by John Helmer, Moscow

@bears_with

All that glisters isn’t gold. But as all Russian goldminers know, when it comes to the reputation of the mining company, its chief executive, and its share price, glister will do just as well. That has been the view of Suleiman Kerimov (lead image, right) whose Polyus is Russia’s most important goldmining company.

Glister has been Kerimov’s lucky colour; his longtime chief executive Pavel Grachev (left), the same. Through one of his children, Kerimov owns and controls Polyus. Grachev does everything Kerimov senior has been telling him to do since 1998, twenty-two years ago. Last month Kerimov senior told Kerimov junior to tell Grachev to start advertising Sukhoi Log (Russian for “Dry Gulch”), an underground store of gold in southeastern Siberia whose ownership has been fiercely fought over by international and Russian mining companies since 1992.

Unmined still, but firmly in Papa Kerimov’s possession, Sukhoi Log’s prospective value has more than doubled Polyus’s share price this year – and double the share price gain of Newmont of the US; triple that of Barrick of Canada, the international leaders of the gold world.

But that’s on the Moscow stock market this year. Kerimov and Grachev are hoping Sukhoi Log will now draw US sharebuyers with an acceleration in annual gold production and future, life of mine output which is also much faster than Newmont and Barrick.

Kerimov’s glister has always been mistaken for gold at the Financial Times, so Grachev started his campaign there on October 22. He then gave an expansive interview in Kommersant last Tuesday.

When we last reported on Grachev, it was only to spell his name in the caption under an official photograph of the board of directors of Polyus Gold, when it passed out of one pair of oligarch hands, Mikhail Prokhorov’s, into Kerimov’s. That was in 2014. By then the market capitalisation was $9.5 billion, down from its peak of $13 billion in December 2010. Renamed Polyus instead of Polyus Gold in 2016, this week the company is worth the rouble equivalent of $29 billion. Its share price on the Moscow Stock Exchange (MOEX, formerly MICEX) has jumped by 124% in the year to date.

The value of this goldminer has not always reflected the price of gold or the value of the gold reserves Polyus owns, mines, or is planning to mine. The company has often been calculated to be worth what the market thinks of Kerimov, Prokhorov, or before him another Russian oligarch, Vladimir Potanin. Grachev’s new job this week, as it has always been his job, is to rub the oligarch glister off the company, and turn its share price into true gold. As if Kerimov wasn’t there.

The Polyus Gold archive is a long story of asset raiding and share price manipulation; that can be followed here. It began with an Australian junior miner’s bid to beat the Americans, Canadians, and South Africans to the door of Yegor Gaidar for his signature on the Sukhoi Log licence. Saintly since his death in 2009, Gaidar was Boris Yeltsin’s chief privatiser of state property as acting prime minister, then first deputy prime minister – as corruptible by foreign power and money as Yeltsin and the rest of his circle.

The Kerimov story is not as long; he is a creature of Vladimir Putin’s time.

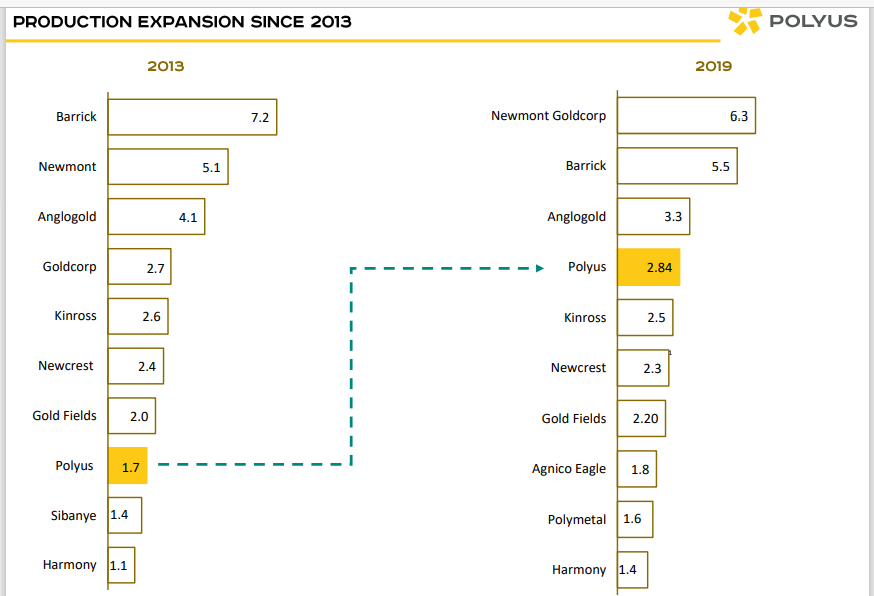

This is Polyus’s last annual report. In the October presentation by the company to the international investment community, this is how the company ranks against its international goldmining peers:

