through Primerod, Shvidler may be the direct owner of a stake, while Abramovich has claimed that he owns 25% of Primerod. Tenenbaum, a Canadian accountant for KPMG whose fortunes took off when he went to work for Abramovich, represents the Abramovich interest in Highland Gold.

Yakushkin established his reputation for credibility when working as press secretary in the final days of Boris Yeltsin’s presidential administration. His most memorable utterance during that tour of duty came in 1999 when he attacked reporting by Moskovsky Komsomolets, saying: “Here we are up against obvious wickedness.”

Here’s what Yakushkin and Highland Gold have to say this week about falling gold production at the minehead [3]. It looks like that the weather has done for Abramovich et al. as Marshal Winter did for Napoleon and Hitler. The 20,000-tonne fall in gold production anticipated for the year is “principally due to a requirement for additional open pit waste stripping during Q4 in order to access high grade ore at Mnogovershinnoye (MNV) and also to the bad weather conditions noted earlier in the year.”

According to the company announcement, shareholders shouldn’t be concerned because the impact on earnings would be no greater than 10%, while “cash flows remain strong and there will be no impact upon Highland’s operational, capex and project pipeline commitments.” And now for the good news: “Highland Gold expects to access higher grades at MNV [Mnogovershinoye mine] in the coming weeks and remains focused on ramping up production at Novoshirokinskoye, in addition to continued project development and exploration goals.”

Market reaction was to cut Highland Gold’s share price by 9% over the past week. Andrew Jones, mining analyst at Renaissance Capital, explains why. The production cut, he said, is “disappointing, considering the company’s strong track record of delivery over the past two years. Last year it was the only gold company of the four we cover to meet production guidance. It has led the Russian space in cost containment in recent reporting periods. We believe the news is most damaging from a sentiment point of view, as it slows Highland’s momentum. We were aware of production difficulties due to bad weather in 1Q11, though management asserted that it remained on track and that 2H11 would be stronger.”

Just how bad was the weather in the second quarter? Yakushkin was asked; and if it wasn’t, how to explain the new production forecast, compared with the second and third-quarter targets promised by the company. Why release the bad news now, in November?

Yakushkin responded through a spokesman: “Yes, the report is correct. On November 14 the Company actually reported a change in the production forecast. We faced bad weather conditions in the first quarter of 2011, this was reported initially in August 2011 when we reported the production figures for the first half alone, and then in September 2011 when we accounted for the audited operating and financial results for the first half, thus the Company reported this factor in the very first report after the factor set in.”

For Renaissance Capital, Jones has also warned of trouble for the company above and below ground next year. “We see risks to 2012 production coming from Highland’s application to build a plant at Belaya Gora. No licence has been granted yet, and management’s last guidance – that the plant would be commissioned in 3Q12 – looks increasingly challenging. We decrease our 2012 Belaya Gora production forecast by 11koz in order to be more conservative, but we expect this to be partially offset by higher grades at MNV. We reduce our 2012 production, revenue and EBITDA estimates by 4%, 3% and 2%, respectively, as a result.”