IF NOT FOR THE ANGLO-AMERICAN WAR AGAINST RUSSIA, POLYUS MIGHT BE THE MOST VALUABLE GOLDMINER IN THE WORLD

Annual gold production in million troy ounces. Source: https://polyus.com/ -- page 22.

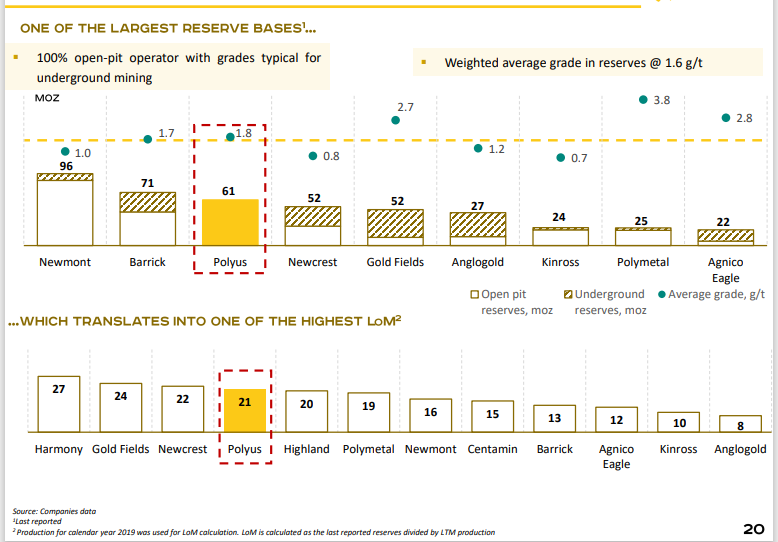

Source: https://polyus.com/

For a larger image, click on link and go to page 20. How long reserves will last in years of digging them out is called the Life of Mine (LOM), a number calculated by dividing the latest gold reserves figure by the gold output for the last twelve months (LTM). Note also the grade of gold, which is the number of ounces extracted from each tonne of ore. The higher the grade from an open-pit mine, the cheaper it costs to produce the gold, and the more profitable for the company and its shareholders. Polyus’ cost of production averages half the cost of rivals like Newmont, Barrick, Newcrest, and Kinross.

Papa Kerimov’s control of the company is vested in his 25-year old son Said who holds just over 78% of the shares. Another 21% is a free float on the Moscow Stock Exchange, and the remainder is held as treasury or management stock. Of the free floating shares the biggest block is held by BlackRock fund managers of the US, but their holding represents only 2% of the aggregate. American institutions make up 38% of the free float; London investment funds, 32%; Russians, 8%. Chinese investment interest evaporated over a few months of 2017-2018; Kerimov prefers Americans to Chinese; the latter know this, and in 2018 withdrew their offer to give him their money.

There is a parallel listing in London of American Depositary and Global Depositary Shares, linked to the Moscow-listed shares. Four Americans sit on the board of directors as nominal independents. The US stock market is the Kerimov target – the Americans on the board are the wool to be pulled over the Trump, now Biden Administration’s eyes. When Kerimov returned Polyus to the London Stock Exchange as a depositary security tied to the value of the shares on the Moscow exchange , the two US banks underwriting the scheme were Goldman Sachs and JP Morgan. The prospectus says: “Mr. Suleyman Kerimov does not own or in any way control or influence the shares in the Company held by his son”.

Papa Kerimov was sanctioned by the US Treasury in April 2018 on a list of Russian oligarchs conducting “worldwide malign activity”. He and the others ran “the Russian government… for the disproportionate benefit of oligarchs and government elites,” declared Treasury Secretary Steven Mnuchin.

Kerimov was “designated for being an official of the Government of the Russian Federation. Kerimov is a member of the Russian Federation Council. On November 20, 2017, Kerimov was detained in France and held for two days. He is alleged to have brought hundreds of millions of euros into France – transporting as much as 20 million euros at a time in suitcases, in addition to conducting more conventional funds transfers – without reporting the money to French tax authorities. Kerimov allegedly launders the funds through the purchase of villas. Kerimov was also accused of failing to pay 400 million euros in taxes related to villas.” By the time Kerimov appeared on the list, his son Said (below) was in his highchair at Polyus, and the French had dropped the charges. For the French story, read this.

Left: Said Kerimov; right, the villa story began here.

By the stock market measure of capitalisation, the leading goldminer in the world is Newmont of Colorado, at US$53 billion of share value. It is trailed by Barrick of Toronto, C$60.2 billion (US$46 billion); Newcrest of Australia, A$24 billion (US$18 billion); Polymetal of Russia (US$11 billion); and Kinross of Toronto, C$13 billion (US10 billion). From the stock charts it is plain that for steepness of takeoff in share price this year Polyus is the leader. This reflects the addition to its reserves of Sukhoi Log. This mine is overcoming the Kerimov discount from which the Russian miner has suffered for years. It is also a rabbit’s foot for the Kerimovs to ward off the harm US sanctions aim to inflict.

YEAR-TO-DATE SHARE PRICE TRAJECTORY OF POLYUS COMPARED TO AMERICAN, CANADIAN, AUSTRALIAN PEERS

KEY: Grey=Polyus; green=Newmont (US); brown=Barrick (Canada); orange=Kinross (Canada); yellow=Newcrest (Australia). Source: https://markets.ft.com/

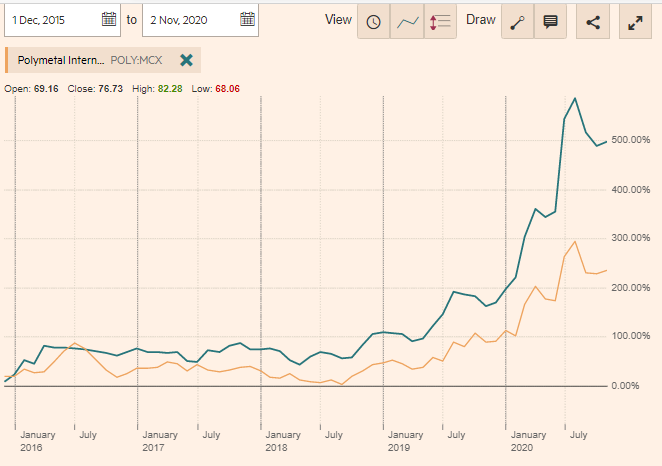

5-YEAR SHARE PRICE TRAJECTORY OF POLYUS GOLD ON THE MOSCOW EXCHANGE (MCEX) COMPARED TO POLYMETAL, RUSSIA’S 2ND GOLDMINER

Key: Grey=Polyus; yellow=Polymetal. Market capitalisation for Polyus is Rb2.2 trillion ($29 billion); for Polymetal, £8 billion ($11 billion). Polyus’s share price on MOEX has jumped 124% this year so far. Another UK registered entity, Nugget Capital, remains as successor to Polyus Gold Plc, which operated between 2011 and 2017, with renaming in December of 2017. The group delisted from the London Stock Exchange in 2015 and then returned in 2017.

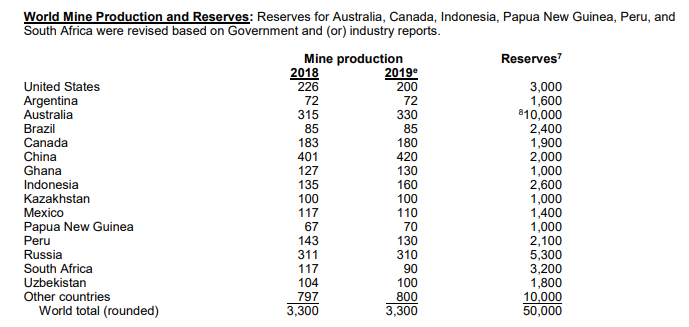

To overcome both the Kerimov discount and Washington’s war against Russia, Grachev is now advertising the company’s prize asset, Sukhoi Log, the world’s largest unmined gold deposit. Sukhoi Log is so rich in gold, it will support a growth rate in annual gold production for Russia of about 4%. This means that in a decade, Russia will become the world’s largest gold producer – well ahead of China, Australia, the US, and Canada The Financial Times, which takes big money very respectfully, said last week: “That has made Suleiman Kerimov, who owns a majority stake in the company through his family, Russia’s richest man.”

GOLD PRODUCTION, GOLD RESERVES BY COUNTRY, 2019

According to the US Geological Service, in ‘000 troy ounces

Source: USGS -- page 70.

A source who once directed exploration of Sukhoi Log comments that the fresh drilling of 300,000 metres reported by Polyus to have been carried out at the minesite near Bodaibo, in remote Irkutsk region, “is impressive. Grades have not improved though; they remain still 2.3 grams per tonne. It looks like they did not trust the work performed by the Soviet mining company Lenzoloto, or the feasibility study of the mid-1990s performed by Star Mining and financed by Standard Bank of South Africa.” Several volumes of that study are collecting dust in a Moscow warehouse where they were left after Star and Standard Bank were run out of Sukhoi Log by a mining mister later dismissed in disgrace.

The new numbers were announced by Grachev to the Moscow market last week. He added that there are still more reserves to come. “Reserves totaled 40 million ounces with an average gold content of 2.3 grams per ton. This field is not just the largest in the world, but has the highest metal content among assets of a comparable class in terms of size and method of production. There is a real prospect of increasing reserves, due to additional exploration of the flanks and deep horizons. That’s what we’re doing right now. Separately, I want to note the degree of study of the ore body. Since the acquisition of the license, Polyus has drilled 300,000 metres in addition to the 200,000 metres of Soviet exploration. Not every major asset, even an active one, can boast of such a volume of exploration work. At the same time, the current and historical results mostly coincided.”

Pavel Grachev in Kommersant last week. Source: https://www.kommersant.ru/doc/4573978

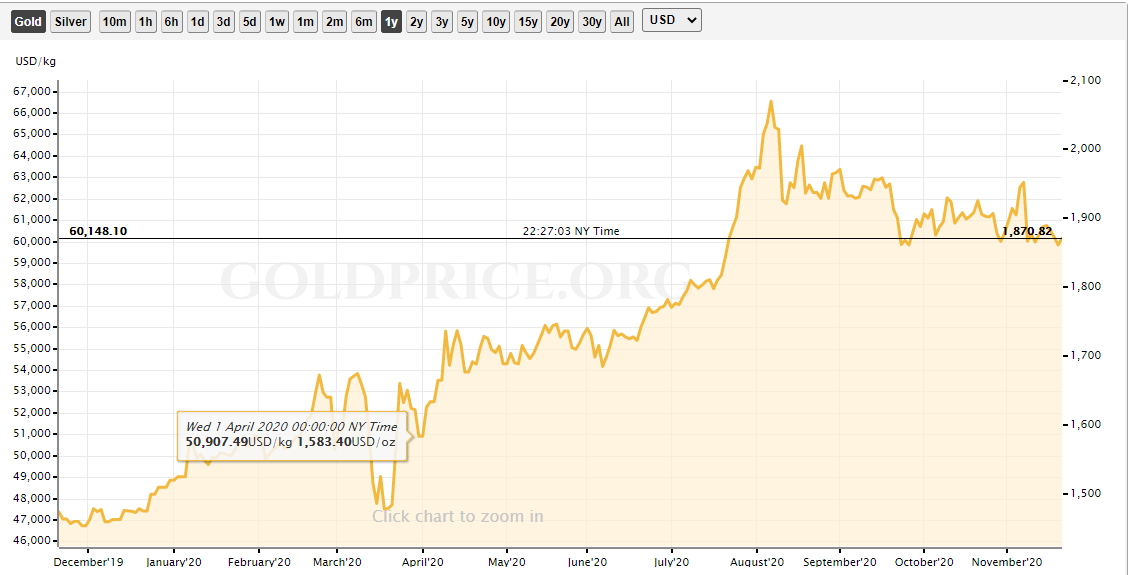

Grachev was also keen to advertise that Polyus’s and Sukhoi Log’s profitability is estimated on the projection of a future gold price of just $1,200 per ounce. “The rally that we have seen over the past six months has its own reasons, and I do not expect them to disappear in the near future. Sooner or later, there will be a correction, but not now… At the same time, if you look at the most ambitious forecasts of $3,000 and higher, you probably need to wait for certainty about the volume of monetary stimulus in the United States. But this does not negate short-term volatility against the background of certain events and statements, such as the recent news about the imminent appearance of a [Covid-19] vaccine.”

THE GOLD PRICE IN THE YEAR TO DATE

In USD per troy ounce

Source: https://goldprice.org/gold-price-chart.html

Click on link for larger image.

“We believe,” said Grachev, “it is correct to operate on conservative macro parametres to maintain a responsible attitude to expenses. In a cyclical market, it is better to be safe. [What price do you put in the budget for next year?] A little more than this year [$1,200]. Higher, but not by much.”

“The cost of production (TCP) at the Sukhoi Log will be at the level of our key ore assets — about $390 per ounce. This is an order of magnitude lower than the majority of gold deposits in the world.”

Grachev dismissed the possibility of direct foreign investment in the mine. “[Against the background of rising gold prices, are foreign players interested in investing in Sukhoi Log?] There were such requests, Yes, but we initially decided to develop Sukhoi Log independently. We believe that this is a unique project. And in general, in relation to greenfields, attracting a partner at the development stage can be justified either by a lack of funding or competencies. Otherwise, there is no point in sharing the upside. Polyus has a net debt-to-EBITDA[earnings] ratio below 1, despite the fact that large-capacity open-pit mines like Sukhoi Log’s are our specific specialty. In addition, the region is familiar. So there’s no reason to look for a partner.”

Grachev was reluctant to be in drawn into recent history. “[Did Chinese investors express interest?] There were a number of international companies.”

He also dismissed the possibility that Kerimov is aiming to expand the portfolio of Polyus to include non-gold metals. “[Do you think that the presence of only gold assets in the company’s portfolio is a weakness or an advantage?] Gold mining companies have their own category of investors who are focused on precious metals.”

Not long ago, according to a well-known London-based Russian miner, Grachev had no record or reputation in the international or Russian mining sector. That was despite his having been chief executive or a board director, or both, for two major Russian mining companies when Kerimov controlled them before Polyus — Polymetal (2006-2008) and Uralkali (potash, 2010-2013). “I have met him a few times,” the source said. “This is just a classic case of loyalty before competence” A second international miner, specializing in precious metals with more than twenty years of Russian mine experience, confirmed that except for the record of his official positions, Grachev has no reputation in the mining community.

That is to say, Grachev has had no reputation which is independent of Suleiman Kerimov, who first employed him at the Moscow branch of the Milan law firm, Pavia e Andaldo, between 1998 and 2006. After Grachev left the law firm, he joined Nafta Moskva, Kerimov’s Moscow asset holding. He was Kerimov’s house lawyer — no more, no less. In Milan, among investigative reporters for Il Sole 24 Ore, his name has drawn a blank; the activities of Pavia e Ansaldo in Russia the same.

For Grachev to spend fifteen years at the top of Russian mining with three internationally listed mining companies, and to leave no track whatsoever of individual decision-making and no reputational finger-prints, is unprecedented. A search of all public sources, including mining media, kompromat websites, and court files reveals nothing concrete about Grachev except for the record of his changing jobs in the employ of Kerimov; and his taking Maltese citizenship, according to a report by the Maltese government in 2018.

One of the only Moscow investment bank analysts to report anything at all about Grachev was Mikhail Stiskin in 2010. At that time Stiskin was mining analyst for the Troika Dialog investment bank; he covered both the goldmine sector and the mineral fertilizer sector. When Grachev’s appointment to run Uralkali was announced, Stiskin reported that Grachev was “a professional manager”. According to Stiskin, Grachev had no expertise in mining potash (or anything else), but he added this was unnecessary for Uralkali at the time. Stiskin was employed by Kerimov at Polyus after the collapse of Troika Dialog into Sberbank. He remains in Polyus today in charge of finance and development, ranking next after Grachev.

Leave a Reply